For all their long-term tax advantages, real estate investments can also be structured to provide immediate tax benefits. For decades, investors have used Section 1031 exchanges, also known as like-kind exchanges, to swap real estate assets without triggering taxable gains. Now the new Qualified Opportunity Zone program provides another way to postpone and eliminate certain taxable gains. So, which is better, a 1031 tax exchange or a QOZ real estate investment?

What Is an Opportunity Zone?

The government established opportunity zones as part of the Jobs Act in 2017, adding them to the tax code to incentivize long-term investments in low-income urban and rural communities. An opportunity zone’s investment rolls over capital gains and helps a real estate investor to both earn more and keep more of their gains. Investors don’t buy properties directly in an opportunity zone; instead, they buy into an opportunity zone fund.

What is A 1031 Exchange?

1031 exchange rules offer similar benefits as opportunity zones; either capital gains tax deferral or elimination. A 1031 has a different framework than opportunity zones but gives you a similar outcome.

In a 1031 exchange, you must buy and sell properties within a short timeframe, but where you can invest isn’t limited geographically. These are called like-kind exchanges, where you’re exchanging one asset for another that is just “like” it.

Similarities Between 1031 Exchange and Qualified Opportunity Zones

- Both programs allow the investor to defer capital gains taxes on the property. While the rules and regulations for each plan are unique, each program gives tax deferral incentives. If deferred indefinitely, properties purchased under a 1031 Exchange will be inherited by your heirs at the time of your death, without any tax burden whatsoever.

- Both the 1031 Exchange and Opportunity Investment Fund encourage investors to reinvest their profits back into the real estate market. Therefore, both programs help keep the market secure. In the case of Opportunity Investment Funds, investors can also help rebuild impoverished and underserved communities, giving new life to previously underdeveloped areas. In both cases, the emphasis is on economic growth, helping not just the investor, but all those involved.

- Each program allows investors to diversify their investment portfolios. By adding commercial real estate investments to a portfolio, investors can protect their funds in the event of a significant stock market crash.

Differences Between 1031 Exchange and Qualified Opportunity Zones

However, this is often where these two investment vehicles diverge.

- Timeframe of Gain Deferral

Perhaps the primary difference between a 1031 exchange and an investment in a QOZ is the deferral timeline. For the 1031 exchange, an investor can defer tax on the gain from the original property sale until the sale of the replacement property. Alternatively, they can continue to roll the investment into a third property, and defer tax until the final property sells.

With QOZs, there is an option. QOZs allow for the deferral of tax on the gain until either the sale of the property or December 31, 2026, whichever comes first. With that in mind, 1031 exchanges may be more affective vehicles for longer-term deferral, since there is at present no deadline.

- QOZ Exclusions

Additionally, when it does come time to pay tax on the capital gain, there is a difference in how much of it will be taxed. With 1031 exchanges, it is straightforward. When the gain is eventually realized—when the property investment is sold for cash—the investor will need to recognize the full capital gain for tax purposes.

For QOZs, if the gain is deferred long enough by holding onto the investment, the investor may be able to receive exclusions on a percentage of the gain. For example, if the investment is held for more than five years, 10% of the gain can be excluded, meaning that only 90% of the final capital gain would be taxed. If held for seven years, the exclusion ticks up to 15%.

- Step Up Basis

If the QOZ investment is held for at least 10 years, the investor can receive the stepped-up basis on the investment. When the investment is eventually sold, the basis (or amount of original investment) is increased to the fair market value at the time of the sale. Since taxpayers are taxed on the capital gain, or difference between their basis and the sale price, this effectively makes the transaction tax-free. This does not exist with 1031 exchanges.

- Property Types

There are some subtle differences in the types of properties into which QOZ and 1031 exchange investments can be made.

With 1031 exchanges, replacement properties must be of a “like-kind” to the previous property sold, meaning it is “of the same nature, character or class. Quality or grade does not matter. Most real estate will be like-kind to other real estate.” It must also be used for a trade or business or for investment. There are no geographic requirements.

Personal property (not real property) no longer qualifies for like-kind tax-free treatment, effective 1/1/2018. With QOZs, investments must be made by Qualified Opportunity Funds into Qualified Opportunity Zones, which are government-designated distressed communities across the country. Only property in these areas qualify for the tax-deferred/tax-free treatment.

- Original Investment

1031 exchanges follow the “like-kind” rule when it comes to the original capital investment, whereas with QOZs, any capital gain is allowed, whether from a real estate or stock market sale.

Which Investment Strategy is Best?

Both a 1031 Exchange and an Opportunity Investment Fund give investors tax advantages. Depending on your overall financial goals and your current real estate portfolio, only you can determine which investment option works best for you.

While 1031 Exchanges and Opportunity Investment Funds are two separate tracks that generally cannot be combined, there are ways to roll an existing 1031 into an Opportunity Zone purchase. For example, if you’re interested in purchasing a property using an Opportunity Investment Fund, you can sell the property on which you have a 1031 tax deferment. Upon that sale, you will use those funds to purchase an Opportunity Zone property. Now, you’re under an entirely different tax structure, but you can reduce your overall tax burden by owning the property for at least seven years.

How Sera Capital Can Help With 1031 Exchanges and Opportunity Investment Funds

First, we always recommend that any investor talk with a CPA or tax attorney who is knowledgeable about 1031 Exchanges and Opportunity Investment Funds. Our experts can give you the most up-to-date details regarding each investment strategy and help you find the option that works best for you and your family. If you have questions on which investment route makes the most sense for you, contact us at Sera Capital for professional guidance.

FIXED VS VARIABLE ANNUITIES

This tale will give you some framework to see how you can analyze different types of investments. In particular, this tale focuses on analyzing annuities, specifically fixed vs variable annuities, as well as alternative investments. However, we call it An Alternative Tale because you must always look to compare one investment to another and then choose the alternative that best fits your situation.

We should note that we are neither proponents of annuities nor detractors. On one hand, we have seen many situations where an annuity solves the situation at hand exactly, and the investor couldn’t possibly be happier. On the other hand, we have also seen certain types of annuities that absolutely stink, and we wonder how anyone could allow one of their clients to own something so costly and complicated.

Let me touch on a subject that appears to cause a lot of confusion. There are some people out there – mainly insurance agents and sales-driven advisors, which I call SADS because you will be sad if you listen to them – that think people should own annuities in retirement plans. We are not of this ilk though we have seen one situation for an ultra high net worth family where it made sense.

However, one situation in 35 years of looking at individual portfolios is an exception to the rule and not the rule. In general, tax-deferred investments such as annuities in a tax-deferred account are self-serving at best. Why do we see them where they don’t belong? The answer is two-fold. The first is that with the exception of registered investment advisor directed annuities, annuities pay the selling agent a sizeable commission. The second is because the buyer wants peace of mind and is willing to sacrifice rate of return for it.

ANNUITIES

Let’s get started. All annuities are tax-deferred investments sponsored by insurance companies and come in two varieties. The first is the fixed variety and pays a fixed rate. The second is the variable variety and pays a variable rate. What they typically have in common is a high commission to the person (or SAD) that sells these to you.

If you happen to run into one of these people, I suggest you run – do not walk – to the nearest alternative advisor. Any advisor that would make a recommendation to own a tax-deferred investment in a tax-deferred account is no friend of yours, with the one exception for ultra high net worth families. They are acting in their own interest and if you are gullible or uninformed enough to take their advice, shame on you. Don’t own a fixed or variable annuity in a tax-deferred account, there are better alternatives.

The next logical question is should someone own annuities at all? Should you own them in a taxable portfolio? Our general rule is no, but it isn’t a hard and fast rule. We can see how someone, after contributing the maximum allowed to their retirement plan, would want to invest in a tax-deferred vehicle. What we caution is they must make sure they read the fine print of whatever they buy because some of these annuities are very expensive and will “fee” your portfolio until they make more than you do.

WE AVOID ANNUITIES

Typically we avoid annuities, but we can understand why someone might like them. Why do we say to avoid annuities? Since this tale is about alternatives let’s look at some alternative investments to annuities. We’ll examine the two most common situations or comparisons that an investor should analyze in a taxable situation. We will see that in both cases the alternative investment is superior to the annuity. In the first situation, you have to make a choice between investing in a tax-deferred fixed annuity or a tax-free investment such as a municipal bond. In the second situation, you have to make a choice between investing in a tax-deferred variable annuity or an index fund. Which is the best choice?

Let’s take these two one at a time. The analysis between the fixed annuity and the tax-free investment is simple to make. You simply calculate the after tax rate of return and choose the one that gives you the most money. There are calculators available to do this or you can contact your accountant if you can’t understand the math. Fortunately, if you make the wrong decision in this case, the consequences are not punitive. I don’t want to be overly harsh on fixed annuities in taxable accounts. I can see why people invest in these, even if they are inferior investments. People aren’t perfect and if they make this type of error, it isn’t the end of the world. However, if you choose to invest in a variable annuity instead of a comparable index fund then you are possibly committing a grave financial error. Let me tell you why.

Every variable annuity we’ve analyzed, with the exception of a few, are actually wearing a disguise. They disguise themselves as tax-deferred stock mutual funds but they have a problem they won’t reveal. They keep their mask on and never let you know what you are missing. What are you missing other than exorbitant fees? Variable annuities don’t let you take advantage of the low taxes on dividends and long-term capital gains that come with owning an equivalent mutual fund. They may grow tax-deferred, but when you want to convert your money to income one day, your income is subject in most cases to higher tax rates than dividends and long-term capital gains. It’s a little secret.

LOOK AT ALTERNATIVES

This tale teaches us to look at alternatives and alternatives require an understanding of how things actually work. The rest of this tale will focus on comparing the merits of investing in a variable annuity vs. investing in a low cost stock index fund like the S&P 500. Let’s do the type of analysis that sheds the most favorable light possible on variable annuities, what you will be pitched when someone wants to sell you a variable annuity, and then progress from there to reality. Let’s compare the best-case typical variable annuity to a similar investment in a stock index fund.

Let’s make some assumptions. Let’s assume that the S&P 500 index fund goes up 9.60 percent per year for 30 years and that you invest $10,000 at the beginning of the 30 years in both alternatives. You have to pay taxes along the way at the rate of 30 percent on dividends and long-term capital gains from you index fund but only 33% of the 9.60% is taxable. The reason you use 33 percent is because historically about one third of the returns from a the S&P 500 come from dividends and long-term capital gains while the other 67 percent comes from tax-deferred capital appreciation. You see, the variable annuity purveyor will never explain that a stock index fund is an extremely tax efficient way to grow your capital. In the tax-deferred variable annuity, we assume it also grows at 9.60 percent per year for 30 years. We use 9.60 percent because it is a good estimate of an expected return over 30 years. It could be more or less but it doesn’t matter for the purposes of evaluating which investment is better.

How much money do you have in the variable annuity compared to the stock index fund? You will have $156,429 in the variable annuity compared to $120,460 in the stock index fund. Right now, it seems like the variable annuity is winning. But what really matters is the conversion of capital in the variable annuity as well as in the index fund to an income stream. Said differently, how much can I spend from what I’ve saved. Things start to equal out right about now. If we keep the same 9.60 percent rate of return, the variable annuity lets us spend $10,512 per year and the stock index fund lets us spend $10,523 per year. This is virtually the same, and I would be indifferent between the two. In fact, I might have put $5,000 in the variable annuity and $5,000 in the stock index fund if I expected things to work out this way.

THE REALITY OF VARIABLE ANNUITIES

What we have modeled above is the best-case scenario in our opinion. The reality is that variable annuities carry significant fees and fees are the primary differentiator between those that are good and those that stink. We have seen variable annuities in our travels with hidden fees as high as 3.5 percent annually which makes them a terrible investment when compared to a stock index fund. To see how even a 2 percent differential hurts your income in retirement, let’s drop the return on the variable annuity to 7.60 percent. What happens to our money in this case? After 30 years, we only have $90,026 in the variable annuity instead of the unrealistic case of $156,429 and our income drops from $10,512 per year to $4,789. Even a 2 percent differential is generous. Most variable annuities are high cost, higher than 2 percent and we don’t recommend them.

Let’s complete the final whammy on variable annuities. Can you guess what it is? If you answered, “The income from variable annuities is taxed as ordinary income,” then they look even worse. As of this writing, the tax rate is 39 percent, which drops the income you will be able to spend from $4,789 to $4,174. We think this is adding insult to injury. Give us a stock index fund any day.

Some people look at the above and say, “My variable annuity will outperform the S&P 500. I don’t believe this is fair comparison because mine is better.” Do the words Brooklyn and Bridge mean anything to you? When the majority of mutual funds – almost 80 percent – underperform the S&P 500 index, don’t let yourself think that your variable annuity is the needle in the haystack. It isn’t.

As I said at the beginning of this tale, there are many inferior investments. The vast majority of annuities are just one kind. The list is long but you can analyze every investment by comparing it to the basic building blocks of stocks, bonds and cash.

"So Carlos, what do you think about when you step up to the tee on a par 5?"

"So Carlos, what do you think about when you step up to the tee on a par 5?"

I recently got this question from a friend and I gave him an off the top of my head answer. While the first thing that comes to mind is “often said in jest,” it is also often the best answer. My response was “Blah, Blah, Next Shot Counts.” You may be asking what this has to do with money, and if you don’t understand golf you might be lost, so let me explain.

Wait, What Does Golf Have to Do With Money?

A par 5 is the easiest hole relative to par for an accomplished player. It is a hole where the accomplished player should take 5 shots to hit it from the tee into the hole. The way a 5 is scored on the hole has a typical sequence where the player hits their tee shot - The first "Blah," then their second shot. The second "Blah" and then hits their third shot as close as possible to the hole - next shot counts. The first "Blah" means the golfer allows for a large margin of error. If they hit it slightly to the right or left or long or not as long doesn’t really matter because they can recover on their second shot.

What they can’t do on their first shot is bring danger or penalty into the equation because the first shot is simply a set up for the second shot. The second shot or second "Blah" is very similar to the first Blah. It is simply a set up for the third shot. While the first and second shot are important and essential, they are not the critical component to success. The shot that counts, the third shot is the one that really matters. It’s the one that really makes a difference and all accomplished players focus on this one, just a little bit more than then first two.

So what does this have to do with money? The similarity is as follows: Blah, Blah, Next Shot Counts is to golf as personal finance, personal finance, investment skill is to money. Yet, what’s alarming when it comes to wealth creation is that people think the only thing that matters is personal finance. They don’t focus on what matters. Without a focus on what really counts - Investment skill - it’s no surprise that people end up with a, “Blah, Blah, Blah” portfolio.

Where Checklists Fail

Why do you suppose this happens? The answer is surprisingly simple and why I chose the title of this tale to deal with financial checklists. People love checklists of all kinds because they want to feel a sense of accomplishment. Unfortunately, not all checklists are alike. An improperly weighted checklist is a sure path to failure because they encourage people to take shortcuts. Financial checklists are seldom useful as anything other than reminders. Financial checklists don’t focus the appropriate amount of time or effort on the difficulty of the task and the importance of the task.

Here’s a typical checklist; take out the trash, feed the dog, paint the house. When you look at this list, you instinctively know that the first Blah-take out the trash doesn’t require much effort and neither does the second Blah. However, unless you are prepared to do a very sloppy job of painting the house, the third item requires considerable effort. It is the same with money.

Let me give you a money example. You will often get a note from your purveyor of financial services or from a leading magazine that tells you ways to “prepare for the holidays” or a “year- end checklist” or a “what to do at tax time.” These checklists should serve as reminders but our minds don’t think that way. Our minds want to assign an equal weighting to each of the items on the list. It is why we see ridiculous lists that say check your credit rating, review your life insurance needs and examine your investment plan. Excuse me!

So, What Should You Do?

The writer of these lists is no friend of yours. Here is what the list should say, spend 10 minutes checking your credit score, 10 minutes checking your life insurance requirements and 10 months educating yourself about investing. Why doesn’t it say this? Once again, the answer is simple - investment skill is difficult to achieve for you as well as for the writer of these checklists.

A great tale to accompany this is A Martini Tale. If this tale doesn’t get the point across then a different perspective might help. What you must remember and the reason for this tale is to remind you to focus your attention where it matters - investment skill. If you do, then your wealth creation and retention journey will be a success. Don’t fall victim to Blah, Blah, Blah. Focus on Blah, Blah, Next Shot Counts.

One of the great gifts that humans have is the ability to self-regulate. For example, the body’s ability to maintain a constant temperature stems from its ability to self-regulate and is called homeostasis. Unfortunately we have no simple term or way to describe homeostasis in a culture, society, country, etc. We simply call it regulation or self-regulation. Given the recent events and breakdown of regulation in the global banking, investment and mortgage markets, we are facing a brave new world and I am sure it will be a source of much debate over the next few years.

One of the great gifts that humans have is the ability to self-regulate. For example, the body’s ability to maintain a constant temperature stems from its ability to self-regulate and is called homeostasis. Unfortunately we have no simple term or way to describe homeostasis in a culture, society, country, etc. We simply call it regulation or self-regulation. Given the recent events and breakdown of regulation in the global banking, investment and mortgage markets, we are facing a brave new world and I am sure it will be a source of much debate over the next few years.

The term regulation conjures up different meanings to different people. To some it is a positive to others it is a negative. We have all heard that things are too regulated or there isn’t enough regulation. This is not a tale that will speak to either extreme when it comes to regulation. This tale recognizes that there is a range of regulation where it is effective and that we know that moving too far in either direction or moving to extremes is fatal. This is a tale of financial homeostasis.

What do I mean by financial homeostasis? Financial homeostasis is the way that people and businesses have since the dawn of man been self-regulating when it comes to their finances. From an evolutionary perspective we have come too far too fast and we as a body are learning to deal with financial risk. In particular we are learning to deal with credit or risk. We live in a brave new world where access to credit is readily available and until recently it was even available to the un-creditworthy or to the poor business model. When my parents came to this country in the 1950’s if they wanted to buy a house they needed to save 20% of the purchase price in order to make a down payment or they had to have a well-documented credit history so that they would qualify to receive a loan or mortgage. 50 years ago this level of regulation or assessment of a person’s ability to repay what they borrowed was a form of financial homeostasis.

As we move forward through time, when my in-laws moved back to America in the late 1970’s after years in the Foreign Service they were introduced to the concept of the credit card. Many people think the credit card has been around a long time but it hasn’t. 30 years ago the credit card was an oddity and very few people had them. Yet today, I and other parents take their children to freshman orientation at college and credit card companies are offering free pizzas if these young 18 year olds will sign up for their credit card. The credit card is a fact of life, it isn’t going away but its’ correct use runs contrary to the way people are built. It runs contrary to their DNA. It runs contrary to years of evolution where we learned to survive without access to credit. Easy access to credit has temporarily disrupted man’s financial homeostasis. Businesses are no different. Why do I say this?

In the past, when people had to save to make purchases they, you guessed it, saved to make purchases. When a business had to pay for expansion from cash flow and live with the consequences it evaluated business opportunities wisely. The temptation of, buy now or invest now and pay later was not an option. People were regulated by their ability to create capital. It was financial homeostasis. When people reached their golden years or retired they had a set lifestyle and spending pattern that was constrained or regulated by their ability to produce capital over their lifetime.

Access to credit and clever marketing has allowed people to spend more over their lifetime than they can produce. Access to credit and poorly structured compensation schemes allowed corporations to invest in businesses or take risks that the prudent entrepreneur or company founder of old would not have taken. Individually we see this by the drop in the savings rate over the last 30 years since the introduction of the credit card into mainstream society. On a corporate level, we see this by the introduction of the professional executive that is compensated by risk-taking where heads they win and tails society losses. America has gone from a society that would save in order to consume later to one where we consume now and hope for the best tomorrow. The pendulum has swung to an extreme propelled by the force of easy credit access and our inability to delay gratification and poorly structured incentives.

The introduction of access to widespread credit availability has introduced what is called an exogenous variable to our society. Drawing on my science training at Johns Hopkins University, I will go so far as to hypothesize that most people don’t have a debt gene and aren’t well equipped to deal with this new development. Most people don’t cope well with debt. After dealing with countless people over the years I also notice that when people find themselves under the stress of too much debt they exhibit a marked disincentive to work or produce. The need to save is in our gene pool. We know we will age, and we know that we must save for the day that we can’t work. When a person reasons that no matter how hard they work the outcome won’t change this often leads to counterproductive behavior.

Can we escape financial homeostasis either individually or collectively? Can we escape the sins of overspending and over-borrowing? The answer is no to the collective and yes to the individual. Collectively, the pendulum must swing back as we are seeing as of this writing in the fall of 2008. Individually we can learn to manage debt intelligently as so many of these tales try to teach. I am confident that we will make the necessary adaptations to the wise use of credit as we learn to incorporate credit into our DNA. Man always has and always will. Those that are best suited to this brave new world and use credit correctly will be the survivors.

So what is the correct use of credit? The correct use of credit is one where you are not encouraged to consume more than you produce. The correct use of credit means paying your bills in full and on time. If you look at your credit card balance and you can’t make payments in full and on time you are spending more than you should and you need to purge credit from your life. If you are familiar with a debit card I encourage you to use one. Make sure it is one that doesn’t let you spend more than you have in your account otherwise it defeats the purpose. A good tale to read for those that are in a credit mess is A Green Tale. It shows how a couple was able to overcome the lure of easy credit and a lifestyle that was beyond their ability.

In summary, the credit card as well as easy access to credit has changed the idea of saving or delaying gratification. Through the widespread availability of credit we have found a way to allow instant gratification where it was not possible before. This is a mind-boggling concept. We as humans lived in societies that had a built-in regulatory system when it came to our finances. It kept us from overspending and now it is gone. We are now responsible for not only spending what we have but what we don’t have. Prior generations didn’t have this responsibility. They didn’t have a choice. We do. We are a buy now and hope we can pay later society.

In closing, the notion that a college freshman that is dependent on their parents for money is credit-worthy is insidious to say the least. If I were a college administratorI would forbid credit card solicitors from stepping foot on my campus. Nevertheless it is a fact of life. The lure of easy credit is like the siren call. It sounds so sweet at first but it will surely kill you if you listen. The siren call goes out earlier and earlier to the young and this tale won’t change anything I suspect. But for the few that it touches, learn to deal with it or you are in trouble.

(Note: This tale was written Nov. 13, 2008. Credit Card Companies are no longer allowed on college campuses.)

An essential component of financial success is the need to assemble a team of trusted advisors. Other than practicing the discipline of saving money I think it’s the most important component to financial success. This tale follows A Tale of Gender because we also know that money knowledge isn’t gender specific and that women must understand how it works and what role it plays since in all likelihood they will spend some portion of their lives as single women. This tale teaches us that the most important person that you must have on your team of trusted advisors is your spouse or significant other. This is a tale of two couples and how they went about building their family savings and their lives. In one case it is a wonderful life in the other it is, in my opinion, a tragedy.

An essential component of financial success is the need to assemble a team of trusted advisors. Other than practicing the discipline of saving money I think it’s the most important component to financial success. This tale follows A Tale of Gender because we also know that money knowledge isn’t gender specific and that women must understand how it works and what role it plays since in all likelihood they will spend some portion of their lives as single women. This tale teaches us that the most important person that you must have on your team of trusted advisors is your spouse or significant other. This is a tale of two couples and how they went about building their family savings and their lives. In one case it is a wonderful life in the other it is, in my opinion, a tragedy.

COMMUNICATION IS KEY

This tale illustrates the need to communicate with your spouse on a financial level as well as a personal level. It teaches us that one’s goals can’t just be financial to the exclusion of life’s little pleasures. Lastly, you must find the way to make the most out of your life and not just the most out of your money.

Jane and Mary were childhood friends that were born in the same small Pennsylvania town circa 1915. Neither one of them came from wealth. They went to grade school together, played together, graduated from high school together, and married their high school sweethearts. Soon after their wedding Jane and her husband Paul moved to the Washington DC area. Mary and Robert soon followed. When Jane and Paul bought a house in the Maryland suburbs, Mary and Robert soon did the same. They were young, starting a family and living the American dream. They didn’t have any money to speak of and they knew that there wouldn’t be any family financial windfalls such as inheritances, but they were confident in their abilities and optimistic about the future.

Both Paul and Robert worked for the federal government and were promoted frequently through the years but essentially they made the same level of income throughout their careers as well as enjoyed the same level of retirement benefits. Both Jane and Mary chose to stay at home and raise a family. Both let their husbands handle the family finances. Where they differed is while Jane took an active role on a monthly basis to understand the family finances, Mary did not.

OVER THE YEARS

Through the years they raised their families and tried to give their children the best they could offer. They each had two children. Their children attended public schools and ultimately their 4 children graduated from college. Jane and Paul, my clients and friends, moved to a nicer part of town after many years in their old house and were well regarded and respected in the community. If someone needed help, one of them was there to lend a hand. When Paul retired, they maintained their residence, gardened, traveled, visited grandchildren and were active in their church. Jane and Paul could live comfortably from his pension, but they always took 3-4%/year from their approximately $1,000,000 investment account to enjoy each other’s company and enrich those around them. Jane and Mary maintained their friendship throughout their lives.

In the meantime, Mary’s husband Robert studied in the evenings and became a lawyer. It took him many years of night school but at the age of 40 he passed the bar exam and took a Federal government position that was more in line with his legal interests. But like Paul he never left his government position and they both retired at age 55 from their respective government positions. Unlike Paul that chose to completely retire, Robert chose to continue working and joined a private law practice where he worked until physical incapacity at age 72 forced him to retire as well as move to an assisted living facility with Mary.

FAMILY SAVINGS FOR RETIREMENT

Mary and Robert had lived almost 50 years in the same home and they now found themselves in a new environment. It was shortly thereafter that Mary’s husband surprised her with her half of “what he’d been saving for their retirement.” In an envelope was a check for $3,000,000 made out to Mary. Naturally, having never bothered to understand the family finances, Mary assumed it had to be some type of mistake. She thought that maybe Robert’s mind was starting to slip. However, when she deposited the check and it didn’t bounce she knew it was no joke. Mary turned to her friend Jane for advice. Jane called me and asked me to speak with her friend.

A few days later I visited privately with Mary and the first words out of her mouth were “No way did we have this kind of money.” The sad thing is that Mary’s husband had actually saved $6,000,000 for what he considered their retirement without her participation or input. She didn’t even know what the goal was. When reality finally set in Mary became angry and bitter. As she told me, “I had no idea. Do you know everything I’ve missed? Do you know that I’ve never eaten at a fancy restaurant, or taken an exotic vacation? She said she had never bought a new dress, instead making her own clothes. We never had a new car, we never enjoyed any of the finer things in life and now when we can no longer enjoy these things I find out that I’m rich. This is the cruelest trick life has ever played on me.”

UNDERSTANDING FAMILY FINANCES

I asked Mary why she never took an active role in understanding the family finances. I asked her how she let it come to this. Her answer stunned me but as I’ve learned from many similar conversations with women of her generation it’s not that unusual. She told me that she felt that it was her husband’s role as head of the household to handle the family finances and that her involvement might appear as a sign of disrespect. I asked her how she could be friends with Jane for all these years and not mention to her that she wasn’t an active participant in her family’s finances. Jane was certainly involved in her family’s finances. She answered that money is a private matter that isn’t to be discussed amongst friends.

How does this story end? Mary set up trusts for her children with most of her “retirement money” but not before she made them pass a financial proficiency test and discuss their family finances openly with their spouses. She wasn’t going to let her children repeat the same mistake. I know that she died a few years later happy in the knowledge that at least her children and others would be able to benefit more fully from her life.

What are the lessons to be learned from Jane and Mary?

- Understanding Family finances is a responsibility that must be shared between the spouses. This does not mean that they have to be split evenly. However, common goals must be clearly outlined and reviewed at least on an annual basis. Since one spouse will probably outlive the other it is imperative that they both understand the family finances.

- Over-saving is almost as dangerous as under-saving since it diminishes the quality of life aspect of money. Money is not something to be hoarded and used exclusively for essentials. It may, out of necessity, be that way at certain points in one’s life, but once an individual or family unit develops an appropriate savings and investment methodology, the excess, if there is any should be spent.

- If you over-save and keep expenses to the essentials you too can build a tremendous net worth but you are paying a steep price. The price you pay is what most people consider a diminished quality of life. You must find a balance.

- As I’ve pointed out in A Disciplinary Tale, a healthy goal is to save 15% of every paycheck. This number represents an amount that I think balances the present desire to enjoy your life with the future need to be financially self-sufficient.

We learned in A Wealthy Tale that wealth is a state of mind. You determine if you are wealthy. The assumption behind this statement is that you must at least understand the value or worth of your assets. In the case of Mary, she was wealthy by almost anybody’s standards yet since she didn’t know her financial condition she couldn’t answer the question “are you wealthy?” There is a saying “ignorance is bliss.” Let me tell you that in the case of Mary it wasn’t bliss. She must have either lived in a state of financial apprehension or complete trust in her husband. I hope it was the latter. Robert of the other hand knew the family finances intimately buy may or may not have thought that they were wealthy. I can’t explain what particular set of circumstances let Robert think that he was behaving rationally buy her certainly thought he was saving for retirement. Let me say on last time when it comes to your family finances ignorance is not bliss. All couples must work as a team when it comes to finances.

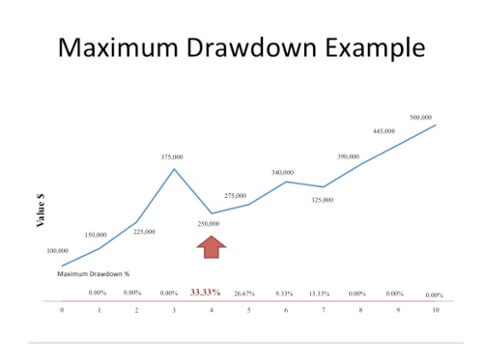

In A Practical Tale, we learned the importance of understanding the expected behavior of asset classes, which of course impacts the expected behavior of your portfolio. We can be fairly certain that when it comes to asset class risk, which we define as how much money you can lose if you invested in an asset class at precisely the wrong time, asset classes will behave the same in the future as in the past. In this tale, A Transformative Tale, we will learn how to transform one type of asset class return into another. This is called a transformation and thus the name of this tale. We will specifically look at transforming bond returns to stock returns. Please note that I don’t recommend that you try this at home. I would leave this type of transformation to professionals but I write this tale so that you can understand once again the importance of assessing risk by focusing on the maximum draw down.

In A Practical Tale, we learned the importance of understanding the expected behavior of asset classes, which of course impacts the expected behavior of your portfolio. We can be fairly certain that when it comes to asset class risk, which we define as how much money you can lose if you invested in an asset class at precisely the wrong time, asset classes will behave the same in the future as in the past. In this tale, A Transformative Tale, we will learn how to transform one type of asset class return into another. This is called a transformation and thus the name of this tale. We will specifically look at transforming bond returns to stock returns. Please note that I don’t recommend that you try this at home. I would leave this type of transformation to professionals but I write this tale so that you can understand once again the importance of assessing risk by focusing on the maximum draw down.

When I first started out in this business I was told to never trade stocks on margin. The reason I was told and I quote from the wiser more experienced brokers “When you trade stocks on margin you will make spectacular returns 17 out of every 20 years and your clients will love you. Unfortunately in the other 3 years, you will have to find a whole new set of clients because you will wipe them out.” This was, still is and will continue to be sound advice. The numbers may be slightly off but the intention is correct. If you trade stocks on margin, which means you borrow money to buy more shares than you could normally afford to buy, then when markets go up you make more than without borrowing. However, when markets go down, you also lose more. So in essence you are simply increasing the volatility of your portfolio when you trade on margin. But what happens if you could find a strategy, approach, technique, asset class, trader or investor that can make more than stock market rates of return with the same risk as the stock market or even less risk? This would be a superior investment and benefit most people. It’s not that complicated.

Suppose we had two strategies or two types of predictable behavior. In the first strategy or predictable behavior one we would make 7.5% per year annualized but during bad periods we might have a loss or maximum drawdown of 50%. This is a fair representation of the stock market or SP500 and as we know, this strategy has a Mar Ratio of 7.5% divided by 50% or 0.15. In the second strategy or predictable behavior, we would make 5% per year annualized but during bad periods we might have a loss or maximum drawdown of 16.5%. This is a fair representation of the intermediate bond market or Aggregate Bond Index and as we know this strategy has a Mar Ratio of 5% divided by 16.5% or 0.30. So given these two types of strategies, which one is better?

Given a choice between these two types of strategies some will go for strategy 1 while others for strategy 2. Others might even put a portion of their money in one and a portion of their money in another thus creating a 3rd strategy. But those types of choices aren’t the point of this tale. This tale is meant to show you how to transform bond returns into stock returns by borrowing money to buy bonds. You can then decide for yourself which one is better. You see the wise fellows that first taught me never said to avoid trading bonds on margin. So what do we need to make the transformation? We need to determine what someone will charge us in order to lend us money to buy bonds. For simplicity let’s assume that rate is zero and do the math.

If we could borrow money at a zero interest rate to invest in bonds, how much would we want to borrow to transform bond returns into stock returns? Let’s suppose we borrowed 1 times our investment. In this case we would make 5% on our original investment and 5% on our borrowed investment. This would mean a 10% rate of return but would also cause our maximum drawdown to increase from 16.5% to 33%. Upon inspection, borrowing just 1 times our initial capital to buy bonds is a far better strategy than buying stocks. Our return on the transformed bond strategy exceeds that of the stock market and it also has a lower maximum drawdown. Given this set of circumstances, I suspect very few would chose to invest in an unleveraged stock portfolio compared to a leveraged or transformed bond portfolio.

What if we borrowed 2 times our capital? Then our original capital would make us 5%, and our borrowed capital would make us 10% for a total of 15%. Of course our maximum drawdown would increase to 49.5%. Upon examination, this maximum drawdown of 49.5% is almost identical to the maximum drawdown of the SP500 with no borrowing. Yet while this strategy produces a 15% return, stocks only produce 7.5%. This too is clearly superior.

What does this mean to us as investors? It means the next time someone tells you that stocks make more money than bonds what they are really saying is that stocks make more money than bonds under the assumption that you don’t borrow any money to buy bonds.

Unfortunately, being able to borrow money at a zero interest rate isn’t the real world. In the real world you will have to pay to borrow. The math doesn’t get much more complicated however. If the rate they lend is at 1% then the transformation at 1 times capital is 5% on the original plus (5%-1%) on the borrowed or a total of 9%. The maximum drawdown is 16.5% on the original plus 16.5% on the borrowed or a total of 33%. This is still a superior investment than the stock market. At a rate of 2% then we are looking at an 8% return with a maximum drawdown of 33%. Once again this is a superior investment. At 3% we are looking at a 7% return with a 33% maximum drawdown. Once again, this is a superior investment because though the 7% return in the transformed bond strategy is slightly less than the 7.5% return from the unleveraged stock strategy, because the maximum drawdown is so much lower, there is room for additional borrowing. Let’s see what happens if we borrow more.

What if you wanted to borrow 2 times your capital? At a 1% borrowing rate then you would make 5% on your original investment plus 4% on the 2 times your investment that you borrowed or 8% for a total of 13%. Your maximum drawdown would increase to 16.5% plus 16.5% plus 16.5% or 49.5%. Once again, this is a superior investment to buying stocks on an unleveraged basis. At 2% the return drops to 11% with a maximum drawdown of 49.5%. At 3% it drops to 9% with a maximum drawdown of 49.5%. These are also superior to investing in the stock market. However, at a 4% rate, the stock market is a better investment than transforming the bond market on a 2 times basis. In this case the return drops to 7% and the maximum drawdown is 49.5%. This tells us there is a level where it makes no sense to borrow money to buy bonds and why earlier I suggested you leave this type of investment approach to the professionals.

So what have we learned? There are countless ways to transform bond returns into stock returns. But the two keys are to borrow cheaply and to make sure your assumptions on maximum drawdown are correct. If one were to borrow money to buy stocks we can see how with a maximum drawdown of 50%, your capital could be wiped out very quickly and will be if you use margin to buy socks into perpetuity. So if you want to trade stocks on margin make sure it is situational such as those times when markets are so low and beat up that you can’t help but make money. If you want to trade less volatile asset classes on margin, make sure your assessment of maximum drawdown is correct.

As an aside, how does our understanding of transforming one asset class into another by understanding its predictability of return and maximum drawdown relate to understanding how banks operate? We learned that during the 2008 financial crash many banks had capitalization ratios of 30-40 and that as of today, many European banks have capitalizations that are still in the 30 to 40 range. What does this mean? A capitalization of 30 translates to an investment portfolio that for every dollar that you earned and put into your portfolio, there is someone willing to lend you $29 dollars to buy whatever you want. So, this by definition means that when banks assess their maximum drawdown they better have a very small expectation of potential losses if they are going to have 30 or 40 to 1 capitalization ratios.

Of course we all know the result here in the USA and can easily predict what will happen to the European banks. What was the result and what can we predict? Of course the result was that many US banks failed and had to be bailed out. Their assessment of risk was wrong and their incentive to speculate was not adequately regulated. In the US the capitalization rate is now 12. This translates to a maximum drawdown of 8.33% which is derived by dividing 100 by 12. What will happen in Europe? European banks will also have to be bailed out since many of their largest banks still have capitalization rates over 30. It doesn’t take a rocket scientist to understand how maximum draw down is the key measure to determine risk.

This tale focuses on a common investment pitfall. I call it stealing. It was a normal scam since it appealed to the victim’s common sense and trust.

This tale focuses on a common investment pitfall. I call it stealing. It was a normal scam since it appealed to the victim’s common sense and trust.

I was asked by a friend to review his girlfriend’s portfolio. Her name was Pam. He said it looked fishy but he wasn’t sure. He was particularly concerned with a limited partnership that she owned. Upon inspection I saw that Pam’s portfolio was comprised of two accounts. In one she had about $25,000 and in the other she had $10,000. The $25,000 portfolio was with a small broker-dealer that I did not recognize. The $10,000 portfolio was with a different broker-dealer that I also did not recognize. I was familiar with the investments that she held in her larger portfolio. They were all mutual funds that paid the sales driven advisor or SAD or broker a big commission and I just assumed that he had made his initial commission and like so many others had simply disappeared. Pam had not heard from him in over 2 years. I was unfamiliar with the investment in the smaller portfolio. This is where the limited partnership resided and it had a stated value of $10,000.

I asked to see the limited partnership document and I suspected a problem. The limited partnership document had as its stated objective the investment in precious gems. I had never seen a precious gems limited partnership and was curious to see the terms, the risks, the expected returns, etc. Unfortunately, I couldn’t find anything out about it. No matter how I tried, it didn’t seem to exist. I called the broker’s office and got no answer. I called the broker-dealer and got no answer. I called the broker dealer of the larger portfolio and was told that the selling broker had not worked for them in years.

What happened? There was no partnership at all. It was a fake. The selling broker had fabricated a limited partnership as well as a broker dealer and was sending annual statements to Pam showing her the value of her portfolio. When he stopped sending reports is when Pam suspected something was amiss. Methods to part a fool from their money have been around since the inception of time and this one was no different. It seems the broker had convinced Pam several years before that she should invest $10,000 into the precious gem fund since it would provide her with diversification. What a believable story is all I could think to myself. Apparently, the broker convinced her that every portfolio should be invested in stocks, bonds, real estate and precious gems. She bought it hook, line and sinker. Read An Asset Allocation Tale to get a good understanding of the types of assets that should be included in a diversified portfolio. Here’s a hint, I don’t classify real estate, gems or commodities in the portfolios I develop. You shouldn’t either.

I learned three important lessons from this encounter. The first was I was surprised that an individual that had the wherewithal to conceive of such an elaborate scam would be willing to settle for such a small amount to steal. I assumed that he went on to bigger and better scams and that this was just a starter. The second was just how easy it was to convince someone to invest in a diversified portfolio just by including the buzzword diversification into the phraseology. Lastly, I learned to avoid investments that I can’t track on an exchange or at least have some certainty of their existence. To quote Will Rodgers, “It’s not the return on my money I’m worried about, it’s the return of my money.”

My father-in-law was a wise old Yankee from Massachusetts when I met him at the ripe old age of 63. He was 17 years older than my mother-in-law, and because he had spent most of his career as a State Department diplomat, I would listen closely to what he had to say since his world and perspective was so alien to the one I knew. He was born in 1915, and like many of his generation, his thinking was shaped by the events of the Great Depression and then World War II.

My father-in-law was a wise old Yankee from Massachusetts when I met him at the ripe old age of 63. He was 17 years older than my mother-in-law, and because he had spent most of his career as a State Department diplomat, I would listen closely to what he had to say since his world and perspective was so alien to the one I knew. He was born in 1915, and like many of his generation, his thinking was shaped by the events of the Great Depression and then World War II.

His formal education was “cut short” due to financial hardship, but that didn’t mean he stopped learning. He would always say that he went to college at the school of hard knocks. He never gave me any unsolicited advice in all the 27 years I knew him, but if asked, he would offer an opinion, which I always valued. He had a saying that is particularly relevant to this tale and that I remember often. He would tell me, “Common sense is the least common of the senses.” I’ve come to appreciate the wisdom of this phrase as well and use it often. It’s especially true when it comes to investment management.

What my father-in-law meant by the phrase, and how it applies to your portfolio, is that you shouldn’t over-think or over-intellectualize a problem. Investing is something that if you over-think or over-intellectualize it usually costs you money. Good advisors know they need to keep things simple or else they lose the attention of their audience. This tale speaks to a common sense approach to investing and outlines the duties of the advisor.

We’ve learned in other tales to identify several types of advisors as FABs, SADs and HAMs. As a reminder, FABs are fee-based advisors, SADs are sales-driven advisors and HAMs are hired asset managers. What we haven’t learned is anything about their day-to-day duties and responsibilities to us as their clients. So what do advisors do to merit the money they charge you? This tale looks at what SADs and FABs have to offer and why it’s valuable.

From what I’ve learned over the past 30 years of advising clients and assuming that SADs can overcome their inherent conflict of interest is the following: SADs and FABs have two primary duties of equal importance and one secondary duty with, in my opinion, little value.

PRIMARY DUTIES OF ADVISING

The first of the two primary duties is to determine the appropriate asset allocation or capital allocation that’s right for you. They identify and suggest different types of investments for different buckets. The key here is they suggest what is right for you. You are not a formula and neither is asset allocation. If you meet with an advisor who is formulaic and says something inane like “Your bond allocation should match your age, so you should have 35% of your portfolio in bonds because you are 35 years of age,” you should immediately head for the exits. These simplistic asset-allocation formulas based on age are flat-out wrong, devalue the importance of the right asset allocation and give people the impression that one size fits all. You are not a cookie, so forget the cookie-cutter approach. I consider proper asset allocation critical to my client’s long-term success. Make sure you have the right allocation and stick with it. Call it your plan.

The second of the two primary duties is to hold your hand by advising you to “follow your plan” when you want to “alter your plan.” People have a tendency to self-destruct. It seems silly but it’s not. There are countless behavioral reasons for people to have this tendency, and I find it so important that many of my peers classify me as a financial behaviorist. Nevertheless, handholding is a critical duty of an advisor. Following your plan is critical to your financial success. People, left to their own devices, have difficulty practicing the required detachment, objectivity and discipline that a good advisor brings to your situation. These skills, developed over an advisor’s lifetime, are important, and you should not downplay them. They are essential to your success.

As an example, let’s look at the typical mutual fund investor. The mutual fund is a long-term investment. My parents have held the same mutual funds for 40+ years. I haven’t asked them to sell them, and I know better. Yet study after study shows that the length of time individual investors hold mutual funds is getting shorter and shorter. The last study I read said that the average mutual fund holding period has dropped to fewer than three years. What this means is that people are trading mutual funds. This is a recipe for disaster since most people are lousy traders of anything, and that includes mutual funds. The results prove to be true. The typical mutual fund trader consistently underperforms the very same fund he is trading by 4–5% per year. A good advisor knows this about mutual funds and prevents the individual from practicing this type of self-destructive behavior.

DON'T GO IT ALONE

Many great investors suggest that the average investor can “do it” themselves. They should go it alone. You simply follow their rules, and presto—success. If it were this simple, we would all be rich. The basic message of these great investors/books/sites, other than the knowledge they impart, is that you can and should go it alone. You should act as your own advisor. You should manage your own investments. You can perform well if you follow their rules. I disagree completely. I have seen that people can’t follow rules, even simple rules. Although the guru’s facts are correct, the conclusions don’t match my conclusions for most people.

Many gurus go through a series of logical progressions giving the impression that advisors aren’t necessary. They say to keep it simple. They are right. They say to diversify. They are right. They say to keep costs low and use exchange-traded funds and index funds. Again, they are right. They say to stick to your asset allocation plan through thick and thin and rebalance when necessary, and again they’re right. They say that market timing is an unprofitable pursuit for most individual investors, and again they are right. Please note it is not an unprofitable pursuit for the gurus since they don’t follow their own advice. They are all market timers or else they wouldn’t be gurus, they would be a stock index fund. Finally, they say that most importantly you must stay disciplined. This is where things fall apart and the reason a good advisor is worth what you pay them. Gurus think that staying disciplined is easy. It’s not. It’s easy for them but not for others. Underestimating people’s irrational reactions under stress leads them down the wrong path. They conclude that people can follow rules. My empirical observations say the opposite. Most people can’t follow rules, they are undisciplined and, left to their own devices, will self-destruct. Limiting this tendency, or perhaps reducing it entirely, along with the proper asset allocation, is the true value of an advisor. Please note that I believe most advisors are just as undisciplined as the average investor. This leads to a blind-leading-the-blind relationship and is why I always say you can only work with those that have a methodology and have been through multiple market cycles. If you can’t, then you must learn to do it yourself.

I don’t think gurus can appreciate how difficult it is to advise people to stay true to their plan when faced with periods of extended gloom or extended boom. It’s especially true given that people are most fearful and most greedy during these periods. The media bombards them with “expert advice” everywhere they turn. In any event, I suggest you read guru books. You may just be the type of person that can stay disciplined.

This leaves a real possibility. Are gurus aware of the individual investor’s lack of discipline and yet still recommend they go it alone? Perhaps the true motivation behind a go-at-it-alone advice is advisor competency. Because gurus recognize that most advisors who individual investors or small investors can hire are either incompetent or self-serving, perhaps they have a point. Perhaps they have factored this into their equation and concluded you should invest your own money and not use advisors. They may reason that most advisors have no more discipline than the individual investor. Perhaps they reason that the SAD will always overweight a person’s portfolio toward stocks because they make more money when their clients are in stocks than in bonds or cash. Perhaps they reason that a SAD has a financial incentive to move your money out of the market and into safe investments at or near market bottoms, or the opposite, to move your money into risky investments at or near market tops. They may not say it, but they understand the financial landscape and, all things considered, still think you should go it alone. Either way, it doesn’t matter. The more you learn, the better your result will be.

FINAL DUTY: INVESTMENT SELECTION

So what is the final and secondary duty that you get when you hire a good advisor? The answer is investment selection. In my opinion, it’s of limited importance. Most individual investors think investment selection is the most critical component to investment success, but they couldn’t be further from the truth. Today’s advisor, good or bad, has at their disposal about as much personal finance information as the average investor. Information is now a commodity. It is a great equalizer. But, “where” to invest is very different from “how” to invest. “Where” deals with investment selection, while “how” deals with asset allocation and staying true to your plan. A good advisor knows “how” to invest and stays disciplined. They possess knowledge, experience and wisdom. They recognize when you throw these three things into the equation, you get common sense, and “common sense is the least common of the senses.”

So in summary, when you hire an advisor, hopefully an expert one, you may think you are paying them for “where” to invest your money. In fact, you are paying for their asset allocation interpretation and, most importantly, for their discipline. You are paying for their “how.” You shouldn’t expect to achieve the rates of return that a guru achieves, but you shouldn’t short-change yourself either by hiring incompetent or self-serving advisors.

My 85 year old father recently received a solicitation from AARP. For those that may not know about AARP, it stands for the American Association of Retired Persons. He showed me the solicitation letter and since we both thought the offer looked tempting, we did exactly what the letter instructed and asked AARP to send us more information. We were particularly intrigued about how my father could

My 85 year old father recently received a solicitation from AARP. For those that may not know about AARP, it stands for the American Association of Retired Persons. He showed me the solicitation letter and since we both thought the offer looked tempting, we did exactly what the letter instructed and asked AARP to send us more information. We were particularly intrigued about how my father could

1) Receive 9% a year for the rest of his life,

2) Never outlive this 9%, and;

3) How my mom would receive any leftover money that he might not get if he were to die before he received an amount equal to his original investment.

I had a pretty good idea of what AARP would send, but ever the optimists, we waited with anticipation and a week and a half later we received the “magic solution.” If you scroll to end of this tale, you can see the “magic solution” my father received from AARP.

Many know by now that what they were asking my father to invest $50,000 into is called an immediate annuity. However, I like “magic solution” much better since like the alchemist of old, AARP and their preferred vendor New York Life are trying to make you think they can convert a less than 1% world into a 9% dream. This fantasy of getting something for nothing is obviously the image AARP and New York Life wants to imprint in your brain. Many people might say things like “shame on them” for trying to deceive the unsuspecting consumer. Many might say things like “the government should do something about this and protect the innocent.” I say, and the reason I write Financial Tales–you must protect yourself. Ignorance is not an excuse. Learn the facts and learn that when dealing with anyone or any product that offers you a stream of guaranteed income for life that what they typically try to sell you is called “The Payout Rate” and if you don’t understand simple math you will confuse it with “The Interest Rate.” The two are not the same and it is a vital lesson for anyone contemplating giving money to an insurance company or an esteemed organization like AARP. It is the reason the subtitle of this tale is The Payout Rate vs. The Interest Rate.

Let me digress before I continue with this tale. Some of you may have read A Lumpy Tale. Essentially it answers the question—Should I take a lump sum amount at retirement or a stream of income for life? The circumstance in this tale where my father could invest $50,000 in exchange for an income stream for life is the same analysis. So I suggest you read it as well. If you don’t let me summarize, in A Lumpy Tale in many cases I recommend that a person about to retire that has never saved money in their life should avoid taking a lump sum. I know this is heresy to the mainstream financial planning community and investment advisory community but they are flat out wrong. They don’t factor client behavior and habits into the equation. I recommend this course of action for these types of savings-challenged people because if a person hasn’t saved money by the time they go to retire and someone hands them a Lump Sum of money they will more than likely blow it. Remember these tales are meant to impart wisdom and often go against mainstream financial planning. Nevertheless, it is instructive for those on the verge of retirement to understand the difference between The Payout Rate and The Interest Rate.

Let’s see just how AARP works their magic by providing a 9% rate in what I consider a 1% environment. I think everyone would like to know how they do it, so let’s sum up their offer and then examine if it is a good investment or not. Here’s what they offer. If my 85 year old father invests $50,000 into the “magic solution,” they will guarantee him $4,500 per year for the rest of his life no matter what. If he dies at age 86 and has received one payment of $4,500, my mom will get $45,500 back. If he dies at age 87 after receiving 2 payments of $4,500 for a total of $9,000 over two years, my mom gets $41,000 back. This goes on like this until he eventually dies. If he lives to age 97 he would have received $54,000 by then and if he dies my mom would receive $0.

So let’s analyze the “magic solution” and as always compare it to alternatives. Let’s first compare the “magic solution” to investing cash under your mattress. If my father took $50,000 and put it under his mattress he could take out $4,500 at age 86 and if he died my mom would find $45,500 left under the mattress—the exact same as with the “magic solution.” If he took out an additional $4,500 at age 87 and then died my mom would find $41,000 left under the mattress—once again the exact same number as the “magic solution.” This could go on for many years and in fact until my father reaches age 96. At that point there would only be $500 left for my mom should he die—and once again, the exact same amount as under the “magic solution.” So the analysis is simple—if putting money under you mattress gives you a 0% rate of return for 11 years and the “magic solution” does the same, then the “magic solution” is also making you a 0% rate of return over the same time period and equivalent to mattress investing. This is not a very good investment in my opinion. In fact I think it’s terrible. However, they are paying you $4500 per year which is a 9% payout rate on the $50,000 investment. That’s the point of this tale. They are taking your own money and in a legal variation of a Ponzi Scheme they are giving it right back to you for 11 years.

It’s beyond my imagination to think that with the intense scrutiny of financial regulation aimed at protecting the consumer, a coordinated effort on a national level could exist where it appears to me the sole objective is to—- imprint a 9% return into the minds of the unsuspecting when for the first 11 years of the investment the real return is no better than putting money under a mattress. This simply can’t be. I must be missing something. After all we are talking about AARP and New York Life. These are reputable and esteemed firms.

So I ask, what might be behind this offer that I can’t see. For example, what happens if my dad lives more than 11 years? Let’s say he lives to 100. By then he would have received 15 payments of $4,500 or $67.500 which is $17,500 more than he invested so all is not lost. The expected value of this investment is in fact not 0% but something higher since in fact some 85 year olds that enter into the “magic solution” contract with New York Life under the blessing of AARP will in fact live beyond the age of 96 and in fact actually make some return on their $50,000 initial investment. So I ask the question, how long would my father have to live in order to achieve a 9% rate of return on his investment instead of a 9% payout rate?

The answer is he would have to live to age 114. By then he would have received 29 payments of $4,500 each or a total of $130,500. Though my father is very healthy and exercises regularly. I couldn’t recommend he invest $50,000 into the “magic solution.” It doesn’t make sense to me to make a 0% return on money for 11 years. It may make sense to some but not to me.

When I was in elementary school we would spend endless, countless, boring hours focusing on the three R’s: reading, writing and arithmetic. While most can commiserate with my experience towards the three R’s, nowadays, I find myself focusing on The Three R’s of Investing: the Reward, the Risk and the Ratio. Over the past 25 years, The Three R’s of Investing have helped me manage money for clients and here’s how they can help you.

When I was in elementary school we would spend endless, countless, boring hours focusing on the three R’s: reading, writing and arithmetic. While most can commiserate with my experience towards the three R’s, nowadays, I find myself focusing on The Three R’s of Investing: the Reward, the Risk and the Ratio. Over the past 25 years, The Three R’s of Investing have helped me manage money for clients and here’s how they can help you.

In my opinion, the Ratio of Reward to Risk or simply Reward divided by Risk is the simplest way to understand the essential behavior or price movement of any investment. As a rule of thumb, the higher the Ratio the better the investment and the more likely an investor will be to hold a particular investment or stick with a particular investment philosophy. This ratio has a name and was not developed by me. It was originally developed to analyze commodity trading systems and is called The MAR Ratio. I have adopted this ratio to measure more than just commodity trading systems since I view any investment that has historical and continuous price data as a trading system. To emphasize how attractive I consider investments that have high MAR Ratios, I have created The Financial Tales Portfolio.

As a tribute to my heritage, Alto means High in Spanish and just like the name says–it strives to deliver an Alto or High MAR Ratio for those that embrace the approach. This tale is called An Alto Mar Tale because it will give you a simple way to analyze the relationship between reward and risk associated with an individual investment such as a stock or bond or a broad-based investment such as a portfolio style, asset class, index or philosophy. This tale and especially A Practical Tale will also give you a rudimentary yet very effective and intuitive way of comparing one investment to another.

Let’s take a look at the first R of the three R’s, Reward. We are all familiar with the word reward. The investment word doesn’t try to confuse or break any new ground when using this word. In investment parlance like in normal language, reward is a good thing. It is positive. It is measured by the positive rate of return an investment is expected to make over time. It is the expected compounded annual growth rate of an investment or CAGR.

Now, we’ll examine the word Risk. Unlike academicians that define risk in ways that have absolutely nothing to do with reality, we define risk by answering the following 2-part question;

1) What is the maximum amount of money I could lose if I invested in a particular Security or Property or Portfolio or Index or Mutual Fund or ETF or Etc. at the worst possible time and,

2) If I were to have invested at the worst possible time, how long will it take before I recover my initial investment?

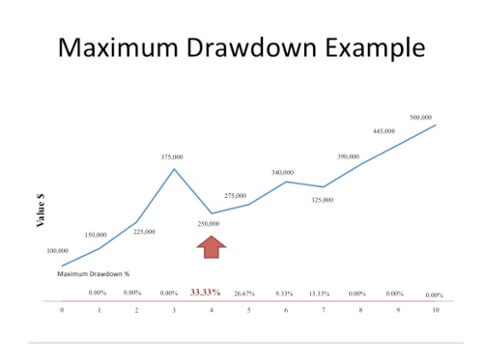

The answer to the above is called the Maximum Draw Down or MDD of an investment and is the subtitle of this tale. It is how we define risk and can be used to analyze the risk of just about anything you might want to own. It is very important to pay attention to part 2 of the question because you can’t calculate an investment’s MDD until it has exceeded its initial investment. This is just common sense because one can’t tell if an investment has stopped going down from where it was purchased until it has exceeded the purchase price.

Let’s look at a recent US stock market example to understand how to calculate MDD or risk.

Had you invested in the S&P 500 at the peak price in September 2000, then at the lowest price in October 2002 your capital would have declined by almost 50%. The peak price of the S&P 500 was not exceeded until June of 2007, or almost 7 years after the 2000 peak. It is only in June of 2007 that you can precisely measure the MDD that occurred from September 2000 to October 2002. Once again, this almost 50% drop is called TheMaximum Draw Down or MDD and is how I define risk and you should as well. It is a critical term to understand and can’t be over-emphasized. Believe me when I tell you that if you don’t pay attention to this term and how it applies to every investment in your portfolio you could be in big trouble. As a practical example, a retiree would much rather retire in October of 2002 after a 50% market decline than in September of 2000 before a 50% market decline. Since most investors have no way of knowing what stage the market is in when they retire—they better understand the nature of the investments they own. Timing matters and investing in a way that reduces MDD or risk is one of the best ways to tilt things in your favor.

Once again, risk is the MDD of an investment or how much an investment can lose if purchased at the most inopportune time. It’s important to assume you will make an investment at the least opportune time because anything other than this assumption would give you an edge over other market participants. If you have this edge, then power to you. But if you do not, then you fall under the category of investors that will either purchase something at the least opportune time, retire at the least opportune time or already own it when it peaks. Since it’s natural for a person to look at their portfolio and when they see it peak consider it “their money”, then it is also natural for them to see a loss from this peak as a loss of “their money.” This natural behavior is the reason it’s imperative that we measure how much of a decline a portfolio or individual investment can suffer.

Getting back to the word risk, it’s more complicated than reward because there are so many clever yet useless ways to define it. Some think of it as negative reward. Others think of it as how volatile the price of the particular investment can behave over time. Others perceive of it as the possibility of a loss of permanent capital over time. We think of risk in a simple manner. In case you haven’t been paying attention, we define risk as follows;

How much money could I lose if I invested at the worst possible time before I recover my initial investment?

We know this is not the way risk is defined in Modern Portfolio Theory, which uses volatility or standard deviation as the definition. While standard deviation provides certain insights that MDD doesn’t, it lacks the behavioral reality that is meaningful to investors. As I have said countless times, Modern Portfolio Theory and standard deviation treat risk as though a person would be equally happy going from poverty to wealth as from wealth to poverty. This is simply not true. Thus in our opinion MPT, in looking at risk in a symmetrical manner, is not a reflection of reality. We therefore define risk the same way our clients do. It’s the natural way to define risk. We think we are in good company. When Warren Buffett’s business partner, Charlie Munger, was asked how he defined riskhe looked a bit confounded as though someone had asked him a trick question and said, “Risk is defined by how much money you can lose.” I urge all to adopt this same attitude and definition.