Many investors with multiple real estate properties desire to defer capital gains tax for years while increasing cash flow. Read on to explore a brief guide to 721 exchanges and learn how they can help investors.

What Is a 721 Exchange?

721 exchanges follow Section 721 of the IRS code, permitting investors to transfer properties in like-kind exchanges for real estate investment trust shares. 721 exchanges won’t trigger the need to pay capital gains taxes—it’s a helpful mechanism used by institutional investors, as individual investors don’t share familiarity with the concept.

Investors utilize 721 exchanges to manage cash flow, then reinvest other properties without requiring direct sales taxes due to it being an IRS-sanctioned process. Additionally, 721 exchanges work for consolidating multiple properties by transforming them into a single property. This method assists investors by reducing overall investment portfolios.

1031 vs. 721 Exchanges

Investors often use 721 exchanges as an alternative to 1031 exchanges for their managerial responsibilities and tax capabilities. While both offer unique benefits to investors, their differences determine whether they fit specific investment plans. One considerable difference is the daily management and property ownership responsibilities.

The investment property responsibilities include property maintenance, rent collection, and property tenants. Additionally, 721 exchanges don’t cause taxable events, as you aren’t required to pay investment taxes until shares are redeemed. You can spread tax payments across time, or investors can do it all at once.

1031 Exchanges Pros and Cons

After briefly going over 721 exchanges, it’s essential to learn about the pros and cons of 1031 exchanges. Firstly, 1031 exchanges allow for capital gains tax deferment, which allows wealth to accumulate faster, increasing before your first investment. Furthermore, 1031 exchanges expose investors to new markets, allowing them the power to quickly unload existing real estate investments and get exposure to new markets. Lastly, 1031 exchanges allow for capital gains deferment until the passing of the investor.

However, 1031 exchanges also have their downsides. To start, 1031 exchanges have a specific timeline investors must follow. Investors have 45 days from the starting sale date to relinquish their property for a like-kind one, then 180 days to close the sale of the replacement property. Moreover, finding like-kind replacement properties can become a struggle, so investors must plan before starting a 1031 exchange.

Can 1031 Exchanges Become REITs?

Investing in real estate is an exceptional strategy to diversify investment portfolios and increase passive income. A REIT, or real estate investment trust, can operate as a helpful investment tool for increasing cash flow, especially for investing in real estate with managerial responsibilities.

Can you turn your 1031 exchange into a REIT? While investors can’t turn 1031 exchanges into REITs, there are alternatives to consider for capital gains deferment. These alternatives include Delaware Statutory Trusts (DSTs) and umbrella partnership real estate investment trusts (UPREITs). These are optimal investment tools that can help increase cash flow, defer capital gains, and establish estate planning.

Benefits of 721 Exchanges

Investors who want to pursue 721 exchanges receive many benefits. It can range from obtaining passive income opportunities to various tax advantages. Discover some benefits that can entice investors into performing a 721 exchange.

Estate Planning

One of the first benefits of 721 exchanges is for investors to pass their assets onto their chosen heirs. When the time of an investor’s passing comes, shares split equally, either passing through trusts or remaining held.

Because physical real estate can become difficult to sell, 721 exchanges can pass down to chosen heirs, receiving a step-up basis by deferring capital gains taxes. Furthermore, the state also defers depreciation recapture taxes.

Portfolio Diversification

Another reason investors choose the 721 exchange is the ability to diversify their assets. More specifically, 721 exchanges allow investors to obtain diversification capabilities across industries, tenants, asset classes, and geographies in REIT structures. Individual investors participate in real estate portfolio diversification, no longer dependent or concentrated on a single asset, obtaining appreciation and cash flow.

REITs also provide similar real estate ownership benefits, such as depreciation tax shelters, income, appreciation, principal pay downs, and more. Numerous REITs continuously make ongoing acquisitions. Moreover, it allows investors to benefit from future buying opportunities without triggering depreciation recapture tax events or capital gains tax.

Tax Advantages

Many investors choose 721 exchanges due to their tax advantages. 721 exchanges permit investors to defer capital gains tax through tax-deferred exchanges of appreciated real estate assets. This impacts operating partnership shares, also known as OP Units. OP Units can convert into REIT shares, which can be sold for operating partnerships.

Furthermore, REITs require distributing 90 percent of an investor’s taxable income via dividends paid to shareholders. These dividends become declared annually by REITs, typically distributed monthly or quarterly. It’s a helpful tool for continuously deferring capital gains and increasing passive income.

Passive Income

Another perk of 721 exchanges is the passive income opportunities. The economy can drastically impact property investments, including market fluctuations. These fluctuations can result in cash flow changes in rental properties, thus creating less rental income than previously established. 721 exchanges pay shareholders with dividends and create passive income.

Managers take charge of REIT operations and asset management, while investors have a considerably smaller role. Managers take on the daily decision-making for portfolio assets. Adversely, 721 exchange investors receive updates and information regarding acquisitions, dispositions, and distribution from the managers. Moreover, investors can use their time to focus on their other real estate investments while managers handle the everyday work.

721 Exchange Rules To Follow

Pursuing a 721 exchange involves meeting specific rules and qualifications. Initially, 721 exchanges required institutional-grade real estate investments due to investors owning particular properties. 721 exchanges also don’t allow direct property contributions for REITs. There are several rules to follow for pursuing 721 exchanges.

One of the first rules is that 721 exchanges mention that no gains or losses become recognized in partnerships or partners. It applies toward partnership properties, thus receiving partnership interest. Additionally, 721 exchanges do not apply to realized gains via partnership property transfers. Lastly, if gains become part of an investor’s gross income, investors don’t receive gains on property transfers from partnerships.

Sera Capital offers its services and expertise to individuals with highly appreciated assets. We are a fee-only fiduciary that offers knowledge of 721 and 1031 exchanges, along with information for Delaware Statutory Trusts, Opportunity Zones and Funds, and more. Our 721 UPREIT exchange services allow investors to increase portfolio diversification and investment liquidity while deferring capital gains. If you have questions about our 721 exchange services, schedule a free phone call today.

Investing in REITs tends to entice real estate investors who want quick profits. So, here are the benefits of investing in REITs sooner rather than later for investors.

Short Path To Profit

There’s only partial truth in tenants paying monthly rent higher than your mortgage payment and creating profit. Investment property rent should cover your mortgage payment, property taxes, HOA fees, home insurance, maintenance, property management fees, and other miscellaneous costs.

You can calibrate your rental rates just right if you have professional P&L (profit and loss) experience, effectively covering mortgage and side payments with interruption. You can achieve quicker profits through proper P&L statement experience.

Higher Yields

REITs have the potential to reach high yields via dividend payouts. Rental income creates a steady cash flow if there’s a consistent stream of tenants. Furthermore, REIT investors also have capital appreciation opportunities through REITs, as commercial real estate prices increase steadily over time.

Residential apartment rental rates historically increased, meaning REIT holding apartment dividends and other residential areas can increase. It’s crucial to remember that REITs yields depend on upfront investment fees, occupancy and location, and management fees.

Portfolio Diversification

One benefit of investing in REITs as soon as possible is portfolio diversification. REITs are helpful tools for companies, as they offer a more straightforward entry into the real estate market compared to other real estate investments. REITs allow investors to invest in a bigger real estate asset variety if purchasing properties for themselves.

Creating a more diverse investment portfolio comes through pool funds accumulated with other investors. Furthermore, investors can also choose from a mix of mortgage REITs and equity to further diversify their real estate income earnings.

Available REIT Share Liquidity

REIT share liquidity can occur because real estate properties take weeks or months to sell. Investors who wish to benefit from real estate investments won’t have to wait to cash out, as REITs can provide them with liquidity opportunities. Publicly traded REIT shares offer high liquidity due to being readily traded through public security exchanges.

Publicly traded REIT shares tend to attract real estate investors as they take less time to complete than direct investments into real estate properties. Because private REITs don’t sell through public security exchanges, not all REITs offer liquidity opportunities.

Flexibility and Transparency

Many investors choose REITs due to their flexibility and transparency. Because purchasing shares in REITs is a straightforward process, it’s an accessible passive income that’s flexible for investors. Investors can choose three REIT types that best suit their investment goals.

Investors purchasing publicly-traded REITs provide a level of protection via transparency. Due to being traded on the public stock exchange, information about trends and share prices is widely available.

Sera Capital offers its REIT experience and services to individuals with highly appreciated assets. The benefits of Section 721 C Partnerships allow increased investment liquidity and portfolio diversification, alongside capital gains tax deferment and recapture tax depreciation. Ask about our services and expertise today.

Investing in a singular or multiple properties doesn’t have to be complicated. Investors involve themselves in 1031 exchanges because of their many advantages, including tax benefits, passive income opportunities, estate planning, and more. Here are some of the advantages of choosing a 1031 tax-deferred exchange offer and why investors should consider it in their investment portfolio.

What Is a 1031 Exchange?

A 1031 exchange originates from Section 1031 of the US Internal Revenue Code. It allows investors to defer paying capital gains taxes when selling properties and reinvest proceeds from property sales within a specific time frame. It applies to singular or multiple like-kind properties, allowing investors to defer capital gains tax from property sales.

A 1031 exchange then puts the proceeds from the sale toward another property, often referred to as trading up. There are many reasons to invest in 1031 exchanges, such as investors seeking properties with better return prospects or those seeking to diversify assets. Furthermore, utilizing 1031 exchanges allows real estate investors to look for an already-managed property instead of managing one themselves.

1031 Exchanges Qualifications

Investors must meet several qualifications to perform a 1031 exchange. Such exchanges are a common tax strategy to help grow investment portfolios and efficiently increase net worth.

Identifying Eligible Properties

The Internal Revenue Service requires like-kind properties to have the same character or nature as the replacement property, even if the quality is different. According to the IRS, real estate properties must remain like-kind, regardless of how real estate improves. The Tax Cuts and Jobs Act eliminates intangible, personal properties from being involved in tax-deferment exchanges.

Active real estate investors perform 1031 exchanges on properties being sold and bought, allowing for capital gains, tax deferment, or complete elimination via estate planning. As such, it helps investors become more liquid, using capital gains to scale their estate portfolios at a better pace.

Follow the Three Main Rules

The three major rules of 1031 exchanges start with ensuring that an investor’s replacement property should have a similar or greater value than the selling property. To get the most out of an exchange, investors should identify the three potential replacement properties to purchase regardless of market value. Alternatively, investors must identify unlimited properties if the combined real estate values don’t exceed over 200 percent of the replacement property. Lastly, investors can identify unlimited properties if the acquired properties value 95 percent or more of the replacement property.

Secondly, the IRS requires that replacement properties must be identified within 45 days. Experienced real estate investors don’t wait for their property to sell before seeking out a replacement, thus ensuring they receive the best price on the replacement property. Finally, replacement properties must be purchased within 180 days; the IRS counts each individual day, including holidays and weekends.

Benefits of 1031 Tax-Deferred Exchanges

The advantages of 1031 tax-deferred exchange offers are plentiful, from portfolio diversification to a reduction in management responsibilities. Below are the various benefits that can come out of 1031 exchanges.

Consolidation and Diversification

A 1031 tax-deferred exchange offer allows exchange flexibility for investors, whether they’re finding one or multiple properties. Furthermore, this type of exchange enables investors to consolidate multiple properties into one by acquiring properties within the United States.

For instance, investors can acquire a retail strip mall in exchange for two duplex properties in their possession. They can also take advantage of newly growing areas by exchanging properties in one state for properties in another. The options are incredibly versatile as long as the investor focuses their exchanges within the United States and other US-owned areas.

Increased Income and Cash Flow

One thing investors want to gain from their real estate investments is passive income, which can support them even into retirement. A 1031 tax-deferred exchange offer allows for passive cash flow and overall profits, which can increase over time.

For instance, vacant land that doesn’t generate cash flow can be exchanged for a property that does. This can allow investors to create passive income, invest in retirement, and create generational wealth.

Exposure to New Markets

Many investors strive to get their foot in the door early for up-and-coming markets, hoping the decision will lead to bigger returns in the future. 1031 tax-deferred exchange offers allow investors to invest in markets with growing potential, especially with like-kind exchanges that aren’t constrained to state lines. Investors can capitalize on a real estate property’s advantage, which results in diversified risk.

1031 exchange offers allow passive investors to leave a single-managed property and explore different passive investments, thus spreading risk across other markets and reclaiming time spent managing and maintaining properties.

Reduced Managerial Responsibilities

If there’s one thing that holds investors back from taking on properties, it’s the managerial responsibilities they have to shoulder. Luckily, a 1031 tax-deferred exchange allows investors to own one or several rental properties without managing costly maintenance and intensive management tasks.

1031 exchanges can reduce the stress and headaches associated with property management. Investors can increase their profits and decrease the effort and time spent focusing on rental property maintenance. The exchange puts the responsibility in an impartial third party’s hands, leaving the investor to focus on increasing profits and investing in other properties.

Boosted Purchasing Power

A 1031 tax-deferred exchange offer creates increased purchasing power for investors. More specifically, capital gains get taxed the maximum 20 percent of the capital gains tax rate, with a 25 percent recaptured depreciation for individual taxpayers. Furthermore, most states within the US have a predetermined state capital gains tax that defers through 1031 tax-deferred exchanges, resulting in increased purchasing power.

Investment Leverage

One significant benefit of 1031 exchanges is their leveraging capabilities. Investors can benefit significantly from 1031 tax-deferred exchanges by acquiring more valuable investment properties.

They can increase down payments and improve their buying power by acquiring expensive replacement properties and utilizing money paid to the IRS via taxes. Therefore, they can leverage their money and continuously build wealth via real estate investments.

Investors who wish to diversify their investment portfolios and spread risk across various real estate investments can benefit from 1031 exchanges. At Sera Capital, we believe in supporting and educating individuals with highly appreciated assets who want to go in the right direction. Our 1031 exchange advisors help provide tools and guidance on investing in real estate properties for long-term financial planning. If you have questions regarding our 1031 exchange service, contact us through a free 30-minute phone call today.

A diversified portfolio can prevent investors from placing all their eggs into one basket. Consolidating investments puts a portfolio at more risk when the market changes. It’s crucial to learn how to construct a diverse real estate investment portfolio.

What Is Portfolio Diversification?

Portfolio diversification involves an investor spreading their investments across various assets, asset classes, or strategies to reduce risk. Diversification includes concentration on a singular asset, improving long-term value potential, and reducing short-term volatility risks. Other portfolio investments can help balance the difference with their existing gains if an investment doesn’t perform well. Proper portfolio diversification involves choosing investments that don’t correlate highly with one another, as similar investments will likely move in similar directions simultaneously.

Real estate investment portfolio diversification consists of structure, assets, and strategy. For instance, asset diversification could translate to different property type investments, including commercial, industrial, residential, and more. REITs, or real estate investment trusts, are non-traded, private funds, direct ownerships, or partnerships that consist of flipping family homes, commercial land leasing, bridge lending, and more.

Why Investment Portfolio Diversification Matters

Real estate investments can come with challenges and risks, such as being illiquid, meaning it takes time to sell properties to access cash. Each real estate investment should come with the assumption of having different, individual timelines. Because real estate consists of complex, tedious transactions, it can carry high costs due to ongoing maintenance, transaction costs, and management fees. Lastly, real estate depends highly on local marketing trends, interest rates, supply and demand, and economic wellness.

Portfolio diversification can help mitigate potential risks, such as investments in different property types or locations. This method can help reduce local market condition exposure. For instance, if one market area performs poorly, other market areas may do better, helping to balance out investors’ returns. Investing in differing vehicles can help spread risks across broader structures and assets, reducing investors’ reliance on a single investment or property. As such, diversification can benefit an investor’s portfolio in emergency situations where they can access their capital differently. Structuring a real estate investment portfolio can create peace of mind and significantly impact long-term investment.

Tips for Constructing a Diverse Portfolio

Investors can benefit significantly from real estate investment portfolio diversification. Use these tips on how to construct a diverse real estate investment portfolio concisely and straightforwardly.

Finding the Right Location

The performance of real estate can vary across different locations. It’s crucial to consider investing in various properties in other areas to produce varying results. While one place can have few rental locations or more vacancies than actual tenants, another can have a competitive real estate market with more renters. Some location examples include urban, suburban, and rural areas, foreign or domestic locations, regions, and high- or low-income communities.

Unpredictable market behavior can impact your real estate investments. However, when searching for high-growth markets, keep in mind that population growth, job opportunities, and job diversity can correlate with property demand in return.

Understanding the Property’s Role

The purpose of a real estate investment property can vary. Property purposes vary between offices, industrial sites, residential properties, healthcare facilities, retail establishments, and multi-family homes.

Each real estate asset type can have varying levels of risk depending on its location and interactions. For instance, retail establishments in high-volume areas can thrive compared to remote town vendors. Factors such as tenants and location can impact the price of rent and tenant consistency.

Property Ownership Structure

The ownership structure is another consideration for real estate investment portfolio diversification. It can help define how much investors become at risk upon accepting an investment. Direct ownership comes with full risk potential. Fractional ownership, like DSTs and REITs, provides investors with risk flexibility.

A fractional ownership structure, such as a Delaware Statutory Trust, is an option for investors not wanting to qualify for beneficial interest gains for property debt. When investors get involved with debt, the trust then takes on the debt, assigning a portion to the investor based on a ratio of loan-to-debt.

Real Estate Property Tenants

Tenants in real estate can present various factors for investors, such as expected behaviors, rent price changes, lease consistency, and upkeep expectations. For instance, if a real estate investment property suits college-age students, it can result in lower upkeep expectations and rent prices. Properties further from campus may not permit high earnings on rent but can result in not needing as much property improvement.

Furthermore, the student turnover rate sits higher. There are other tenant types of real estate, such as individuals, small businesses, government agencies, families, healthcare workers, and more.

Property Investment Strategy

When investors want to diversify their real estate investment portfolio, they must consider their strategy. Investors that use multiple diverse strategies across differing properties can also influence potential gains and risks. For instance, a buy-and-hold approach is a long-term, passive investment technique that helps create a stable, consistent portfolio over a long period, generating increased returns. Investors will wait for a market upturn to gain and sell.

Other real estate investment properties can lend themselves to renting and rehabbing processes, which generate income in a timely manner. Combining various real estate investment portfolio diversification strategies can help investors prepare for potential market downturns and minimize risks. So, investors must consider their investment strategies for future obstacles.

Real Estate Management Structure

Real estate management structure is one of the most essential considerations in property diversification. An investor can manage properties themselves, but it can come with a significantly large time commitment, taking time away from focusing on other investments and monitoring local market trends. Investors can opt to work with fund sponsors or third-party management companies to decrease responsibilities throughout their portfolios.

Third-party management companies and fund sponsors do come with their expenses. Suppose an investor makes plans to work with third-party management companies. In that case, they must consider the costs as they can outweigh their property investment’s potential gains and the time commitment needed.

Portfolio diversification takes a considerable amount of understanding, time, and thought. We at Sera Capital help individuals who seek guidance on optimal investment portfolio diversification with fee-only consulting practices, including 1031 and 721 exchanges, Delaware Statutory Trusts, Opportunity Zones, and more. Our financial advisors in Annapolis, IN, help many clients with professional learning tools, tutorials, newsletters, and more to overcome investment obstacles and reach their financial goals. In stressful economic situations, we provide professional insight into individual investment behavior. If you have inquiries regarding our services and expertise, schedule a free 30-minute phone call today.

A 1031 exchange can offer numerous benefits to investors, but it can also become overwhelming. Check out these five tips to ensure a smooth 1031 exchange process for investors.

Sign Exchange Documents Before Closing

The 1031 exchange rules state that investors must sell their relinquished properties and acquire replacement properties later. By signing exchange documents and strictly following 1031 exchange regulations, it becomes an exchange instead of a sale and purchase.

Investors must sign essential exchange documents before or on the closing date of a relinquished property. Additionally, they must follow up by signing a document outlining their assigned rights under the contract, giving the seller notice.

Stay Up-to-Date on Deadlines and Rule Changes

Working with 1031 exchanges requires knowledge of legal jargon and regulations. Furthermore, 1031 exchanges need investors to move swiftly throughout the process; they have 45 days to identify a replacement property, then close on said property 180 days from the original sell date.

Performing a 1031 exchange around Tax Day can add stress, as investors must close by the given tax deadline for the original sale year. If deadlines remain unmet, investors cannot qualify for capital gains tax deferral. Lastly, monitoring tax code changes can impact regulations and rules around 1031 exchanges.

Consider the Expenses

Before moving into a 1031 exchange, you should consider some expenses that go into the process. For instance, some costs can include escrow fees, transfer taxes, brokerage commissions, and exchange fees. So, investors must come with their funds if they want to avoid taxes.

Work With a Supportive Team

Because the 1031 exchange consists of multiple moving parts, it can quickly become overwhelming and stressful to keep track of for a single investor. So, one tip to ensure a smooth 1031 exchange process is to work with a team of experts that offer guidance throughout each of the steps of the exchange.

Qualified individuals to work with include financial advisors, Qualified Intermediaries, and experienced commercial estate attorneys. These professionals can help with paperwork for successful transactions, inspections, and placing debt into replacement properties.

Create a Backup Plan

Sometimes, a 1031 exchange plan may fall apart when least expected. Always have a backup plan to ensure a successful 1031 exchange. It’s crucial to meet 1031 exchange qualifications, even in instances of plans not working out.

Investors can scramble to find last-minute replacement properties, leading to less-than-ideal investments. Investors should use the 3-Property or 200% Rule to identify a plausible investment alternative.

Sera Capital allows people with highly-appreciated assets to defer capital gains tax and expand their investment portfolios. Our DST 1031 exchange services help investors defer capital gains tax on investment or commercial real estate for people who want to unwind their real estate responsibilities and holdings. For more information, contact us at Sera Capital today.

Real estate investment trusts (REITs) are a helpful investment tool for creating passive income. But what goes into REIT taxation? Here’s our quick beginner’s guide to REIT taxation.

What Are REITs?

REITs are favorable investment tools for investors who desire to own income-generating real estate properties without needing to purchase or manage properties. Investors praise REITs due to their generous income avenues.

Qualifying for a REIT involves trusts distributing at least 90 percent of their taxable income to designated shareholders. As such, REITs do not pay corporate income taxes due to earnings getting passed along as dividend payments.

Types of REITs

There are three types of REITs: Equity, Mortgage, and Hybrid. Equity REITs allow trusts to invest in real estate, deriving income from dividends, property sale capital gains, and rent, making for a popular REIT.

Mortgage REITs involve trusts investing in mortgage-backed securities and mortgages, which earn interest from investments, but remain sensitive to interest rate changes.

Hybrid REITs invest in both mortgages and real estate.

REIT Taxation

Before getting involved in REITS, it’s essential to recognize how REIT taxation works and how it can impact an investor. There are two types of REIT taxation: at a trust level and a unitholder level.

Trust Level

REITs could get taxed as a corporation if it were not for their special REIT status. Most assets and income must originate from real estate to meet a REIT. Furthermore, at least 90 percent of taxable income must go toward shareholders.

As such, REITs don’t pay corporate taxes, but any retained earnings would get taxed at a corporate level. REITs must invest at least 75 percent of their assets into cash and real estate while obtaining 75 percent of gross income from mortgage interest and rent.

Unitholders

Dividend payments received by REIT investors can constitute capital gains, capital returns, or ordinary income. The 1099-DIV states that REITs send to shareholders each year, as much of the dividend gets passed-along income from the company’s real estate business; therefore, treated as ordinary income. As such, the specific dividend becomes taxed.

Sera Capital offers its services to investors and individuals with highly appreciated assets who need guidance and advice to reach their financial goals. Our 721 tax deferred exchange services aid individuals and benefit them by increasing their portfolio diversification and investment liquidity. We help by creating passive income for investors with our 721 exchange services, offering a hands-off approach. If you have any questions, contact our specialists today.

Which is right for you: a registered investment advisor or a commission-based broker? Let’s find out.

What Is a Registered Investment Advisor?

A registered investment advisor, or an RIA, is a financial firm that helps manage investment portfolios and advises clients on securities investments. RIAs register through the US Securities and Exchange Commission or state security administrators. RIAs often earn income through managerial fees, which get calculated as a specific percentage of a client’s AUM, or assets under management, by the RIA.

Common Investment Advisor Misconceptions

To know whether a registered investment advisor is right for investors, reviewing common myths surrounding them is essential. Firstly, many people assume that any investments through an investment advisor end up in high-risk stocks. Registering investment advisors ensure clients have a stable, short-term saving account for emergencies or significant purchases. Advisors help create a balanced, diversified portfolio for clients to ensure the investment strategy is in the investor’s favor.

Another misconception regarding registered investment advisors is that they treat their clients less seriously. However, registered investment advisors help guide clients through the investment process and patiently explain each detail to the client’s understanding. They must treat clients respectfully, as investors rely on advisors to reach their goals.

What Is a Commission-Based Broker?

A commission-based broker is a brokerage company employee who receives payment through the number of trades they perform. The difference between registered investment advisors and commission-based brokers is that their commission structure often encourages unethical behaviors, including dishonesty, that won’t benefit their customers. Brokers often earn a percentage of client asset trades; the more their client trades, the more income they receive.

Potential Unethical Practices

Commission brokers earn money through business volumes. If clients don’t perform trades, they, in turn, receive no income. As such, commission brokers can get involved in bucketing, where they purchase or sell securities at more favorable prices than the client expected and don’t pass the value onto the client, pocketing the profit. Furthermore, they can perform churning, where a broker generates commissions through excess trading in a customer’s account.

Sera Capital helps its clients with deciding their financial futures and diversifying portfolios for those with highly appreciated assets. Our professional registered investment advisors give investors the tools to create personalized wealth management, defer capital gains tax, and advise which financial avenues benefit their goals. If you have any questions about our advisors and their services, schedule a free 30-minute phone call today.

Which is right for you: a 1031 exchange or a Qualified Opportunity Zone? Let’s review their pros and cons to determine the best action.

What Is a Qualified Opportunity Zone?

A Qualified Opportunity Zones, or a QOZ, acts as an investment vehicle, often supporting community-nominated areas selected by the Treasury Department and the state. These areas usually experience economic distress, receiving a Qualified Opportunity Fund, or a QOF, in the form of a domestic partnership or corporation.

QOFs invest indirectly through holding stocking or owning interest in businesses located in QOZs or invest directly by holding QOZ business properties. It offers taxpayers potential federal capital gains tax incentives due to long-term investment commitments, especially in low-income areas. Qualified Opportunity Zones have benefits and downsides, depending on the investor’s goals and planning.

Qualified Opportunity Zone Pros

Qualified Opportunity Zones benefit low-income areas and significantly benefit the investors who participate. Let’s review the various benefits that make QOZs so well-regarded, from capital gain reduction and tax deferment.

Capital Gains Reduction

Investing in a Qualified Opportunity Zone can do a lot of good for the area, but noticing any improvement can take a considerably long time. However, the program rewards investors who keep their money in the QOF for an extended period.

The longer the investor maintains their investment, the more benefits they get from it. For instance, investors who hold their investments for 10 years can obtain a 10 percent capital gains tax reduction. Furthermore, any appreciation won’t become subject to capital gains. While investors still pay capital gains tax on their investment a decade prior, they won’t have to pay any more tax on their investment profits.

Capital Gains Tax Deferment

One of the biggest draws to Qualified Opportunity Zones is their capital gains tax deferment benefits. Capital gains tax is one of the most infuriating parts of accumulating wealth; the better their investments perform, the higher they must pay. However, QOZs have a loophole that allows investors to defer some of their capital gains tax with generated passive income.

For instance, if investors provide a QOZ investment within 180 days of incurred capital gains, they can defer taxes on investment amounts until December 31, 2026. This permits investors to generate more income before getting forfeited to the government.

Qualified Opportunity Zone Cons

Qualified Opportunity Zones can act as a great helping hand in low-income areas. However, QOZs can also have some minor downsides. So, here are some cons that come with Qualified Opportunity Zones.

Community Investment Uncertainty

Qualified Opportunity Zones can benefit low-income areas in the United States and the investors, as the purpose is to create a beneficial investment for local communities while boosting financial returns. However, the QOZ legislation states that community leader input isn’t required for development processes.

Because of protests and legal challenges, less popular projects could become held back over others. Investors can end up funding projects that can gentrify low-income areas and raise living costs, especially without understanding the residents living in those areas.

Initially High Buy-In Costs

While some investors don’t mind the costs of QOZs, others can feel a certain uneasiness about the size of initial investment amounts can be. Since QOZs require a staggeringly high six-figure investment, they can make up most of the investor’s available wealth.

Since Qualified Opportunity Zones remain a relatively new concept, they don’t have an established track record for assessing potential investment risks. Even more so, investors may feel uncomfortable tying so much money into a long-term untested investment model.

What Is a 1031 Exchange?

1031 exchanges allow investors to swap one real estate investment property for another with “like-kind” qualities. These investment properties qualify for capital gains tax deferment, consisting of various moving parts that real estate investors must understand. Furthermore, the IRS rules limit its use towards vacation residences, along with time frames and tax implications to consider.

One significant difference between QOZs and 1031 exchanges is that 1031 exchanges apply towards real estate assets; the investor sells real estate investments and trades for replacement real estate investments. QOZs can go towards real estate, bonds, stocks, and more. 1031 exchanges act as a tax break, and a third party holds proceeds from real estate investment sales in escrow.

1031 Exchange Pros

There are many reasons why investors hold 1031 exchanges in high regard. Let’s review the various benefits of 1031 exchanges and see if it’s a suitable choice.

Market Exposure

One significant benefit of 1031 exchanges is potential exposure to newer real estate markets. 1031 exchanges allow investors to quickly unload occurring real estate investments, helping them obtain further exposure to various markets, especially for seeking better returns.

Additionally, 1031 exchanges can occur anywhere in the country, as there aren’t any restrictions based on US state lines. So, an investor can sell a property on the West Coast and use their sales funds to invest in an East Coast property. Moreover, they won’t have to pay capital gains tax at the time of the property sale.

Estate Planning

Many real estate investors often use the phrase: “swap ‘til you drop,” which refers to investors consistently swapping old properties for new ones until their passing. This allows investors to defer capital gains tax on said properties the entire time. Upon their death, this also leaves properties to heirs, who won’t have to pay capital gains tax accumulated from previous sales.

As such, heirs who inherit their properties receive a “step-up” basis, allowing them to inherit properties at current fair-market asset prices. Any gains tax accumulated will vanish, creating an optimal tool for accumulating generational wealth and having no limits on how many 1031 exchanges can occur.

1031 Exchange Cons

With so many benefits to 1031 exchanges, investors should also remain aware of potential downsides. So, here are some cons that come with 1031 exchanges that investors should remain mindful of.

Structure Complications

Overall, the 1031 exchange structure can create difficulty for investors, especially if many people become involved in real estate investment. For instance, if investors involved other parties in investments, and only a portion wanted to participate in a 1031 exchange, this could create an issue. In situations where investors and other participants in the investment want different things, it can become a complicated endeavor, resulting in a Tenancy in Common (TIC) structure.

Sera Capital provides its clients with education and guidance on real estate investments and capital gain tax deferment opportunities. Our Opportunity Zones Investment specialists offer clients exceptional exit planning tools and advice, creating a public or private partnership to allow investors to sell highly appreciated assets. We believe in helping investors by utilizing QOZs as tax-saving tools on stocks, bonds, jewelry, and so much more. For more information on our investment services and advice, contact our Sera Capital specialists today.

What are the differences between an UpREIT and a REIT? Which one is right for you? Let’s find out.

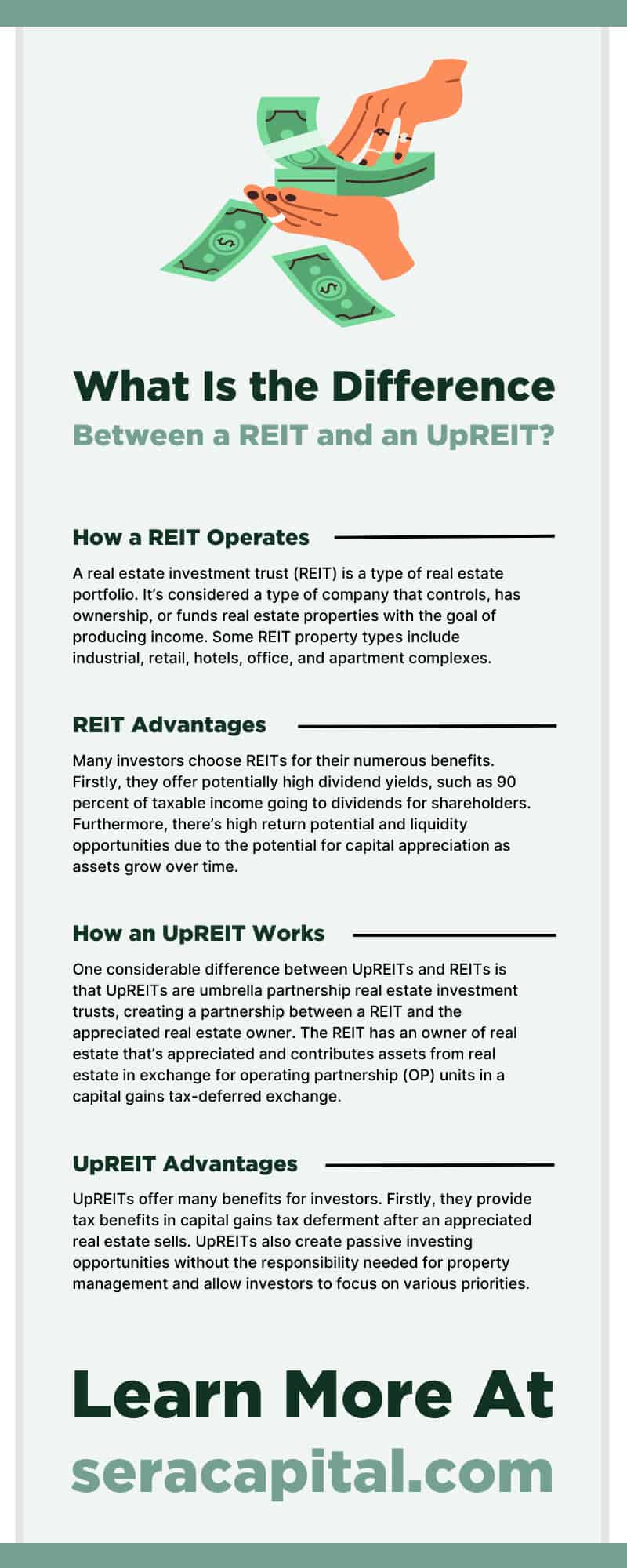

How a REIT Operates

A real estate investment trust (REIT) is a type of real estate portfolio. It’s considered a type of company that controls, has ownership, or funds real estate properties with the goal of producing income. Some REIT property types include industrial, retail, hotels, office, and apartment complexes. REITs allow investors to earn dividends on real estate without having the responsibility of buying, financing, and managing the properties themselves.

REITs allow investors to purchase shares in commercial real estate portfolios, only previously available to large financial intermediaries and wealthy individuals. REITs operate in specialized real estate sectors. Specialty and diversified REITS may possess different property types in their portfolio, including REITs consisting of both retail and office properties. To qualify, a company must comply with certain IRC provisions, including direct long-term ownership of income-generating real estate and distributing income to shareholders.

REIT Advantages

Many investors choose REITs for their numerous benefits. Firstly, they offer potentially high dividend yields, such as 90 percent of taxable income going to dividends for shareholders. Furthermore, there’s high return potential and liquidity opportunities due to the potential for capital appreciation as assets grow over time. This results in investors benefiting from potentially high return amounts. As for liquidity, REITs make for easier selling and purchasing compared to traditional commercial real estate ownership due to getting traded in major stock exchanges.

Additionally, REITs allow portfolio diversification and commercial real estate access to investors. REITs came to fruition as the result of smaller investors wanting to have opportunities to invest in real estate. REITs also offer an alternative means for diversifying investors’ portfolios, treated as stocks representing real estate assets.

REIT Disadvantages

While REITs have many benefits to offer, investors need to remain aware of potential downsides. Firstly, REITs can come with tax burdens due to having complex tax structures. Dividends don’t meet qualified dividends defined by the IRS, which, unless they become collected in tax-advantaged accounts, become taxed as traditional income. Furthermore, REITs act as a leverage to fund growth, leading to lower earnings and higher interest, resulting in bad REIT stock prices.

REITs can also have lower growth. Due to 90 percent of taxable income getting put into dividends, REITs must bring in more cash by issuing new shares and bonds. However, it doesn’t translate into being quickly bought up by investors. Lastly, REITs have potential property-specific risks due to varying sensitivities of the economy compared to others. Investors can risk exposure by investing in one type of REIT.

REITs vs. Direct Real Estate Investment

So, what are the differences between REITs and direct real estate investments? First, it’s essential to know their similarities, including both allowing diversified real estate access to investors. Investor portfolios don’t have to have a complicated portfolio limited to struggling commercial spaces and multi-family units. Furthermore, choosing either investment option can reduce risk factors, as real estate investors provide investors access to stable, consistent income.

Direct real estate allows investors more control over their investments and provides tax breaks to offset the income. As for REITs, investors have a more hands-off approach by putting real estate management and operation into someone else’s hands. Furthermore, REITs work for investors who don’t have the necessary funds or proper financing to purchase real estate. It’s the perfect beginner tool for real estate investment to help gain experience.

How an UpREIT Works

One considerable difference between UpREITs and REITs is that UpREITs are umbrella partnership real estate investment trusts, creating a partnership between a REIT and the appreciated real estate owner. The REIT has an owner of real estate that’s appreciated and contributes assets from real estate in exchange for operating partnership (OP) units in a capital gains tax-deferred exchange. Also known as a 721 exchange, UpREITs share similar benefits with 1031 exchanges, as capital gains become realized when exchange sellers sell OP units that convert into REIT shares or if an acquiring operating partnership sells contributing properties.

UPREITs are also a helpful wealth management tool for private real estate owners who have no desire to manage their taxes, as REITs allow commercial real estate access to individual investors. As such, UpREITs award investors with put options, which can convert to cash or REIT shares after a future agreement period. Lastly, UpREITs allow investors to transfer their estates to heirs without taxes. Heirs can postpone exercising put options until after the owner’s passing.

UpREIT Advantages

UpREITs offer many benefits for investors. Firstly, they provide tax benefits in capital gains tax deferment after an appreciated real estate sells. UpREITs also create passive investing opportunities without the responsibility needed for property management and allow investors to focus on various priorities. Furthermore, UpREITs create passive income as dividends become paid to the investors via income rather than fluctuating cash flow through standard real estate property investments.

Additionally, UpREITs can help with estate planning as OP units become transferred to beneficiaries or heirs upon the investor’s death on a stepped-up basis. As such, heirs can continuously benefit from dividends and allow for complete capital gains tax elimination unless units become converted into REIT shares. Lastly, UpREITs can create portfolio diversification and aid in investment portfolio balance.

UpREIT Disadvantages

UpREITs may have numerous positives, but knowing the potential negatives is crucial. Firstly, UpREITs don’t allow for flexible control, which can disadvantage those who like a more hands-on approach to their investments. Furthermore, UpREITs have limited voting rights but apply to situations that may affect the holder’s rights, such as redemptions, distributions, and tax allocations.

Additionally, UpREITs don’t have a predictable stock market. Shares become subject to stock market fluctuations, but no investments remain impervious to volatility. Lastly, specific state and federal tax filing requirements can become a big obstacle. OP unitholders must file taxes with an operating partnership in each state that transacts business.

UpREITs vs. DownREITs

So, what are the differences between UpREITs and DownREITs for investors? Firstly, UpREITs act as an estate planning tool. Upon the investment owner’s passing, heirs can obtain estate assets and eliminate capital gains tax. Furthermore, UpREITs act as a put option without paying capital gains taxes on appreciated underlying real estate asset values. Exercising put options after the property owner’s passing creates greater liquidity preventing income tax and paying estate taxes.

DownREITs is a newer investment structure consisting of a joint partnership between the REIT and a property owner. It’s meant for property owners who don’t plan on operating under umbrella partnerships but adversely become partners in a limited REIT partnership. Investors who prefer deferring capital gains tax on appreciated real estate property sales choose DownREITs, especially if they believe their properties can exceed REIT-owned property values.

Sera Capital offers 721 exchange, 1031 exchange, DST, and other investment services and advice to individuals with highly-appreciated assets. Our 721 exchange advisors help guide eager investors in the right direction, offering advice and guidance on achieving their financial goals. Schedule a free 30-minute phone call with us today if you have any questions.

Making investments alone can feel intimidating, so hiring a registered financial advisor can relieve some stress. However, don’t let the myths get in the way of obtaining helpful advice from a specialist. Here are five common misconceptions about registered investment advisors.

All Investment Advisors Are Similar

A well-known myth about investment advisors is that they all have the same mantra, services, and end goals for their clients. However, disparities in their business practices and qualifications are considerable because they don’t have coverage by federal regulation or uniform state rules. Some focus on specific services, while others focus on a particular area, like investment planning.

Only Wealthy Clients Use Investment Advisors

Many people assume only wealthy people use financial advisors. In truth, registered investment advisors require their clients to have some discretionary income, while others need a minimum amount of investment assets. Some investment advisors require small budgets to achieve the largest impact while helping clients achieve their goals. These can include college investments or business succession.

All Investments Go Into High-Risk Stocks

One common myth about investment advisors is that they put their client’s investments into risky, intimidating stocks. Realistically, professional investment advisors ensure clients have stable, short-term savings for large purchases or emergencies. If the client can appropriately invest in the long-term account, stocks may become involved.

Most investment advisors establish a diversified and balanced portfolio for their clients. Before doing so, they assess a client’s portfolio and risk tolerance to ensure the investment strategy works for the individual.

Investment Advisors Treat Clients Like Children

While some investment advisors speak professional jargon without consideration, many registered investment advisors will guide their clients and patiently explain every step of the process. It’s crucial for clients to remember the money they put into investment results in educational, helpful advice and guidance over investing in stocks, bonds, and other methods. Investment advisors must treat their clients with respect and integrity, as they trust advisors to help them achieve their financial goals.

Investments Advisors Aren’t Worth the Money

A common misconception about registered investment advisors is that they aren’t worth the cost. However, professional investment advisors ensure clients' fees remain valuable, giving them the confidence to reach their financial goals. Clients don’t need an exorbitant amount of money, nor do they have to be a certain age to receive exceptional services to meet their financial goals.

Sera Capital focuses on giving clients with highly appreciated assets education and advice to reach their financial goals. Our exit planning strategists aid clients in portfolio diversification, asset settlement, and many other services to help investors reach their end goals and reach into the following generations. If you have any questions about our services, schedule a free 30-minute call today.

721 exchanges can be the perfect alternative for real estate investors who want to defer capital gains taxes without following strict guidelines and rules. 721 exchanges have many advantages, including estate planning, diversification, and increased portfolios. So, here are five things to remember before deciding to do a 721 exchange.

721 Exchange Qualifications

Before pursuing a 721 exchange, investors must meet some qualifications. Firstly, most 721 exchanges, or REITs, require institutional-grade real estate investments because some investors own said properties. Furthermore, a 721 exchange doesn’t allow direct property contributions in a REIT.

721 Exchange Rules

Several rules come with 721 exchanges. First, the general rule of 721 exchanges states that no losses or gains can become recognized in any involved partners or partnerships. This specifically applies to partnership properties in exchange for a partnership interest.

Furthermore, special rules state that 721 exchanges cannot apply to realized gain through partnership property transfers. This is because if partnerships become incorporated, it becomes treated as an investment company. Additionally, investors cannot gain on property transfers from partnerships if gains become includable in an investor’s gross income.

721 vs. 1031 Exchanges

Before deciding on a 721 exchange, one must understand its differences from 1031 exchanges. Firstly, 1031 exchanges permit investors to sell properties and reinvest proceeds into another property. However, qualifying for 1031 exchanges involves “like-kind” properties, meaning the property must serve the same purpose and share similar characteristics.

Additionally, 1031 exchanges have shorter timelines than 721 exchanges; investors must find a replacement property within 45 days, then sell their original property within 180 days. Lastly, 1031 exchanges serve exclusively as investment properties, while 721 exchanges serve as investment and personal properties.

721 Exchange Advantages

721 exchange offers many benefits. One of the most well-recognized benefits is its tax deferral properties. Furthermore, 721 exchanges allow for portfolio diversification, estate planning, and liquidity. You can grow your finances and plan ahead for future generations in your family.

Things To Avoid

One consideration of the 721 exchange is its inflexibility. 721 exchange doesn’t have the capability for clients to perform other tax-deferred exchanges. Moreover, they do not allow use in other deferred tax exchanges, as investors must take considerable care in choosing a long-term REIT to prevent any regrets.

Sera Capital offers services to individuals with highly appreciated assets and guidance to clients making financial choices. We strive to help you with your financial goals and provide our expertise in financial planning, advice, and management. Our 721 exchange advisors utilize traditional Delaware Statutory Trusts throughout their consulting practice in cases of appropriate client situations. If you want to know more about our financial guidance services and specialists, contact us today with a free 30-minute phone call.

Building a retirement with passive income can be a challenging endeavor, especially if you’re not sure which avenue to take. Luckily, Delaware Statutory Trusts (DSTs) create a means of passive income while allowing estate planning for the investor. Read on to learn more about how DST investments can help preserve wealth through passive income.

What Is a Delaware Statutory Trust?

A Delaware Statutory Trust is a real estate investment opportunity. In it, individual investors purchase partial ownership in the trust, giving them a proportional share of the income, deductions, and cash flow that the underlying property generates. Professional real estate companies known as DST sponsors establish these trusts. These sponsors are responsible for managing the property, collecting rent, and distributing the profits to the investors.

It is important to note that many DSTs require a minimum investment of $100,000. However, though this is a significant upfront cost, the resulting hands-off income makes the investment opportunity well worthwhile for many people. Furthermore, because DSTs rely on multiple investors, the value of a DST property is often high, likely resulting in high returns.

Types of Delaware Statutory Trusts

So which DST best suits you and your financial goals? Furthermore, what should investors look for in DST properties? While the DST market changes daily, tracking shows that many types of DSTs are always available, while others have only occasional availability. Also, many DSTs have leverage, meaning they have a mortgage on the properties in a deal. Therefore, each investor would have a share in the debt.

Given these variables, you’ll have to investigate the particulars of each DST you’re interested in. To get you started, some of the common types of DST deals that you could partake in include the following:

- Industrial DSTs

- Apartment or multi-family DSTs

- Hotel DSTs

- Assisted living DSTs

- Oil and gas DSTs

- Portfolio DSTs

- Self-storage DSTs

- Medical office DSTs

Main DST Benefits

Delaware Statutory Trusts offer numerous benefits to investors, including eligibility for 1031 exchanges, income potential, tax benefits, institutional-quality asset ownership opportunities, and more. DSTs create opportunities to sell appreciated assets that help defer capital gains taxes, allowing the opportunity to maintain and build wealth. This is especially true when you invest in a DST via a 1031 exchange.

DSTs create greater income potential and tax-saving opportunities for estate beneficiaries. DSTs have a structure of creating cash flow by acquiring high-quality institutional properties in rapidly growing cities. As a result, DST sponsors seek to preserve greater income potential and investment value for investors.

Additionally, DSTs provide estate planning benefits through deferred capital gains tax, net investment income tax, and depreciation recapture upon the passing of an owner. Estates can also seamlessly divide DST investments among beneficiaries.

Delaware Statutory Trusts and 1031 Exchanges

1031 exchanges—originating from Section 1031 of the US Internal Revenue Code—are IRS-approved transactions permitting real estate investors to defer capital gains tax or tax liability on investment property sales. Delaware Statutory Trusts qualify for direct property ownership for tax purposes, thus making them eligible for 1031 exchange tax deferment.

1031 exchanges defer taxes on relinquished property sale proceeds if the investor uses the money to invest in another property of equal or greater value within 180 days of the closing date. This tax deferral permits DST investors to preserve equity from the relinquished property sale so it continues working for them in their new DST property replacement.

How Investing in DSTs Preserves Wealth

You already have an idea of how DSTs generate and protect wealth, but let’s review the specifics of how DSTs help preserve an investor’s wealth. Below are the various ways Delaware Statutory Trusts can aid in preserving wealth and accumulating it beyond the owner’s passing and onto their future family.

Creates Passive Income

Investors can preserve their wealth with DSTs through passive income. You can buy into high-dollar commercial properties by buying only a portion alongside multiple other investors. This partial ownership will earn you a portion of whatever income the property generates without the hands-on management that sole property ownership usually requires. Instead, DST sponsors buy the properties, structure them into DSTs, and handle the daily property management duties while distributing gains to the investors.

Facilitates Real Estate Investment for Retirement

As investors plan for retirement, growing post-retirement wealth and passive income are important goals. Investing in real estate can help boost monthly income rates via rental and other commercial property income. In DSTs, owning investment properties can pay off considerably in the long term upon selling the properties for a lump sum.

Then, investors can invest the proceeds in additional properties or trust funds, leaving behind a financial legacy for their families and loved ones. Furthermore, investors should evaluate their property before retirement, especially if they have borrowed funds to acquire the property. Investors should pay attention to the property’s location, the property’s projected profit, and the property type.

Assists in Investment Estate Planning

While investors can accumulate wealth with DSTs, it’s also helpful for estate planning for future generations. When an investor passes away, estate beneficiaries obtain a stepped-up basis for tax purposes. This means they don’t have to pay capital gains tax on the accumulated appreciation of the assets until the investor dies. This includes capital gains tax deferment on real estate via reinvestment in a DST as a 1031 exchange.

As DST beneficiaries sell their assets, a stepped-up basis occurs in the value at the date of the investor’s death. While the inherited property can defer capital gains tax, DST assets still form part of the investor’s estate, meaning the typical estate tax exclusions and rules still apply. Therefore, it’s crucial for investors to speak to an estate planning professional to help determine how DST investment can impact their estate and how they can avoid certain risks.

If you want to plan your retirement or establish generational wealth, we at Sera Capital can help with your real estate investments. Our team of professional fee-only fiduciaries offers their expertise in real estate investment avenues to individuals owning highly appreciated assets. Our Delaware Statutory Trust 1031 exchange services perfectly suit investors looking to loosen their real estate responsibilities and holdings without paying hefty taxes. For more information about our fiduciaries, schedule a free 30-minute phone call with us today!