Delaware Statutory Trusts and REITs: Comparing Benefits

Carl E. Sera, CMT

February 9, 2024

Investing in real estate can be lucrative, but it also comes with its fair share of risks. That’s why many investors turn to other options, such as Delaware Statutory Trusts (DSTs) and Real Estate Investment Trusts (REITs). These two forms of investment share some similarities, but they also have distinct differences that investors should be aware of. This blog post offers a close look at DSTs and REITs and compares their benefits for investors.

What Is a Delaware Statutory Trust?

A Delaware Statutory Trust (DST) is a legal entity that allows multiple investors to hold fractional ownership in real estate properties. In a DST, the trustee manages the property and distributes income to investors. This distribution enables investors to invest in real estate passively without having to worry about day-to-day management responsibilities.

DSTs are commonly used for single-asset investments, meaning they hold only one property. This property type can include various real estate types, such as apartment buildings, office spaces, and shopping centers. DSTs are also structured as 1031 exchanges, allowing investors to defer capital gains taxes by exchanging one investment property for another.

What Is a Real Estate Investment Trust?

A Real Estate Investment Trust (REIT) is a business that operates and owns income-producing real estate properties. Like DSTs, REITs allow investors to own a share of the real estate without managing it themselves. By law, REITs must distribute at least 90 percent of their taxable income to shareholders as dividends, making them a popular choice for investors seeking regular income.

There are two major types of REITs: equity REITs and mortgage REITs. Equity REITs own and operate income-generating real estate properties, while mortgage REITs finance real estate investments. Equity REITs are a more common choice among investors due to their potential for long-term growth.

Comparing Benefits of DSTs and REITs

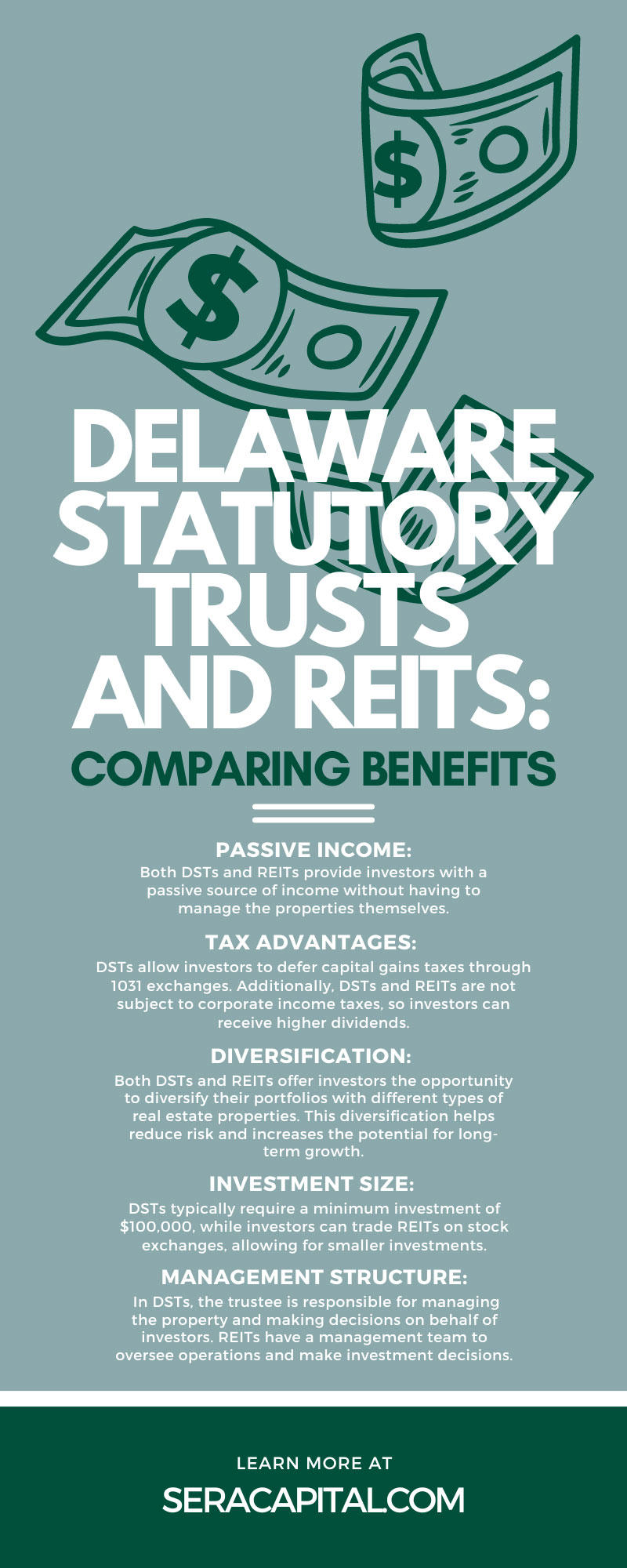

DSTs and REITs offer attractive benefits for investors looking to diversify their portfolios with real estate. The following are some key points to consider when comparing the two.

- Passive income: Both DSTs and REITs provide investors with a passive source of income without having to manage the properties themselves.

- Tax advantages: As mentioned earlier, DSTs allow investors to defer capital gains taxes through 1031 exchanges. Additionally, DSTs and REITs are not subject to corporate income taxes, so investors can receive higher dividends.

- Diversification: Both DSTs and REITs offer investors the opportunity to diversify their portfolios with different types of real estate properties. This diversification helps reduce risk and increases the potential for long-term growth.

- Investment size: DSTs typically require a minimum investment of $100,000, while investors can trade REITs on stock exchanges, allowing for smaller investments.

- Management structure: In DSTs, the trustee is responsible for managing the property and making decisions on behalf of investors. REITs have a management team to oversee operations and make investment decisions.

Evaluating Risks of DSTs and REITs

While the benefits of both DSTs and REITs are attractive to many investors, it’s crucial to understand the potential risks of these investment opportunities.

For DSTs, one of the primary risks is the lack of liquidity. Since you can’t publicly trade DSTs, investors may find it more challenging to sell their interest if they need access to their capital. Additionally, the success of a DST is dependent on the performance of a single property, making it susceptible to market volatility. There’s also the risk of the trustee making poor management decisions that could negatively impact the investment.

On the other hand, REITs are publicly traded, which provides liquidity but also subjects them to the fluctuating nature of the stock market. Like DSTs, the performance of a REIT relies on the underlying properties and the real estate market as a whole. Additionally, while REITs must distribute 90 percent of their taxable income as dividends, there is no guarantee of dividend payments, as they depend on the REIT’s profits. The management of a REIT could make decisions that might not align with the individual investors’ preferences.

In both cases, the potential for significant gains comes with the potential for substantial losses. Therefore, it’s crucial for investors to carefully consider their investment objectives, risk tolerance, and time horizon before investing in either DSTs or REITs. Consulting with a financial advisor or real estate investment professional can provide additional insight and guidance.

Which Is Right for You?

Deciding between DSTs and REITs ultimately depends on your investment goals and risk tolerance. DSTs offer the potential for higher returns through 1031 exchanges, but they also come with a higher minimum investment requirement and less control over decision-making. Conversely, REITs are more liquid and allow for smaller investments but may not provide as many tax advantages.

Tips for Choosing the Right Option

When deciding between DSTs and REITs, consider the following tips to help choose the option that best aligns with your investment goals and risk tolerance.

Evaluate Your Financial Goals

Your investment decision should align with your financial goals. Whether aiming for regular income, tax advantages, or long-term growth, understanding what you want from your investment can guide your decision.

Understand Your Risk Tolerance

Both DSTs and REITs come with their own set of risks. DSTs are not as liquid as REITs and rely on a single property—this could be a risk if that property doesn’t perform as expected. On the other hand, while REITs provide more liquidity, they are subject to the stock market’s volatility. Understanding your ability and willingness to take risks can help determine which investment is right for you.

Consider Your Investment Size

DSTs typically require a larger investment than REITs. If you’re looking to invest a smaller amount, REITs might be a more suitable option.

Consult a Financial Advisor

Real estate investments can be complex. A financial advisor can provide valuable insights into the potential benefits and risks of DSTs and REITs, helping you make an informed decision.

Keep an Eye on the Market

Real estate market trends can have a significant impact on the performance of your investment. Tracking market conditions and projections can help you time your investment and potentially increase your returns.

Remember, there is no one-size-fits-all approach when it comes to investing. What works for one investor might not work for another. Taking the time to understand your financial situation, goals, and risk tolerance can guide you toward the investment option that is most suitable for you.

Final Thoughts

DSTs and REITs are attractive options for investors looking to diversify their portfolios with real estate. While they share some similarities, DSTs and REITs also have distinct differences that you should consider carefully before making investment decisions. Whether you choose DSTs or REITs, it’s crucial to understand your investment objectives, risk tolerance, and time horizon to make an informed decision. Consulting with a financial advisor can provide valuable guidance in assessing which option is best for you. Remember, investing always comes with some degree of risk, but by understanding the benefits and risks of DSTs and REITs, you can make informed decisions that align with your financial goals.

Categories

Strategize Your Success