Modern tax law is constantly evolving, and the landscape of personal finance and wealth enhancement is becoming increasingly complex. As individuals strive to secure their financial futures, the fusion of tax planning with wealth management proves to be not just advantageous but imperative. In this extensive exploration, we’ll untangle the web of tax burdens and unveil how savvy wealth-management strategies play a pivotal role in ensuring that every dollar saved is a dollar earned.

The Essence of Wealth Management

Wealth management can help one achieve various financial objectives, such as wealth accumulation, preservation, and distribution. It encompasses core elements such as financial planning, investment management, and, crucially, tax planning—tools that can sculpt an individual’s financial destiny.

The core of wealth management is personalizing financial strategies based on a person’s unique circumstances. This customization sets wealth management apart from traditional financial services, which often take a one-size-fits-all approach.

Weaving Financial Planning Into the Fabric of Wealth Management

Financial planning serves as the foundation for managing your wealth. When you’re faced with the complexities of financial landscapes, the expertise of a seasoned financial planner is essential. Our approach will help you chart a course toward financial stability with clarity and confidence by clarifying a situation that might seem bewildering and establishing goals and a map to meet them.

Within this framework, tax-planning strategies are born, helping a person steer clear of financial tempests while optimizing the tax provisions they might otherwise overlook.

Tax-Planning Strategies in Wealth Management

Tax planning within the context of wealth management is a meticulous balancing act between honoring one’s civic duty while minimizing the tax bleed that can erode hard-earned wealth.

1031 Exchanges

The 1031 exchange is a powerful tool for real-estate investors. It allows investors to defer capital gains taxes on the exchange of like-kind properties. Maximizing capital growth without immediate tax repercussions enables reallocation of assets from one investment to another, preserving equity and deferring tax liability. With our keen eye for detail, Sera Capital can help you identify opportunities for such exchanges, fostering portfolio diversification while maintaining a deferral of taxation.

Delaware Statutory Trusts

For people looking to invest in real estate without the day-to-day management hassles, Delaware Statutory Trusts (DSTs) are compelling alternatives. DSTs enable multiple investors to hold fractional interests in large institutional-grade properties. Our role is to illuminate the process to help investors understand how DSTs can serve as eligible replacement properties in a 1031 exchange, with the added benefit of potential income streams and depreciation tax shelters.

721 UPREITS

With the intricate mechanism of 721 UPREITS, investors can contribute property in exchange for shares or units of a real estate investment trust (REIT), deferring the recognition of gain until the eventual sale of the REIT shares. Sera Capital provides expert guidance to assess whether such a transaction aligns with an investor’s financial aspirations and tax-planning objectives.

Section 453 Installment Sales

For business-owners contemplating the disposition of a business, a Section 453 installment sale offers a method to spread out capital gains tax over the period in which payments are received. This method, which includes deferred sales trusts and structured installment sales, may allow business-owners to align income recognition with their financial and tax-advantaged strategies while providing liquidity and preserving capital.

Sera Capital extensively evaluates these arrangements to ensure a precisely orchestrated financial picture. If you want to explore our options, make a no-obligation appointment today.

Capital Gains and Losses

Balancing capital gains with losses is a keystone of tax strategy. Investors can minimize their taxable income by intentionally realizing losses to offset gains. The strategic use of tax-loss harvesting can be deployed to reset an investment portfolio’s cost basis, potentially yielding significant long-term tax benefits.

Conversely, managing capital gains recognition can be equally vital. You can soften or avoid the impact of capital gains by timing sales or utilizing charitable-giving strategies such as donating appreciated securities.

The Relationship Between Wealth Management and Tax Planning

When wealth management and tax planning synchronize, the results can be exceptionally powerful. One can achieve significant benefits through the seamless integration of these two disciplines, propelling themselves closer to their financial aspirations.

Maximizing After-Tax Returns

The mark of a well-crafted tax plan is its ability to maximize an investor’s after-tax returns. Wealth management considers more than just the headline returns; it also evaluates the net returns after accounting for taxes, expenses, and other factors that can diminish investment gains.

Minimizing Tax Liabilities

Proactively addressing tax liabilities can free up resources you can then redeploy toward wealth accumulation. Whether through estate planning, gifting strategies, or charitable foundations, a well-devised tax plan can reduce the financial encumbrances that one’s estate might bear.

Enhancing Overall Financial Health and Security

The importance of wealth security lies not merely in its accumulation but also in its preservation. By designing tax-efficient wealth-management strategies, individuals can lay the foundation for secure financial futures, ensuring their legacies endure.

An Ode to Wealth Management and Tax Planning

In a world where nearly every financial decision has a tax consequence, wealth management certainly helps with tax planning. It’s more than just a bonus; it’s essential in the architecture of successful finance.

The attentive practitioner knows that wealth management’s value lies not in just generating greater wealth but in preserving it. Tax planning is the thread that weaves through the tapestry of wealth management, binding together a coherent, resilient financial strategy. Through this integration, one can steer their fiscal fate to new heights unencumbered by the weight of unnecessary taxes.

The interconnection between wealth management and tax planning is clear: one cannot achieve peak wealth efficiency without the other. In a time when the only constant is change—particularly in tax legislation and financial markets—embracing a rounded approach to wealth management that considers tax implications at every turn is the wisest course of action.

For people navigating the waters of personal finance, enlisting the expertise of a professional registered investment advisor is not merely recommended; it is indispensable. By engaging in a thoughtful, comprehensive wealth-management strategy that incorporates tax planning, individuals can work toward realizing their financial dreams with clarity and confidence.

In the grand picture of wealth, every tax-optimized move is akin to a brushstroke that contributes to your financial masterpiece. Each detail—not just the final product—matters, and through the confluence of wealth management and tax planning, you can cultivate a masterpiece that stands the test of time.

If you’re looking for a reputable advisor to handle your wealth-management needs, turn to Sera Capital. We’re a fiduciary that knows how to help you make the right decisions. Contact us today and schedule your free 30-minute constulation—you’ll quickly see why we’re trusted among many.

Fiduciary duty is a pillar of trust. The guiding principle sets certain financial advisors apart, entwining them with legal and ethical obligations beyond standard practice. Understanding the significance of fiduciary duty is not merely a matter of educational awareness for clients navigating the labyrinth of investment choices—it’s an essential step toward safeguarding their futures.

This article is your compass, directing you through the fiduciary duty concept and how it reshapes client-adviser interaction. We delve into the meaning of fiduciary duty, its implications, routes to compliance, and the pivotal questions you must ask. Let’s explore fiduciary duty and what it means for your financial advisor.

Fiduciary Duties Explored

Fiduciary duty embodies an unwavering commitment to act in the best interests of another party—in this context, the client. It’s not an abstract notion but a stringent code that demands loyalty, prudence, and an unwavering focus on the client’s financial well-being. This duty forms the cornerstone of trust and integrity in the advisor-client relationship.

An Adviser’s Bedrock

Fiduciary duty is the legal framework of financial advice. It dictates that advisors must avoid conflicts of interest; when they arise, they must fully disclose them. The pursuit of client benefit must remain untainted, unshaken by the pull of commission or self-gain. But how does this legal and ethical commitment manifest in real-world scenarios?

Navigating Financial Waters With a Fiduciary Guide

A financial advisor will help you navigate the scary waters of finances.

The Sacred Vows

Fiduciary advisors commit themselves to a set of guiding principles. They must put their clients’ interests before theirs, providing sound and unbiased advice. This allegiance to objectivity instills a profound sense of reliability in their clients, who entrust them with their life’s savings and financial aspirations.

Legal and Ethical Mingle

Most importantly, fiduciary duty isn’t just an elevated sense of morality—it’s the law. Advisors bound by fiduciary duty hold themselves to legal standards that are enforceable in a court of law. This melding of ethics and legality sets a higher standard for their advisory services.

When Fiduciary Duty Is More Than Just Words

Imagine a financial adviser as a steward meant to navigate the tides of financial markets for their client’s benefit. A fiduciary steward doesn’t just navigate well—they ensure they equip the client to meet the journey’s challenges.

The Defense Mechanism

A fiduciary advisor can serve as a protective shield for clients in an often stormy financial realm. Their advice is a calculated defense against predatory practices and self-seeking interests. Working with a fiduciary advisor leaves you less exposed to the disruption of poor financial choices.

The Power of Transparency

Transparency is the twin brother of fiduciary duty—an inseparable pair. Being a fiduciary advisor means knowing where you stand without the interference of a sales pitch or predatory motives. Understanding your advisor’s fees, conflicts of interest, and strategies becomes a right and a reality.

The Dichotomy of Duty: Fiduciary vs. Non-Fiduciary Advisors

Not all financial advisors are fiduciaries. You want to know who’s handling your money because, legally, anyone can call themselves a financial advisor if they’d like to.

Knowing the Difference

It’s within the title—fiduciary advisors are vigilantly sworn to their client’s cause, while non-fiduciary advisors must adhere to a “suitability standard.” Suitability is a less stringent criterion, requiring that the advice offered fits the client’s profile. This distinction can mean a world of difference in the quality and nature of the advice they provide.

The Path to Choice

Selecting the right advisor is a pivotal decision defining your financial trajectory. It is about identifying fiduciary advisors and understanding why this label should be non-negotiable in your advisor checklist.

Red Flags and Compliance: A Blueprint for Vigilance

What are some red flags you should keep an eye out for? Let’s explore.

The Violation Playbook

Every breach of fiduciary duty narrates a cautionary tale where client interests come second to advisor gains. These can range from unsuitable investment recommendations to deceptive marketing practices. Each serves as a warning sign that warrants immediate attention and reevaluation of your advisory relationship.

Keeping Watchful Eyes

Vetting your financial advisor shouldn’t be a passive activity. Being informed is your first line of defense against unjust practices. It’s about recognizing subtle cues and patterns in your advisor’s conduct that could signal fiduciary neglect.

Safeguarding Your Finances: The Client’s Checklist

Are you asking the right questions? Should you verify an advisor’s fiduciary status before you hire them? Continue reading for the answers.

Invested in Inquiry

Cultivating a curious approach can be your most potent tool as a potential client. The right questions can often lead to the right answers. Inquiring about an advisor’s fiduciary status, past breaches, and investment philosophy can provide a panoramic view of your prospective fiduciary ally.

Verifying Fiduciary Status

You can verify a financial advisor’s fiduciary credentials in tangible ways beyond relying on their word. Organizations and affiliations often come with stringent fiduciary requirements. Seeking this validation can add another layer of assurance to your advisor selection process.

Partnering With Integrity: The Fiduciary Future

So, is it worth hiring a fiduciary advisor? The answer is clear.

Commit to Fiduciary Advisors

The call to action is clear and resounding. The fiduciary path is not just a preference but a necessity for potential clients seeking an advisor who places their interests above all. It’s about forging a partnership grounded in mutual trust and unwavering commitment.

You and Your Fiduciary

Your financial prosperity deserves an unyielding focus on your interests, goals, and well-being. This commitment, embodied in a fiduciary advisor, charts a course of integrity and assurance, ensuring your advisor is a steward of your finances and a dedicated partner in your financial journey.

A Recap of Fiduciary Duty’s Significance

Understanding the requirements of fiduciary duty and what it means for your financial advisor is vital. It sets the bar high for professional conduct, ensuring your advisor’s guidance has its foundation in trust and commitment to your best financial interests. It is your prerogative to seek advisors who echo this dedication in every service they offer as you stand at the crossroads of financial decision-making, armed with the knowledge of fiduciary duty.

The beacon of fiduciary duty illuminates the path to financial well-being. Embrace, scrutinize, understand its tenets, and witness its benefits unfold in your financial narrative. A financial advisor’s fiduciary duty doesn’t just offer advice; it extends a solemn promise—your fortune is safe in these hands.

The presence of a fiduciary advisor can be the clarity you need. Let fiduciary duty be your north star when you consult your advisor or contemplate an investment decision. Your financial future deserves no less.

There’s no better place than Sera Capital if you’re looking for the best fiduciary advisors for your exit planning. Contact us today for your free consultation to discover how we can help you.

Investing in real estate can be lucrative, but it also comes with its fair share of risks. That’s why many investors turn to other options, such as Delaware Statutory Trusts (DSTs) and Real Estate Investment Trusts (REITs). These two forms of investment share some similarities, but they also have distinct differences that investors should be aware of. This blog post offers a close look at DSTs and REITs and compares their benefits for investors.

What Is a Delaware Statutory Trust?

A Delaware Statutory Trust (DST) is a legal entity that allows multiple investors to hold fractional ownership in real estate properties. In a DST, the trustee manages the property and distributes income to investors. This distribution enables investors to invest in real estate passively without having to worry about day-to-day management responsibilities.

DSTs are commonly used for single-asset investments, meaning they hold only one property. This property type can include various real estate types, such as apartment buildings, office spaces, and shopping centers. DSTs are also structured as 1031 exchanges, allowing investors to defer capital gains taxes by exchanging one investment property for another.

What Is a Real Estate Investment Trust?

A Real Estate Investment Trust (REIT) is a business that operates and owns income-producing real estate properties. Like DSTs, REITs allow investors to own a share of the real estate without managing it themselves. By law, REITs must distribute at least 90 percent of their taxable income to shareholders as dividends, making them a popular choice for investors seeking regular income.

There are two major types of REITs: equity REITs and mortgage REITs. Equity REITs own and operate income-generating real estate properties, while mortgage REITs finance real estate investments. Equity REITs are a more common choice among investors due to their potential for long-term growth.

Comparing Benefits of DSTs and REITs

DSTs and REITs offer attractive benefits for investors looking to diversify their portfolios with real estate. The following are some key points to consider when comparing the two.

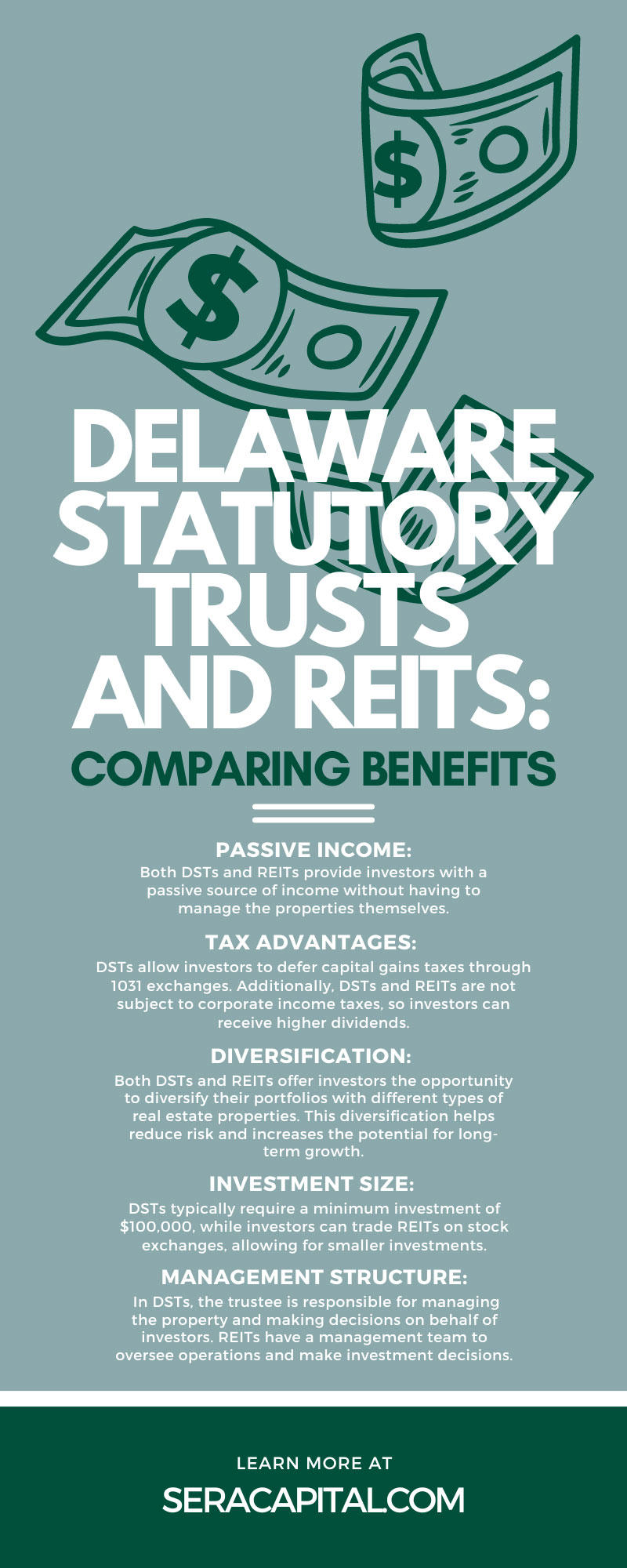

- Passive income: Both DSTs and REITs provide investors with a passive source of income without having to manage the properties themselves.

- Tax advantages: As mentioned earlier, DSTs allow investors to defer capital gains taxes through 1031 exchanges. Additionally, DSTs and REITs are not subject to corporate income taxes, so investors can receive higher dividends.

- Diversification: Both DSTs and REITs offer investors the opportunity to diversify their portfolios with different types of real estate properties. This diversification helps reduce risk and increases the potential for long-term growth.

- Investment size: DSTs typically require a minimum investment of $100,000, while investors can trade REITs on stock exchanges, allowing for smaller investments.

- Management structure: In DSTs, the trustee is responsible for managing the property and making decisions on behalf of investors. REITs have a management team to oversee operations and make investment decisions.

Evaluating Risks of DSTs and REITs

While the benefits of both DSTs and REITs are attractive to many investors, it’s crucial to understand the potential risks of these investment opportunities.

For DSTs, one of the primary risks is the lack of liquidity. Since you can’t publicly trade DSTs, investors may find it more challenging to sell their interest if they need access to their capital. Additionally, the success of a DST is dependent on the performance of a single property, making it susceptible to market volatility. There’s also the risk of the trustee making poor management decisions that could negatively impact the investment.

On the other hand, REITs are publicly traded, which provides liquidity but also subjects them to the fluctuating nature of the stock market. Like DSTs, the performance of a REIT relies on the underlying properties and the real estate market as a whole. Additionally, while REITs must distribute 90 percent of their taxable income as dividends, there is no guarantee of dividend payments, as they depend on the REIT’s profits. The management of a REIT could make decisions that might not align with the individual investors’ preferences.

In both cases, the potential for significant gains comes with the potential for substantial losses. Therefore, it’s crucial for investors to carefully consider their investment objectives, risk tolerance, and time horizon before investing in either DSTs or REITs. Consulting with a financial advisor or real estate investment professional can provide additional insight and guidance.

Which Is Right for You?

Deciding between DSTs and REITs ultimately depends on your investment goals and risk tolerance. DSTs offer the potential for higher returns through 1031 exchanges, but they also come with a higher minimum investment requirement and less control over decision-making. Conversely, REITs are more liquid and allow for smaller investments but may not provide as many tax advantages.

Tips for Choosing the Right Option

When deciding between DSTs and REITs, consider the following tips to help choose the option that best aligns with your investment goals and risk tolerance.

Evaluate Your Financial Goals

Your investment decision should align with your financial goals. Whether aiming for regular income, tax advantages, or long-term growth, understanding what you want from your investment can guide your decision.

Understand Your Risk Tolerance

Both DSTs and REITs come with their own set of risks. DSTs are not as liquid as REITs and rely on a single property—this could be a risk if that property doesn’t perform as expected. On the other hand, while REITs provide more liquidity, they are subject to the stock market’s volatility. Understanding your ability and willingness to take risks can help determine which investment is right for you.

Consider Your Investment Size

DSTs typically require a larger investment than REITs. If you’re looking to invest a smaller amount, REITs might be a more suitable option.

Consult a Financial Advisor

Real estate investments can be complex. A financial advisor can provide valuable insights into the potential benefits and risks of DSTs and REITs, helping you make an informed decision.

Keep an Eye on the Market

Real estate market trends can have a significant impact on the performance of your investment. Tracking market conditions and projections can help you time your investment and potentially increase your returns.

Remember, there is no one-size-fits-all approach when it comes to investing. What works for one investor might not work for another. Taking the time to understand your financial situation, goals, and risk tolerance can guide you toward the investment option that is most suitable for you.

Final Thoughts

DSTs and REITs are attractive options for investors looking to diversify their portfolios with real estate. While they share some similarities, DSTs and REITs also have distinct differences that you should consider carefully before making investment decisions. Whether you choose DSTs or REITs, it’s crucial to understand your investment objectives, risk tolerance, and time horizon to make an informed decision. Consulting with a financial advisor can provide valuable guidance in assessing which option is best for you. Remember, investing always comes with some degree of risk, but by understanding the benefits and risks of DSTs and REITs, you can make informed decisions that align with your financial goals.

As a real estate investor, you may already be familiar with capital gains. These are taxes levied on profits from selling an asset such as a property. Capital gains taxes can be significant expenses, but there is a way to significantly reduce or even defer them: through a 721 exchange.

What Is a 721 Exchange?

A 721 exchange, also known as a UPREIT (umbrella partnership real estate investment trust) exchange, allows real-estate investors to defer capital gains taxes by exchanging their property for shares in a REIT (real estate investment trust). This exchange allows the investor to continue receiving benefits from the property while gaining access to additional investment opportunities and tax benefits.

Benefits of a 721 Exchange

There are several key benefits of utilizing a 721 exchange as a real-estate investor:

Tax Deferral

The most significant advantage of a 721 exchange is the ability to defer capital gains taxes. By exchanging your property for shares in a REIT, you are not technically selling your asset and, therefore, can delay paying taxes on the gains. This deferral allows you to continue investing with more capital and potentially increase your returns.

Diversification

By exchanging your property for shares in a REIT, you gain access to a diverse portfolio of properties, reducing your investment risk. Additionally, depending on the type of REIT, you may also have exposure to other asset classes, such as commercial or industrial properties.

Increased Liquidity

Real estate is an illiquid asset, so selling it quickly can be a challenge. By exchanging your property for shares in a REIT, you gain access to a more liquid investment vehicle that can be bought and sold on the stock market.

Professional Management

Experienced teams professionally manage REITs, giving you peace of mind and freeing up your time to focus on other investments or personal endeavors.

Higher Return Potential

REITs typically provide higher returns than traditional real estate investments do, making them attractive options for investors looking to grow their wealth.

How To Execute a 721 Exchange

To execute a 721 exchange, you must follow a specific process, which involves finding a suitable REIT, conducting due diligence, and exchanging your property for shares. Working with reputable professionals who have experience with 721 exchanges is crucial to ensuring the transaction complies with all tax laws and regulations.

The Importance of Hiring an Advisor

Executing a 721 exchange can be complex, with numerous legal and financial considerations to bear in mind. This is why the expertise of a financial advisor is vital. Engaging a knowledgeable advisor during a 721 exchange can have several key benefits:

- Professional guidance: Navigating the intricacies of a 721 exchange can be challenging. A seasoned advisor will have the experience and knowledge to guide you through the process, helping you understand each step and make informed decisions.

- Risk mitigation: Missteps during the exchange process can result in hefty penalties or unintended tax liabilities. Advisors are well-versed in tax laws and regulations related to 721 exchanges, ensuring compliance and mitigating potential risks.

- Negotiation skills: Advisors can use their industry knowledge and negotiation skills to ensure you receive a fair deal when exchanging your property for REIT shares.

- Time and stress reduction: Coordinating an exchange can be time-consuming and stressful. By hiring a professional advisor, you can delegate these tasks, saving yourself time and minimizing stress.

- Future financial planning: An advisor can help you strategically plan for future investments and tax obligations, integrating your 721 exchange into your overall financial plan.

Executing a 721 exchange independently is technically possible, but hiring an experienced financial advisor will allow you to navigate the process more confidently and efficiently. Their expertise can pay off exponentially, not just in potential tax savings but also in terms of peace of mind and future financial stability.

Things To Consider Before Undertaking a 721 Exchange

Utilizing a 721 exchange offers significant benefits, but there are also some considerations to keep in mind before you pursue this type of transaction:

Tax Implications

A 721 tax-deferred exchange allows you to defer capital gains taxes, but understanding that the tax liability does not disappear entirely is essential. When you eventually sell your shares in the REIT, you must pay those deferred taxes.

Investment Risk

There’s always a level of risk involved with any investment. REITs typically provide stable, consistent returns, but they’re still subject to market fluctuations and economic conditions.

Time Commitment

As we mentioned earlier, exchanging your property for shares in a REIT can free up your time from managing your assets. However, this doesn’t mean no time commitment is involved. Conducting thorough due diligence and monitoring your investment to ensure they align with your financial goals are still essential.

Investment Objectives

Before you pursue a 721 exchange, you must evaluate your investment objectives. This option may not be in your favor if you’re looking for quick returns or short-term investments.

Potential Drawbacks of 721 Exchanges

While 721 exchanges offer a multitude of benefits for real-estate investors, understanding the potential downsides before engaging in such a transaction is crucial.

- Limited control: When you enter a UPREIT, you relinquish control over your original property. The REIT’s management team assumes control, and your influence is limited to your voting rights as a shareholder.

- Market risk: Investing in a REIT exposes you to market risk. Unlike individual properties, REIT shares can fluctuate in value based on broader market trends and economic factors.

- Tax complexity: A 721 exchange offers the advantage of deferred capital gains tax, but it may also introduce additional tax complexities. The tax implications of REIT dividends can be complex, and understanding how they’ll affect your overall tax situation is essential.

- Liquidity constraints: Despite REITs generally offering more liquidity than direct real-estate investments, you may encounter some limitations. Some UPREITs restrict when and how you can convert the shares into cash.

- Exit strategy: Exiting a UPREIT transaction can be more complex than selling a property outright. When you’re ready to cash out, you might be subject to capital gains tax on the appreciated value of your share of the REIT.

Given these potential drawbacks, you should approach a 721 exchange with careful consideration and detailed analysis. Consulting with financial and tax advisors who are experienced in real estate and REIT investments will ensure your 721 exchange aligns with your long-term investment goals and financial plan.

A 721 exchange can be a valuable tool for real-estate investors looking to minimize their tax payments and diversify their portfolios. However, understanding the process, potential risks, and your investment objectives before you pursie this type of transaction is crucial. As with any significant financial decision, consulting with qualified professionals who can guide you through the process and ensure compliance with all tax laws and regulations is essential. With careful consideration and expert guidance, a 721 exchange can effectively optimize your real estate investments. So if you want to minimize your tax payments and maximize your returns, consider exploring the potential benefits of a 721 exchange.

The real estate industry offers many incredible investment opportunities. Delaware statutory trusts (DSTs) and real estate investment trusts (REITs) both offer the opportunity to invest in real estate without property management responsibilities, but they have significant differences that investors should be aware of. Understanding the key differences between DSTs and REITs will allow you to make informed investment decisions. If you have a rental property and want a 1031 exchange into an investment product, continue reading to explore the way these trusts differ from one another.

What Are DSTs?

Delaware statutory trusts are legal entity types that allow multiple investors to pool their money and invest in real estate properties. A DST is typically structured as a private placement offering, meaning there’s no public trading on a stock exchange. Instead, only accredited investors can use this option through private placement memorandums (PPMs).

Benefits of DSTs

One of the main benefits of DSTs is the ability to invest in larger and more diverse real estate properties. With DSTs, multiple investors can come together to invest in institutional-grade properties such as apartment buildings, office buildings, and shopping centers. This collaboration allows investors to diversify their portfolios and potentially earn higher returns on their investments.

Another advantage of DSTs is the pass-through taxation structure. As pass-through entities, DSTs do not pay corporate taxes. Instead, the property’s income and losses pass through to the individual investors, who then report them on their personal tax returns. This advantage can benefit investors, as it may result in a lower overall tax liability.

Potential Risks of DSTs

As with any investment, there are also potential risks associated with DSTs. One risk to consider is the illiquid nature of these investments. Unlike publicly traded REITs, DST interests are not easily sold or transferred. Investors may also face limited control over the management of the properties, as the DST sponsor or manager typically makes decisions. Additionally, DSTs are subject to high fees and expenses, which can eat into potential returns. These fees often include acquisition, asset management, and disposition fees.

What Are REITs?

REITs are companies that own and operate income-producing real estate properties. They are publicly traded on major stock exchanges, making them more accessible and liquid than DSTs. REITs must disperse a majority of their taxable income to shareholders as dividends, making them desirable options for investors seeking regular passive income.

Benefits of REITs

One of the main benefits of REITs is their accessibility. Since you can publicly trade REITs, investors can easily buy and sell shares on a stock exchange, providing liquidity for their investment. Additionally, REITs offer the opportunity to invest in various real estate property types, including residential, commercial, and industrial.

Another advantage of REITs is that they tend to have lower fees than DSTs, since they do not require private placement offerings. REITs also offer the potential for dividend income, making them popular among investors seeking regular cash flow.

Potential Risks of REITs

REITs are not without their risks as well. Due to their publicly traded nature, they can be susceptible to market fluctuations, and they may experience high volatility. This risk could potentially result in significant losses for investors.

Additionally, REITs are subject to corporate taxes, meaning the dividends shareholders receive may have a higher tax rate than those from DSTs. This higher rate could potentially affect an investor’s overall return on investment.

Key Differences Between DSTs and REITs

Now that we have explored the respective benefits and potential risks of DSTs and REITs, let’s take a closer look at the key differences between these two investment options.

Ownership Structure

DSTs are structured as private placements, meaning investors own the underlying properties directly. On the other hand, REITs are publicly traded companies, and investors own shares in the company rather than individual properties.

Access to Properties

As we mentioned earlier, DSTs allow investing in larger and more diverse properties, whereas REITs may have more limited portfolios.

Taxation

DSTs are pass-through entities, while REITs are subject to corporate taxes. This variety can result in different tax implications for investors.

Liquidity

REITs are publicly traded and therefore offer more liquidity than DSTs, which are not easily sold or transferred.

Control

Investors in DSTs have limited control over property management decisions, while REIT shareholders have the opportunity to vote on major company decisions.

Decision-Making in REITs vs. DSTs

Regarding decision-making, there’s a stark difference between REITs and DSTs. As REIT shareholders, investors have a certain degree of control over major company decisions. They have voting rights proportional to their shareholdings, allowing them to influence the company’s strategic direction. These decisions may include electing board members, approving significant asset sales, or merger and acquisition activities.

In contrast, DST investors typically have minimal control over the day-to-day operations or bigger strategic decisions related to the property. These decisions, which may include leasing, property improvements, or eventual property sale, are primarily made by the trustee or the designated sponsor company. Some investors may view this as a disadvantage, but others find it appealing because it allows them to enjoy the benefits of real estate ownership without the burdens of direct management. Therefore, the choice between a DST and a REIT may ultimately come down to the individual investor’s preference for the level of control and the involvement they desire in their real estate investments.

DSTs and REITs offer unique opportunities for investors interested in real estate. DSTs can invest in larger and more diverse properties and benefit from pass-through taxation, but REITs offer accessibility and the potential for dividend income. Ultimately, the decision between DSTs and REITs will depend on an investor’s goals and risk tolerance. Carefully considering all the factors before making any investment decisions is essential.

We recommend consulting with a financial advisor who can provide personalized guidance based on your financial situation. Get a financial service consultation with Sera Capital to ensure we’re the right advisor for you. With the right knowledge and careful consideration, you can make informed investment decisions that align with your goals and objectives. So choose wisely, and happy investing!

Welcome to Sera Capital – Your Partner in Strategic Real Estate Transactions

Are you in Annapolis and considering selling your investment property?

If you've found your way here, you might be searching for assistance in selling or leasing your commercial real estate. While we don't specialize in traditional property sales or leasing, we bring a unique approach that sets us apart.

Our Focus: Minimizing Taxes, Maximizing Your Sales Proceeds

Why Choose Us?

Most commercial real estate brokers focus on selling or leasing, often leaving individuals without guidance on tax-efficient exits. At Sera Capital, that's our specialty. We not only operate nationwide but proudly call Annapolis our home.

National Expertise, Local Excellence

Nationally, we excel in matching buyers with sellers using innovative strategies such as sections 453, 721, and 1031, leveraging securitized property. Locally, we curate top-notch sales and leasing talent, ensuring you work with the best brokers in the field.

Perfect Profile: Highly Appreciated Real Estate Sellers

Are you seeking to sell your highly appreciated real estate in Annapolis? Unsure about hiring a reputable broker or navigating tax implications? You're in the right place. Our expertise lies in assisting individuals like you who want to defer or eliminate taxes on their sales proceeds.

How We Can Help

Top Broker Selection: We assist you in selecting a top broker tailored to your needs.

Tax-Efficient Strategies: Educating you on tax-efficient strategies to invest your sales proceeds and generate passive income.

Why Us?

Many individuals make the mistake of hiring a broker first, only to face substantial tax bills. We're here to change that narrative. Our team understands the intricacies of tax-efficient real estate transactions, helping you avoid unnecessary tax burdens.

Ready to Take the Next Step?

If you're looking to sell and keep more of your proceeds or need help evaluating the best broker or searching for NNN properties, drop us a line. Let's embark on a journey to maximize your sales proceeds while ensuring tax efficiency.

Book Your Free 30-Minute Phone Call Today.

Discover the Sera Capital Difference – Your Partner in Tax-Efficient Real Estate Solutions, Nationwide and in Annapolis.

Delaware Statutory Trusts (DSTs) have been gaining popularity in recent years as a way for investors to hold fractional interests in large, institutional-grade properties. However, many misconceptions surrounding DSTs prevent potential investors from fully understanding their benefits and risks. In this blog, we will debunk some of the common myths about Delaware Statutory Trusts and provide you with a clearer understanding of this investment vehicle.

A Closer Look

To dig deeper, let’s first understand what a DST is. A Delaware Statutory Trust is a legal trust that offers real estate investors an opportunity to invest in a trust’s beneficial interest. This trust, in turn, holds title to various types of real estate assets. Despite the potential advantages, misconceptions about DSTs abound, giving rise to uncertainty and skepticism among potential investors. These myths often stem from a lack of understanding or misinformation. By debunking these myths, we aim to equip you with factual information and insights to aid your investment journey. Rest assured, we’ll shed light on the realities of DSTs, separating the wheat from the chaff, as it were. Let’s delve into some of these common myths and uncover the truth.

Myth #1: DSTs Are Only for Wealthy Investors

One of the most common misconceptions about DSTs is that they are only available to high-net-worth individuals or accredited investors. This myth is not true. While it is true that many DSTs require a minimum investment of $100,000, it is not a requirement for all DSTs. In fact, the Securities and Exchange Commission (SEC) lifted the restrictions on accredited investors for certain types of investments in 2015. This lift means anyone can now invest in DSTs, regardless of income or net worth.

Myth #2: DSTs Are Too Complex

Another myth surrounding DSTs is that they are too complicated for the average investor to understand. While DSTs do have a unique structure and require thorough due diligence, it does not mean they are overly complex or beyond your understanding. In fact, many investors find that investing in a DST is simpler than owning and managing a property directly.

Furthermore, as with any investment, seeking professional advice and doing research before investing is essential. Many asset management firms offer educational resources and personalized consultations to help investors fully understand the specifics of DSTs. DSTs can be a straightforward and profitable investment with the right support and guidance.

Myth #3: DSTs Offer Limited Diversification

Some investors may believe that because of the nature of DSTs, they offer limited diversification compared to other real estate investments. The truth is that DSTs can offer a high level of diversification by providing access to large institutional-grade properties that would otherwise be out of reach for individual investors.

In addition, DSTs can also hold multiple properties within the trust, allowing investors to spread their investment across different assets and locations. This diversification can help mitigate potential risk and provide consistent cash flow.

Myth #4: DSTs Lack Control and Transparency

Some investors may shy away from DSTs because of the perceived lack of control and transparency in these investments. However, as a beneficial owner of a trust, you still hold an interest in the underlying properties within the trust. While you may not have direct control over the management of the properties, you can still receive regular updates and reports on the trust’s performance.

There are strict SEC regulations in place to ensure that DSTs that provide transparency and protection for investors. To fully understand your rights and responsibilities as an investor, it is vital to thoroughly review all documentation and disclosures before investing in a DST.

Myth #5: DSTs Offer Limited Income Potential

Many investors may believe that DSTs offer limited income potential compared to other real estate investments. However, this is not necessarily true. While DSTs may offer a lower return on investment compared to direct property ownership, they can provide a consistent and predictable stream of passive income.

They also often have lower expenses and fees associated with them, which can increase the overall return for investors. It is essential to consider your individual investment goals and risk tolerance when evaluating the income potential of a DST.

Myth #6: DSTs Are Risky Investments

Perhaps one of the most concerning myths surrounding DSTs is that they are inherently risky investments. While all investments carry some level of risk, DSTs may offer a lower risk level than other real estate investments.

Since investors often use DSTs in large, stabilized properties, they can provide more stability and potential for consistent cash flow. Furthermore, DSTs allow investors to diversify their investments across multiple properties. This diversification allows investors to mitigate potential risks further.

Myth #7: DSTs Are Difficult To Sell

A common misconception about DSTs is that they are difficult to sell. This myth stems from the fact that DSTs, like many real estate investments, do not have a secondary market. While it is true that DSTs are not as easily traded as stocks, it does not mean they are impossible to sell. The reality is that DSTs can be sold, but the process may take longer compared to selling stocks or mutual funds. Moreover, there are ways to strategically plan for liquidity events, such as through a property’s sale, refinancing, or via a 1031 exchange. As always, it’s important to understand the terms of your investment, including exit strategies, before investing in a DST.

Closing Debunking Thoughts

In conclusion, Delaware Statutory Trusts have many benefits, making them an attractive investment vehicle for real estate investors. However, like any investment, there are risks and misconceptions to be aware of before investing. By debunking these common myths, we hope to provide you with a clearer understanding of DSTs and empower you to make informed investment decisions.

We encourage you to do your own research and seek professional advice from reputable asset management firms before investing in DSTs. Find a respected 1031 exchange advisor to help you with the investment process. With the right knowledge and guidance, DSTs can be valuable to your investment portfolio. Don’t let these myths hold you back from exploring this potential opportunity for passive income and portfolio diversification. Dispel those misconceptions and consider adding DSTs to your investment strategy today!

Are you considering investing in a Delaware Statutory Trust (DST) as part of a 1031 exchange? This type of investment can offer tax advantages and passive income potential, making it attractive for many investors. Working with the right exchange advisor is crucial for ensuring a successful and profitable investment. Continue reading to discover the key factors to consider when selecting a 1031 exchange advisor.

What Is a 1031 Exchange?

A 1031 exchange, or a like-kind exchange, permits investors to defer capital gains taxes on the sale of a property by reinvesting the proceeds into another property of equal or greater value. This investment enables investors to grow their real estate portfolio continually without being hindered by taxes.

Who Is a 1031 Exchange Advisor?

A 1031 exchange advisor specializes in guiding businesses and people through the 1031 exchange process. Think of them as the team captain. All teams need a qualified leader with a wealth of knowledge about a particular subject. These advisors are typically certified public accountants (CPAs), qualified intermediaries, or attorneys who have a vast wealth of tax law and real estate knowledge. These people understand the intricacies of Section 1031 of the Internal Revenue Code. They will serve as a strategic partner, the keyword being “partner.” You deserve to work with someone who has your back.

A qualified intermediary (QI) is integral to the 1031 exchange process. They act as a neutral third party who holds the funds from the sale of your relinquished property and transfers them to the seller of your replacement property. Working with a reputable and experienced QI to handle the exchange properly is essential for the success of the process.

Your advisor will walk you through the exchange process. Having a 1031 advisor by your side will maximize the financial benefits of your 1031 exchange and simplify the process.

Top Responsibilities

Executing a 1031 exchange is complex, but you don’t have to do it alone. A 1031 exchange advisor will handle the following responsibilities:

- Prepare the required documentation

- Ensure everything adheres to the IRS rules

- Handle strict deadlines

- Recognize suitable replacement properties

Why are these responsibilities important? If a taxpayer fails to meet a deadline, the IRS could disqualify the transaction from the 1031 exchange treatment. This mistake would result in significant tax liabilities. What do these timelines look like? Your advisor will guide you through the 45-day identification period and the 180-day exchange period, ensuring you meet the requirements and qualify for tax deferral benefits.

Consider Their Experience and Expertise

When choosing a 1031 exchange advisor, consider their experience in handling DST investments. A qualified intermediary with a good track record of facilitating successful DST exchanges can provide valuable insights throughout the process. They should also understand the unique tax implications and requirements for DST investments.

Evaluate Their Communication and Accessibility

Effective communication is vital to any business transaction, and this is especially true for a 1031 exchange. Your advisor should be responsive, accessible, and able to simplify complex information regarding your investment. Additionally, they should keep you up-to-date on the progress of the exchange.

If you notice that your advisor takes too long to return a phone call or email, that’s a red flag. Do they neglect to break down the financial language in a way you can understand? That’s another red flag with their communication style.

Look for a Proven Track Record

A reputable 1031 exchange advisor should have a proven track record of successful DST investments. This proof can include previous clients’ testimonials, case studies, or other evidence showcasing the advisor’s expertise with DST exchanges. We recommend researching the advisor’s reputation and credibility through online reviews or industry associations. Pay attention to green flags, such as positive affirmation of the advisor.

This information will inform you how well the advisor will work for you. Do they have more negative reviews than positive ones? You should continue looking. Other red flags, like the repeating issues popping up in reviews, will help you decide if the partnership will or won’t yield success.

Get Familiar With Their Network and Resources

Having a well-established network and access to various resources can benefit your DST investment. A reputable 1031 exchange advisor should have connections with experienced sponsors, brokers, and other professionals in the real estate industry. This broad network can provide you with diverse investment options and enable you to receive expert advice from various perspectives.

Understand Their Fee Structure

Before selecting a 1031 exchange advisor, you should understand their fee structure and how it aligns with your investment goals. Some advisors may charge a flat fee, while others have a percentage-based fee structure. Discuss these fees upfront with your potential advisor, and fully understand the costs associated with the exchange.

Look for a Transparent and Ethical Advisor

Transparency and ethics are crucial for financial investments. A reputable 1031 exchange advisor should operate with integrity and provide all the necessary information to help you make informed decisions about your investment. They should also adhere to all legal and ethical standards set by governing bodies, such as the IRS and the Securities and Exchange Commission (SEC).

Seek Personalized Guidance

Every investor’s financial situation and goals are unique. Your 1031 exchange advisor should provide personalized guidance for your investment. They should take the time to understand your objectives and risk tolerance to recommend suitable DST options. This individualized attention can help you make an informed investment decision.

Closing Thoughts

As with any investment, selecting the right advisor is crucial to the success of turning your 1031 exchange into a Delaware Statutory Trust. With careful consideration and thorough research, you can find a qualified intermediary who will help you navigate the complex world of DST investments and guide you toward a profitable investment. Do your due diligence, and select an advisor who will work in your favor.

Sera Capital’s advisors check all the boxes. Our extensive knowledge allows us to take calculated risks and help our clients with challenging situations. In fact, we appreciate challenges and put an emphasis on transparency. Use our 1031 exchange services, and trust our expert advisors with your needs.

As a leading provider of financial services, Sera Capital understands the importance of exploring all options when maximizing your investments. The Delaware Statutory Trust (DST) is one such option that has gained popularity in recent years.

What makes them popular? DSTs combine increasing real estate values, low investment returns from traditional banking investments, and aging demographics. They deserve the growth because they offer incredible benefits for real estate investors. What are the potential benefits of DST investments? Continue reading to find out.

What Is a DST?

A Delaware Statutory Trust (DST) is a legal entity that allows multiple investors to pool their money when investing in real estate properties. These properties range from apartment complexes and office buildings to shopping centers and storage facilities. The DST structure is similar to a Real Estate Investment Trust (REIT) but has some key differences.

Allowing investors to own fractional interests in larger, higher-quality properties that they may not be able to afford alone is one of the main benefits of a DST. This freedom allows for diversification within the real estate market without the burden of managing individual properties.

Who Can Invest?

Only accredited investors can invest in DSTs. The Security and Exchange Commission defines an accredited investor as a person who has a net worth of one million dollars or has had a yearly annual income of over $200,000 in the past two years. The average income has to be at or above $300,000 if a couple is filing jointly. It’s important to note that the net worth can’t include the individual’s main residence.

Minimum Investment

DSTs usually require a minimum $100,000 investment. An investor can exchange or acquire ownership of one or more Delaware Statutory Trusts.

Investors receive the entire profit, including potential appreciation gains, when they sell the investment property. You can exchange these investments again to continue deferring tax. Investors typically hold DST real estate investments for three to ten years.

Benefits DSTs Provide

Knowing the potential benefits is important if you’re considering a DST. It will make the decision process easier and ensure you make the right investment. Continue reading to check out the advantages.

Tax Advantages

The potential tax advantages DSTs offer are one of their more attractive features. Investors can potentially defer capital gains taxes on the sale of their appreciated properties by investing in a DST. This deferment is possible because DSTs are similar to like-kind exchanges under Internal Revenue Code (IRC) section 1031.

In addition, DSTs also offer potential tax deductions through depreciation. As property values typically appreciate over time, the depreciation deductions can help offset any taxable income from the property. This offset can be especially beneficial for high-income investors.

Passive Income

Investing in a DST also allows for passive income, as opposed to active income coming from managing individual properties. This benefit means that investors do not have to handle or maintain the properties. Instead, a professional asset manager oversees all aspects of the investment, from property maintenance to rent collection.

This advantage is huge for busy investors who do not have the time or resources to manage properties themselves. It also allows for more passive investing and diversification within the real estate market.

Increased Income Potential

The great thing about DST properties is that the structure focuses on cash flow. They seek to provide greater income potential and focus on preserving investment value. Independent investors can enjoy more monthly income from DST property ownership rather than direct property ownership. Remember that the income will vary from month to month.

Lower Risk

DSTs can potentially offer lower risk compared to other types of real estate investments. Investors can spread their money across multiple properties, minimizing the impact of any individual property’s performance, by pooling their funds. This minimization can help mitigate overall risk and potentially provide more stable returns.

Additionally, experienced asset managers with a vested interest in the success of the investment professionally manage these DSTs. They conduct thorough due diligence on properties before investing and continue to monitor and manage them throughout the life of the DST.

Flexibility and Liquidity

Another potential benefit of DSTs is their flexibility and liquidity. Unlike traditional real estate investments, tying a specific property to an investor for a set period, DSTs have more flexible investment periods. This flexibility means that investors can choose how long they want to stay invested in the trust and potentially exit at any time.

In addition, DSTs offer liquidity options through the secondary market. This option allows investors to sell their interests in the trust to other interested buyers if they need access to their funds before the investment period is over.

Non-Recourse Debt

Most DST-related debt is non-recourse. Non-recourse debts limit an investor’s liability to the lender and protect an investor’s other assets and properties in case an investment fails. What is non-recourse debt? It’s a loan investors can secure with collateral, typically property. It saves the borrower because if they happen to default, the lender can’t seize anything besides the listed collateral, even if it doesn’t fully cover the loan. Non-recourse debts add a layer of protection.

In conclusion, the potential benefits of DST investments are numerous, from tax advantages and passive income to lower risk and flexibility. DSTs provide an alternative option for those looking to diversify their investment portfolio. As with any investment, it is important to thoroughly research and understand the potential risks and benefits before deciding. Consult a trusted, fiduciary financial advisor for guidance if you want to explore DSTs as an investment option. They will help you tailor your specific financial goals and needs. Turn to the most trusted advisors out there, Sera Capital. We are fee-only fiduciary financial advisors who will ensure you’re taken care of and understand what’s happening when it’s happening. We’re not afraid of a challenge and will always put transparency first. Contact our offices today to find out more information if this sounds like what you’re looking for.

So, why not consider adding a DST to your investment strategy today? Your future self may thank you for it. Take the next step towards maximizing your investments with a Delaware Statutory Trust.

A Section 721 exchange, often called a UPREIT transaction, is an often overlooked but powerful tool for real estate investors seeking an effective exit strategy. This strategy allows an investor to convert direct property ownership into an interest in a professionally managed portfolio without triggering a taxable event.

Under the right circumstances, a 721 exchange can provide a smooth exit route, ensuring liquidity, diversification, and a potential for steady income streams. Read on to learn the mechanics of 721 exchanges and how they can be a strategic part of a successful exit strategy.

What Is a 721 Exchange?

A Section 721 exchange, named after Section 721 of the Internal Revenue Code, allows investors to contribute properties to a Real Estate Investment Trust (REIT) or an Umbrella Partnership REIT (UPREIT) in exchange for operating partnership units. This transaction is generally tax-free, provided the exchange is for partnership units and not for cash or other forms of remuneration.

The investor retains a de facto interest in the property, but the REIT assumes the actual management and responsibility of the asset. Then, the investor can enjoy the potential for regular income distributions, portfolio diversification, and liquidity while deferring capital gains taxes that would have been incurred if they sold the property outright.

Benefits of 721 Exchanges

The benefits of Section 721 exchanges are manifold for real estate investors. Firstly, the investor gains access to a diversified and professionally managed portfolio, reducing the risk of holding a single property. Secondly, the exchange provides a pathway to liquidity, as the operating partnership units gained in the exchange can be redeemable for cash or publicly traded securities.

Thirdly, these exchanges offer the potential for regular income distributions, contributing to a steady income. The capital gains tax deferred through a Section 721 exchange represents a significant advantage over outright sales, potentially allowing the investor to save a substantial sum. When strategically utilized, a Section 721 exchange can offer real estate investors an effective and financially beneficial exit strategy.

Tips for Preparing a 721 Exchange

Careful planning and professional advice are crucial when preparing for a Section 721 exchange. We advise consulting a tax expert or a real estate attorney specializing in these transactions to ensure you completely understand the legal and tax implications. Remember that only properties used for investment or business purposes qualify for a 721 exchange.

A thorough analysis of the properties to be exchanged is a prerequisite to confirm they meet the requirements set by the Internal Revenue Service. Verify that the REIT or UPREIT you intend to transfer your property into is trustworthy and has a track record of success. Consider the timing of your exchange—you must follow IRS deadlines once the process begins. Lastly, maintain meticulous transaction records, as the IRS may require documentation for tax purposes.

Common Questions About 721 Exchanges

Common queries often arise regarding 721 exchanges, indicating the need for clarity in this complex subject matter. One frequently asked question revolves around the type of properties eligible for the exchange. Note that only properties used for investment or business purposes may qualify. Another common concern is the tax implications of the exchange. Many investors ponder whether capital gains tax can become deferred.

In most cases, the answer is yes; the 721 exchange allows for the deferral of capital gains tax, but it is essential to consult a tax expert to understand the specifics fully. Because 721 exchanges involve the transfer of properties to a REIT or UPREIT, many investors question the reliability of these entities. Therefore, conduct thorough due diligence on the selected REIT or UPREIT before proceeding with the exchange. Lastly, the time sensitivity of the process is often under discussion because it requires investors to adhere to strict IRS deadlines once the exchange process is initiated.

How To Use a 721 Exchange as an Exit Strategy

A 721 exchange is the perfect exit strategy for investors looking to sell their assets while minimizing tax burdens. To use a 721 exchange, investors must meet certain requirements, like exchanging similar assets and meeting all deadlines.

Identify Eligible Assets

The first step in using a 721 exchange as an exit strategy is identifying the assets eligible for such a transaction. Generally, most real estate investments—land, buildings, and rental properties—are eligible for 721 exchanges. Other types of investments may also qualify, depending on the circumstances of the transaction.

Find a Qualified Intermediary

Next, you will need to find a qualified intermediary who can facilitate the transaction. A qualified intermediary registered with the IRS has experience handling like-kind exchanges. The intermediary will help you navigate the process and meet all requirements to maximize your tax savings.

Exchange Assets

Completing the exchange is the next step in using a 721 exchange as an exit strategy. This involves transferring ownership of one asset, known as the “relinquished property,” in return for another, known as the “replacement property.” Note that both properties must be held for investment or business purposes for the transaction to qualify as a like-kind exchange and not be subject to capital gains taxes.

The Future of 721 Exchanges as Exit Strategies

Looking toward the future, Section 721 exchanges will play an increasingly significant role as exit strategies for real estate investors. With the growing complexity of the real estate market and an increasingly favorable tax environment, these exchanges provide a strategic pathway for investors looking for diversification, liquidity, and tax deferral. As the real estate industry evolves and more investors become aware of the benefits of UPREIT transactions, we anticipate a surge in the popularity of Section 721 exchanges.

Advancements in technology and digital platforms will likely simplify these exchanges, making them more accessible to a wider range of investors. While the potential changes in tax legislation remain a constant variable, the structure and benefits of Section 721 exchanges could solidify their place as a preferred exit strategy in real estate investment.

A 721 exchange as an exit strategy tool can aid investors in achieving their financial goals. At Sera Capital, our specialty IRC 721 advisors can help you increase investment liquidity and assist with your portfolio diversification. For more information, contact us today.

Investing in Delaware Statutory Trusts, or DSTs, can help investors obtain diversification, professional management, and reliable returns. DSTs are an attractive option with many benefits, such as cost-efficiency and easy access to commercial real estate investments.

Before taking the plunge into any big real estate investment, however, wise investors should ensure they know the potential pitfalls associated with these trusts. So, here are some mistakes investors should avoid regarding Delaware Statutory Trusts.

Overview of Delaware Statutory Trusts

A Delaware Statutory Trust (DST) is a type of trust created under state law that allows investors to own a portion of a real estate investment without managing it directly.

The DST allows for passive asset ownership and management, potential tax benefits, and liability protection. A trustee responsible for making decisions on behalf of the investors manages the trust by buying and selling property or taking out loans.

Types of Investments Held by DSTs

DSTs can hold various types of investments, including commercial real estate, residential real estate, energy projects, infrastructure projects, and more. Each type has its advantages and disadvantages that investors should consider before making any investments. For example, commercial real estate may provide higher returns but carries greater risk than residential real estate investments.

Benefits of Delaware Statutory Trusts

Investing in a DST offers several advantages over traditional real estate investments. These advantages can include asset protection, tax deferral benefits, liquidity options for investors, and professional management of assets by experienced trustees and advisors.

Additionally, since multiple investors pool their resources together to invest in one property or portfolio of properties, it allows for greater diversification than would otherwise be possible with traditional real estate investments alone.

Investing in a Delaware Statutory Trust

The process for investing in a Delaware Statutory Trust is relatively straightforward, but seeking professional advice can help considerably. The first step is to research available trusts and select one that meets the investor’s needs and objectives based on factors such as expected return, level of risk involved, fees charged by the trustee, and more.

After selecting a trust, investors must complete an application form. This form requires information such as the investor’s name, address, and Social Security Number, along with information about the investor’s financial situation, such as income level and net worth. Once approved, the investor will then deposit funds into the trust account, which they can use to purchase assets according to the terms set out by the trustee.

Tips for Investing in Delaware Statutory Trusts

Here are some mistakes investors should avoid to get the most out of their investments when understanding the basics of Delaware Statutory Trusts. Reviewing potential risks, learning the mistakes, and researching investment properties can help substantially.

Consider Risky DST Factors

Practicing awareness of the potential risks involved is crucial when considering investment in Delaware Statutory Trusts (DSTs). DSTs are typically illiquid investments, meaning investors cannot easily trade or sell them, limiting their financial flexibility.

Moreover, how DSTs perform largely depends on the real estate market, making them vulnerable to economic downturns and market fluctuations. Investors must also be aware of high upfront fees and ongoing management costs associated with DSTs. It is essential to thoroughly evaluate these risk factors and seek professional guidance before committing to a DST investment.

Research the Investment Property

Thoroughly researching a potential investment property is an imperative step in mitigating risks associated with Delaware Statutory Trusts. Investors must evaluate the property’s location, market trends, historical performance, and future growth prospects.

Understanding the property’s vulnerability to economic swings and its positioning in the real estate cycle can provide insights into its potential returns. Furthermore, investors must study the property’s tenancy rates, rental income, and operational costs to ensure a steady revenue stream. Consulting with a trusted financial advisor or a professional real estate investment service can help investors make informed decisions.

Consider Fees and Administration Costs

Considering fees and administration costs is critical to investing in Delaware Statutory Trusts. These costs can significantly impact the net returns on their investments. Upfront fees may include sponsor acquisition fees, financing coordination, and offering costs, which, collectively, can be substantial.

Furthermore, ongoing costs such as property management, trustee, and asset management fees can erode the potential income from investments over time. Therefore, investors must scrutinize all associated costs, understand how they may affect their returns, and factor them into their overall investment strategies. Always seek guidance from a trusted financial advisor or a professional real estate investment service to help assess these costs.

Avoiding DST Missteps

Avoiding Delaware Statutory Trust missteps can ensure an investor’s journey in making investments. A crucial step in preventing blunders when investing in Delaware Statutory Trusts is to ensure a diversified investment portfolio. Investors can enhance their financial security and mitigate potential losses by not putting all their proverbial eggs in one basket. Over-reliance on DSTs can expose an investor’s portfolio to unnecessary risk due to these trusts’ inherent illiquidity and market-dependent nature. Instead, investors must consider balancing their investment strategies with a mix of asset classes, including stocks, bonds, and other real estate investment options.

Additionally, this consideration ensures that investors clearly understand the DST structure, especially its risks and benefits. Misinterpreting DST rules and regulations can lead to undesirable tax consequences and financial loss. Lastly, investors should monitor DSTs and the overall market conditions, adjusting their strategies as needed. Proper planning, continuous learning, and professional guidance can keep investors from the common pitfalls associated with DST investments.

Minimizing Risks and Maximizing Profits

Minimizing risk and maximizing profit in Delaware Statutory Trust investments necessitates a well-structured strategy. It begins with a prudent selection of properties, focusing on those with proven financial performance and growth potential. Ensure the underlying property’s fundamentals remain strong, with a steady rental income stream and a favorable location. Diversification—or having a mix of asset classes—is paramount across various DSTs and to an investor’s portfolio. This strategy can provide a cushion against potential market downturns.

Investors should regularly monitor and adjust their investment portfolios based on market trends and economic indicators. Moreover, having a keen understanding of tax implications associated with DSTs can help optimize their post-tax returns. It is advisable to engage with professional real estate investment services and financial advisors at every step. Their expertise can provide valuable insights, help investors navigate complex financial scenarios, and assist in crafting effective investment strategies to manage risks and enhance profitability.

Sera Capital ensures confidence and transparency for investors who want to diversify their portfolios and increase profits. Our Delaware Statutory Trust services help investors unwind real estate responsibilities and holdings without paying hefty tax bills. Ask about our services today.