Why Fees Matter When Purchasing 721 Delaware Statutory Trusts (DSTs)

Carl E. Sera, CMT

June 9, 2022

By now, anyone that has read our blog or listened to us either live, by phone or by video knows that when it comes to DSTs, we prefer what we call the 721 DST to the Traditional DST. There are a host of reasons but certainly one of the most important reasons is the high and recurring fees inside the Traditional DST vs the one-time lower transaction or set-up fees in the 721 DST.

By now, anyone that has read our blog or listened to us either live, by phone or by video knows that when it comes to DSTs, we prefer what we call the 721 DST to the Traditional DST. There are a host of reasons but certainly one of the most important reasons is the high and recurring fees inside the Traditional DST vs the one-time lower transaction or set-up fees in the 721 DST.

The savings to investors, all else being equal, makes a significant difference. We’ve put together a model that we can share with you that will let you explore or experiment with different assumptions if you are so inclined, or you can read the rest of this post and understand the big picture. So, let’s set the framework. Let’s assume the following and compare investing in Traditional DSTs vs 721 DSTs under different assumptions and variables.

The following assumptions are:

- The initial investment is $100,000

- Both the Traditional and the 721 DST pay out an annual cash on cash distribution of 4% or $4,000 on the initial investment of $100,000

- The investor expects to hold for 24 years. Some will hold longer some shorter, but the time frame does not matter for the sake of understanding the analysis

- Standard Commission plus Broker Dealer fee on a Traditional DST is 7% every time a Traditional DST turns over

- Additional fees on a Traditional DST are 8% every time the Traditional DST turns over. Between the 7% Standard Commission and 8% additional fees the total is 15% which is a reasonable estimate of the loads or costs inside a Traditional DST. Most are in fact higher than 15% so we are being conservative in this assumption

- The one-time consulting or fiduciary fee for a 721 DST investment is 3% and is never paid again, since the 721 DST does not turn over since it gets absorbed into a REIT

- Additional fees on a 721 DST are 1.75% and never paid again since the 721 DST does not turn over

The Variables to test are 1) Annual capital appreciation and 2) Holding period. In addition to the 4% cash on cash the investor receives as part of our assumptions, we varied the parameters for an annual capital appreciation by examining a 0%, 2%, 4% and 6%. In addition, we varied the holding period… 4 years, 6 years, and 8 years. In all cases, whatever rate of return we assumed for the Traditional DST we assumed for the 721 DST so that we could isolate the effect of fees on your returns.

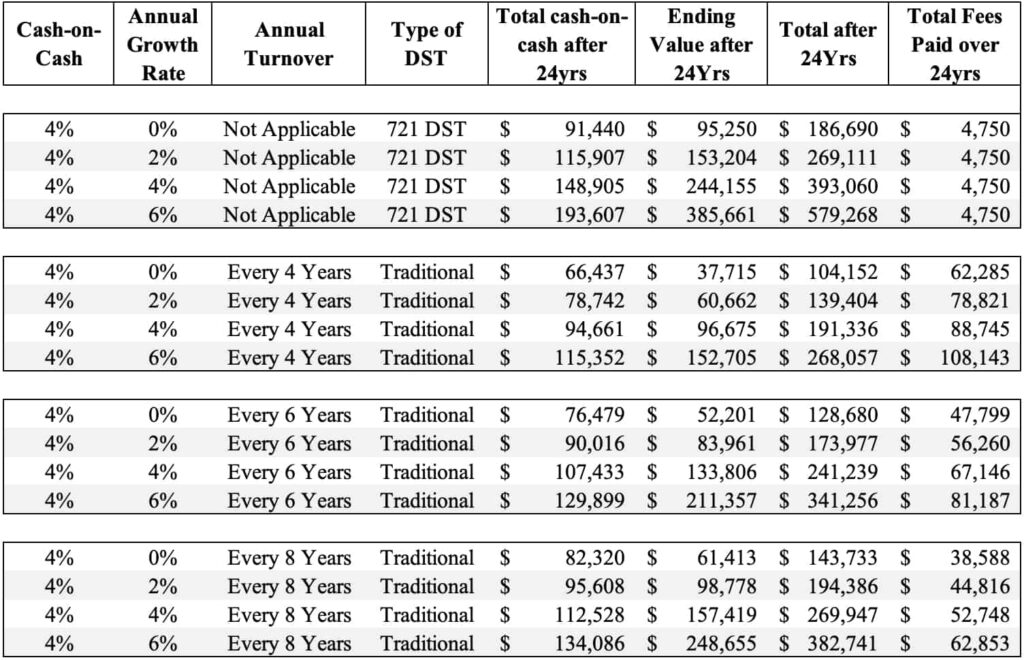

The following tables show the results, and we will provide our observations later in this post.

Growth of Hypothetical $100,000 in Traditional DSTs

vs 721 DSTs Under Different Assumptions

There are 3 glaring takeaways from this table. They are fees, income, and value at the end of 24 years. The first is that the low transaction costs of a 721 DST when purchased from a 1031 Exchange / Delaware Statutory Trust consultant and fiduciary such as Sera Capital and held for 24 years are only $4,750 compared to transaction costs in a Traditional DST over the same 24-year period that could exceed $100,000 which is more than your original investment. The second is how much lower your cash on cash or income is during the 24-year period due to the drag from fees and lastly, how much less your Traditional DST will be worth 24 years from now than the 721 DST due to fees. Remember we assumed both made identical returns and simply isolated the effect of fees. Fees matter and an analysis of which DST to choose without examining fees is no analysis at all.

What does this mean in practice? It means that when you first call someone that can place DST investments for your 1031 exchange the very first question should be “Are you a broker or a fiduciary?” If they answer broker, you should immediately ask them their fee structure. If they answer, “there are no fees, it’s baked in the cake or the sponsor pays the fees”, do yourself and your loved ones a favor and please hang up.

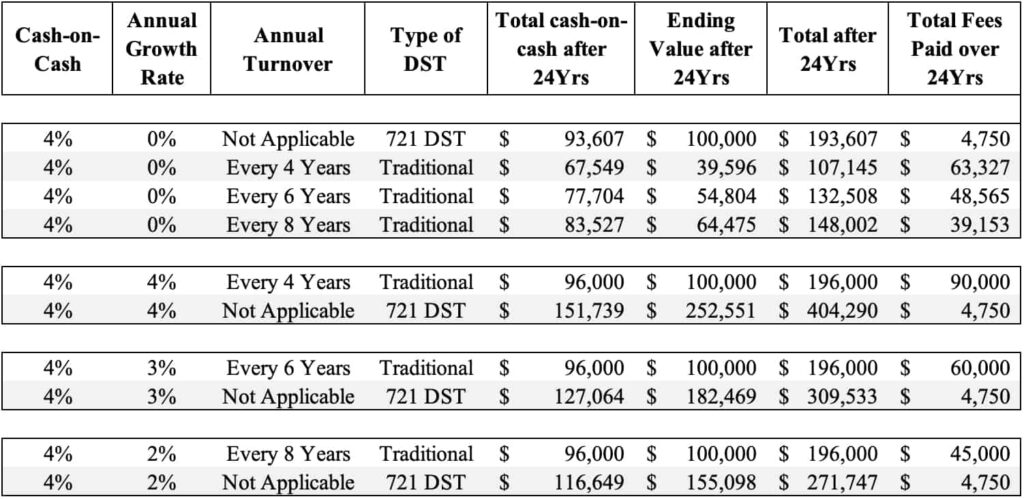

Sometimes, the above table doesn’t hammer the point of fees home in a way that people can understand. So, the following table uses the same assumptions as earlier but works backwards to solve for what your annual growth rate must be in order for your initial investment of $100,000 to be worth exactly $100,000 24 years from today. This is what some would call break even analysis.

What Return do You Need to Make on a Traditional DST or a 721 DST in Order to Breakeven

This is a great table to help us understand the effect of fees. As we can see, the 721 DST only needs to grow at slightly over 0.2% per year for the investor to have an ending value of $100,000 at the end of 24 years. If the Traditional DST were to grow at this same 0.2% rate it would lose value regardless of how long the sponsor kept it open. If they attempted to roll it over every 4 years it would only be worth $39,596, if they attempted to roll it over every 6 years it would only be worth $54,804 and every 8 years it would still not be worth $100,000 it would be worth $64,475. The conclusion is simple, a Traditional DST that pays out 4% cash on cash for 4, 6 or 8 years and only grows at 0.2% per year will lose money after 24 years while the 721 DST will breakeven.

How else can we gain insight from this table? Let’s look at a Traditional DST that grows at 2.74567% per year for 6 years while paying a 4% cash on cash annual distribution yield. At the end of the 24-year period it grows to $100,000 and paid out $96,000 in cash on cash. In the meantime, the 721 DST at the same growth rate of 2.74567 paid out $127,064 in cash on cash and is worth almost twice as much with a value of $182,469 vs $100,000 in the Traditional DST. This is once again compelling evidence of how important fees are to the equation.

The very last way that people think of fees is to ask the following question. By how much does a Traditional DST have to outperform a 721 DST to make up the fee differential? We used 6 years as the Traditional DST holding period. Once again, we’ve done the math and it’s dramatic.

- If a 721 DST pays out 4% cash on cash and does not grow at all the Traditional DST must make 2.44% more annually than the 721 DST or 6.44% vs the 4.0% to equal the performance.

- If the 721 DST pays out 4% cash on cash and grows at 2% annually, the Traditional DST must make 2.65% more annually than the 721 DST or 8.65% vs the 6% to equal the performance.

- If the 721 DST pays out 4% cash on cash and grows at 4% annually, the Traditional DST must make 2.80% more annually than the 721 DST or 10.80% vs the 8% to equal the performance.

As advisors, we look at the amount of ground we must make up when we recommend Traditional DSTs and say, we think we can do it in some isolated cases. However, if our client wants to build a diversified portfolio of Traditional DSTs for “diversification” they don’t stand a chance of outperforming the 721 DST in our opinion. They are starting out at a 2.44% to 2.80% annual disadvantage and anyone with any investment acumen knows this is unlikely.

Fees matter. Let us help you 1031 exchange into a REIT. Get on our schedule if you want to learn more.

Categories

Strategize Your Success