How 721 Exchanges Can Be Used as an Exit Strategy

Carl E. Sera, CMT

October 17, 2023

A Section 721 exchange, often called a UPREIT transaction, is an often overlooked but powerful tool for real estate investors seeking an effective exit strategy. This strategy allows an investor to convert direct property ownership into an interest in a professionally managed portfolio without triggering a taxable event.

Under the right circumstances, a 721 exchange can provide a smooth exit route, ensuring liquidity, diversification, and a potential for steady income streams. Read on to learn the mechanics of 721 exchanges and how they can be a strategic part of a successful exit strategy.

What Is a 721 Exchange?

A Section 721 exchange, named after Section 721 of the Internal Revenue Code, allows investors to contribute properties to a Real Estate Investment Trust (REIT) or an Umbrella Partnership REIT (UPREIT) in exchange for operating partnership units. This transaction is generally tax-free, provided the exchange is for partnership units and not for cash or other forms of remuneration.

The investor retains a de facto interest in the property, but the REIT assumes the actual management and responsibility of the asset. Then, the investor can enjoy the potential for regular income distributions, portfolio diversification, and liquidity while deferring capital gains taxes that would have been incurred if they sold the property outright.

Benefits of 721 Exchanges

The benefits of Section 721 exchanges are manifold for real estate investors. Firstly, the investor gains access to a diversified and professionally managed portfolio, reducing the risk of holding a single property. Secondly, the exchange provides a pathway to liquidity, as the operating partnership units gained in the exchange can be redeemable for cash or publicly traded securities.

Thirdly, these exchanges offer the potential for regular income distributions, contributing to a steady income. The capital gains tax deferred through a Section 721 exchange represents a significant advantage over outright sales, potentially allowing the investor to save a substantial sum. When strategically utilized, a Section 721 exchange can offer real estate investors an effective and financially beneficial exit strategy.

Tips for Preparing a 721 Exchange

Careful planning and professional advice are crucial when preparing for a Section 721 exchange. We advise consulting a tax expert or a real estate attorney specializing in these transactions to ensure you completely understand the legal and tax implications. Remember that only properties used for investment or business purposes qualify for a 721 exchange.

A thorough analysis of the properties to be exchanged is a prerequisite to confirm they meet the requirements set by the Internal Revenue Service. Verify that the REIT or UPREIT you intend to transfer your property into is trustworthy and has a track record of success. Consider the timing of your exchange—you must follow IRS deadlines once the process begins. Lastly, maintain meticulous transaction records, as the IRS may require documentation for tax purposes.

Common Questions About 721 Exchanges

Common queries often arise regarding 721 exchanges, indicating the need for clarity in this complex subject matter. One frequently asked question revolves around the type of properties eligible for the exchange. Note that only properties used for investment or business purposes may qualify. Another common concern is the tax implications of the exchange. Many investors ponder whether capital gains tax can become deferred.

In most cases, the answer is yes; the 721 exchange allows for the deferral of capital gains tax, but it is essential to consult a tax expert to understand the specifics fully. Because 721 exchanges involve the transfer of properties to a REIT or UPREIT, many investors question the reliability of these entities. Therefore, conduct thorough due diligence on the selected REIT or UPREIT before proceeding with the exchange. Lastly, the time sensitivity of the process is often under discussion because it requires investors to adhere to strict IRS deadlines once the exchange process is initiated.

How To Use a 721 Exchange as an Exit Strategy

A 721 exchange is the perfect exit strategy for investors looking to sell their assets while minimizing tax burdens. To use a 721 exchange, investors must meet certain requirements, like exchanging similar assets and meeting all deadlines.

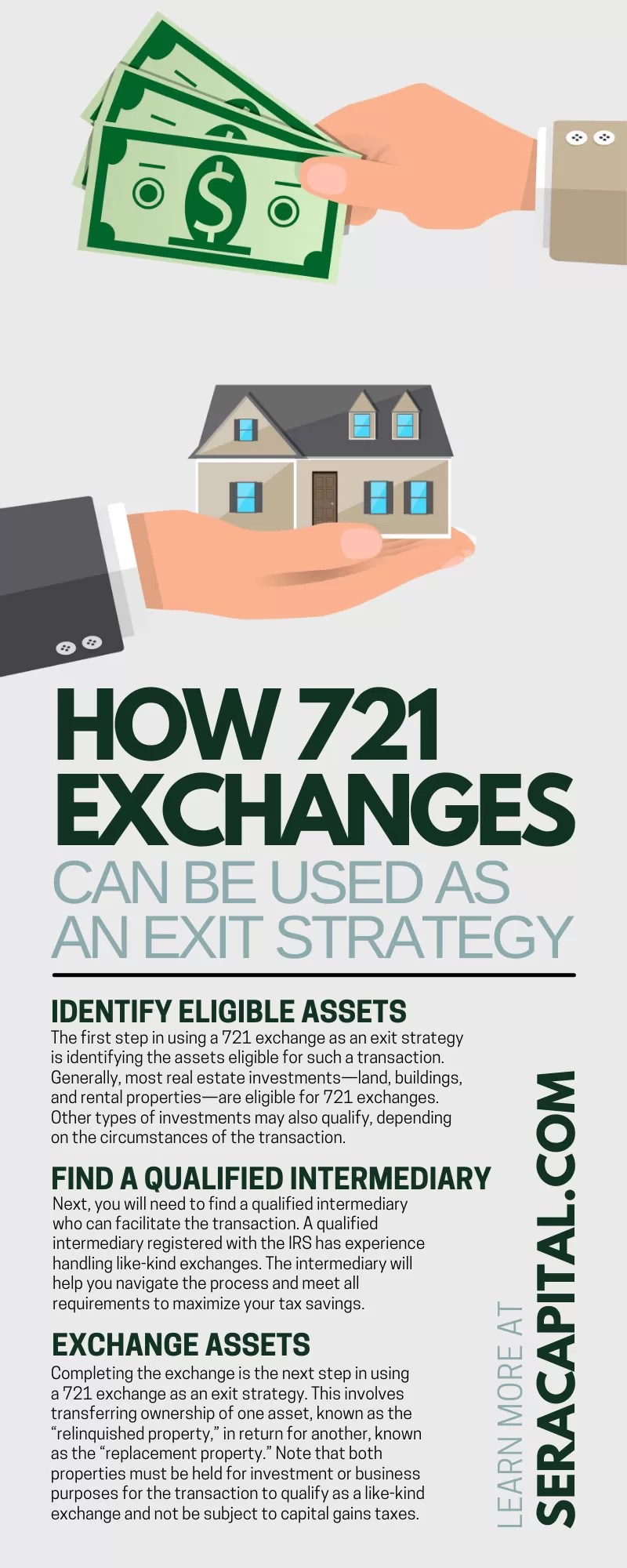

Identify Eligible Assets

The first step in using a 721 exchange as an exit strategy is identifying the assets eligible for such a transaction. Generally, most real estate investments—land, buildings, and rental properties—are eligible for 721 exchanges. Other types of investments may also qualify, depending on the circumstances of the transaction.

Find a Qualified Intermediary

Next, you will need to find a qualified intermediary who can facilitate the transaction. A qualified intermediary registered with the IRS has experience handling like-kind exchanges. The intermediary will help you navigate the process and meet all requirements to maximize your tax savings.

Exchange Assets

Completing the exchange is the next step in using a 721 exchange as an exit strategy. This involves transferring ownership of one asset, known as the “relinquished property,” in return for another, known as the “replacement property.” Note that both properties must be held for investment or business purposes for the transaction to qualify as a like-kind exchange and not be subject to capital gains taxes.

The Future of 721 Exchanges as Exit Strategies

Looking toward the future, Section 721 exchanges will play an increasingly significant role as exit strategies for real estate investors. With the growing complexity of the real estate market and an increasingly favorable tax environment, these exchanges provide a strategic pathway for investors looking for diversification, liquidity, and tax deferral. As the real estate industry evolves and more investors become aware of the benefits of UPREIT transactions, we anticipate a surge in the popularity of Section 721 exchanges.

Advancements in technology and digital platforms will likely simplify these exchanges, making them more accessible to a wider range of investors. While the potential changes in tax legislation remain a constant variable, the structure and benefits of Section 721 exchanges could solidify their place as a preferred exit strategy in real estate investment.

A 721 exchange as an exit strategy tool can aid investors in achieving their financial goals. At Sera Capital, our specialty IRC 721 advisors can help you increase investment liquidity and assist with your portfolio diversification. For more information, contact us today.

Categories

Strategize Your Success