721 Exchange Advisor and 721 UPREIT Exchanges

Schedule Consultationor Call Us at (443) 332-1031

In the beginning, IRS Section 721, commonly called an UPREIT, was rarified air. To complete a 721 UPREIT, the first order of business is that a REIT had to want your property. This is the rare part since most REITs have no interest in the types of investment properties typically held by the vast majority of real estate investors. Nevertheless, the mechanism was straight forward. The REIT would buy your property, and you would receive Operating Partnership Units (OPU) in the REIT. While this type of transaction still exists for very large investors, it is no longer the most frequent type of 721 UPREIT. Things have changed.

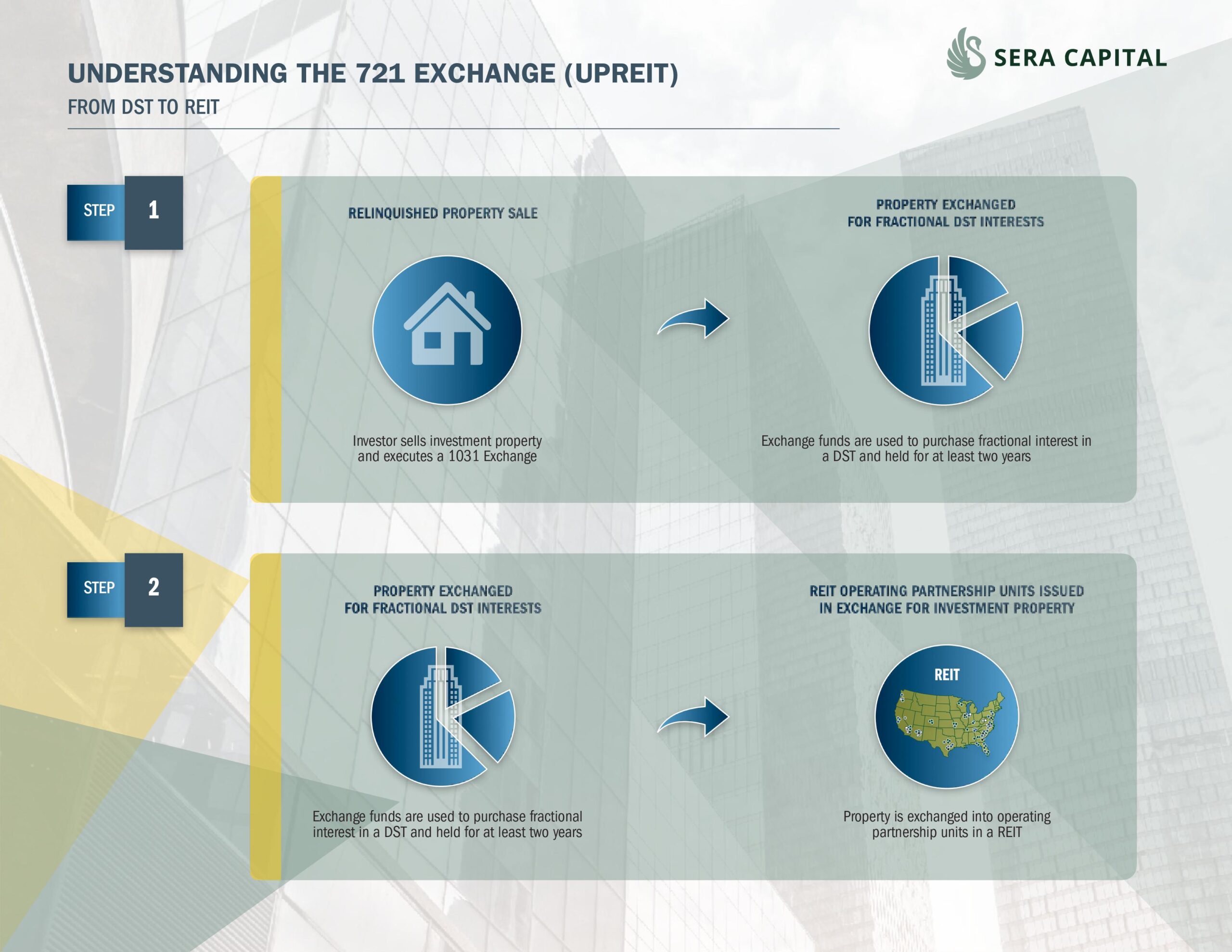

Somewhere along the way, a mechanism that was reserved for only the wealthiest of investors, the 721 UPREIT, has been made available to most. How is this done? You simply add a step. Instead of you selling a property directly to a REIT, you sell it to any investor you choose. Then the sales proceeds get invested into a DST or Delaware Statutory Trust for approximately 2 years. Once you have held the DST for an appropriate period of time, the REIT decides they want to buy the DST property and bring it into the REIT to join the rest of the properties they own. Once they do, you no longer own the DST but instead, you own OPUs in the REIT.

With as little as $250,000, an investor can buy a particular type of DST that converts to a REIT in a few years, thus making the 721 exchange a more democratic and viable option. As an aside, this type of Delaware Statutory Trust is quickly becoming the most popular DST with good reason.

The schematic below shows how this works.

Using Delaware Statutory Trusts (DSTs) in a 1031 Exchange to 721 Exchange & 721 UPREIT

- A REIT creates a temporary Delaware Statutory Trust (DST), allowing 1031 exchangers to purchase or invest in the DST under section 1031.

- After a safe harbor period of approximately two years, the REIT absorbs the DST into its portfolio utilizing section 721. This makes the 1031 exchanger a temporary DST investor, and the due diligence should be focused on the REIT portfolio instead of the individual temporary DST.

- After process completion, the 1031 exchanger owns Operating Partnership Units in the REIT and these OPUs enjoy significantly better tax advantages than owning an equivalent number of shares in the REIT. OPUs are better than shares for tax purposes.

Why is the 721 DST more appealing than the Traditional DST? The table at the end sets out the major differences, but, after working with thousands of real estate investors over the last decade, in our experience, what compels investors to go the 721 DST route are just six things since they both can defer and eliminate taxes through the step-up in basis.

- The 721 DST is liquid and available to the investor for the rest of an investor’s life after approximately three years vs. The Traditional DST providing liquidity for only 45 days every 4-10 years.

- The 721 DST is a sizeable multi-billion portfolio of institutional quality assets diversified by real estate asset class and geography, thus making both the risks and the returns more predictable vs. the single asset Traditional DST with an average equity raise of under $50 million.

- Once you complete a 1031 exchange into a DST that converts to a REIT, you do not have to do another one. While on the surface this may not seem significant, it’s a major advantage. Industry date shows that over 10% of Traditional DST investors fail to successfully roll over one Traditional DST to the next one thus ruining decades of tax planning. Since REITs are perpetual and Traditional DSTs are not, this risk is eliminated.

- Over time, the significantly lower initial and ongoing costs of a 721 DST create significantly more equity or value for the investor than the Traditional DST. See our post “Fees Matter” for details.

- Regulatory Risk. If the 1031 exchange is eliminated, then once a DST expires, the investor will be forced to pay taxes. With the 721 DST, the regulatory risk of 1031 legislation is taken off the table.

- The ease with which an estate can be closed. When the owner of a REIT passes away, their beneficiaries have immediate access to the funds, which is not the case with Traditional DSTs.

Most traditional DSTs hold single asset classes, typically single properties. The expected holding period lasts approximately five to seven years, then is liquidated and carries roughly a 15-20% cost at initial purchase and 3-5% upon disposition or sale. The idea of Traditional DSTs is to defer, rollover, defer, rollover, eventually passing away and avoiding taxes. It was a viable exit strategy until the 721 DST came along.

We like to give 721 DSTs different names based on their function. We sometimes call them Hybrid DSTs; other times, we call them Convertible DSTs; other times, Shape-shifter DSTs, and Final Destination DSTs. Why four names? Because a 721 DST acts precisely like a Traditional DST for approximately the first 2-year period until it shape-shifts or converts into ownership of operating partnership units in a Public Non-Listed REIT. This REIT typically becomes the investor’s final destination, unless they choose to implement section 732 to access their basis tax free or to combine OPU ownership with tax loss harvesting strategies. In summary, this hybrid is part Traditional DST, and soon after purchase, it becomes a REIT.

Sera Capital’s IRC 721 advisors still utilize Traditional DSTs for approximately 15 percent of our consulting practice clients as appropriate for the client situation. In comparison, the remaining 85 percent recognize the benefits of the 721 DST. We uniquely positioned ourselves to provide both Traditional and 721 DSTs to steer clients into appropriate solutions among the two, then into specific investments. For more information regarding our 721 Exchange services,

Schedule a 20-minute call with our professional 721 Exchange advisors today.

To see some of the differences between Traditional DSTs and 721 DSTs, please see the table below.

| Traditional DST | 721 DST | |

|---|---|---|

| Liquidity | Not Liquid | After ~3 years |

| Holding Period | 5-10 Years | Indefinite or Perpetual |

| Diversification | Typically, One Property | Hundreds of Properties |

| Cost to Enter | ~15% of Equity | <5% of Equity |

| Exit Fee | ~2-3% of Equity | No Exit Fee |

| Step-Up in Basis | Yes | Yes |

| Return Predictability | Average | High |

| Annual Ongoing Costs | Average | Average |

| Asset Class Diversification | No | Yes |

| Geographic Diversification | No | Yes |

| Can I sell a % interest? | No | Yes |

| Tax Reporting | 1099 or Grantor’s Letter | K-1 |

| Eligible for 20% QBI | No | Yes |

| Eligible for Section 732 | No | Yes |

| Active Tax Loss Harvesting | No | Yes |