Navigating the World of Publicly Listed Nontraded REITs: Tips for Investors

Carl E. Sera, CMT

March 7, 2023

Here’s a riddle. When is real estate not real estate?

Here’s a riddle. When is real estate not real estate?

Give up?

We’ve found that real estate is not real estate when it is owned as a publicly listed and publicly traded security such as a publicly traded REIT or when publicly traded REITS are held within a mutual fund or ETF investments.

So, if real estate held as a publicly listed and publicly traded security isn’t real estate, what is it?

It’s a stock that owns real estate and behaves as a stock and not like real estate.

What are the ramifications of owning a stock that owns real estate?

It means that real estate can increase in value as it did in 2022 while stocks that own real estate can go down in value. Said differently, a stock that owns real estate is more correlated with the stock market than the real estate market.

Why is real estate held within a stock, mutual fund, or ETF more correlated to the stock market than the real estate market?

Because it’s a security with daily liquidity and typically traded on the New York Stock Exchange on a minute-by-minute basis. It’s a security, it’s a stock, no matter how you slice it, and stocks are subject to the gyrations, fluctuations, psychology, and volatility of the stock market which includes program trading.

Said differently, how you own real estate matters and not just a little, it matters a lot. The following example illustrates the two ways to own real estate and should help you understand why at Sera Capital we advise our clients when executing 721 exchanges, to avoid selling their assets to a publicly listed and publicly traded REIT. We prefer they take a circuitous route through a DST that converts into a publicly listed non-traded REIT.

Private vs Public Ownership

Let’s suppose there are two identical properties in every way, and we mean in every way. For example, let’s assume they are identical triple-A credit Amazon warehouses, with identical 25-year leases that pay 5% annually, with identical annual rent increases, and assume they were both purchased for $1,000,000. The only difference is that the first warehouse is owned by a publicly listed security that trades daily on the New York Stock Exchange and the other is owned privately by an individual investor.

Let’s now see what might have happened during the last two major dislocations in the stock market. Let’s look at the Global Financial Crisis of 2008/2009 and the pandemic in 2020. What we can see from looking at the value of securities that held diversified portfolios of real estate is that they bottomed on identical days as the stock market bottom, March 9, 2009, as well as on March 23, 2020, and that the declines were greater than the declines experienced by a general stock index fund such as the S&P 500.

The only conclusion is that real estate held through public stock ownership is not only correlated with the stock market but also more volatile than the stock market. Why? Because while the S&P 500 experienced a top to bottom drop of approximately 55% during the period that ended in March of 2009, the stocks that held real estate had greater drops in excess of 70%. In 2020, the same held true, the S&P 500 dropped over 30% in a 5-week period during the height of the pandemic crisis while stocks that held real estate dropped over 40%. The only logical conclusion is that over the last 20 years, publicly traded real estate trades like a stock not like real estate.

Let’s translate this to the Amazon warehouse example to understand why how you hold real estate is so critical. If the Amazon warehouse were held via stock ownership in the form of a publicly traded and listed REIT, instead of having a value of $1,000,000 it would have a value of $300,000 at the bottom of the Great Financial Crisis in 2009. Simultaneously, the individual that also bought it for $1,000,000 is more than likely just happy collecting their $50,000 annual income from a AAA tenant and laughs at the concept that their warehouse is only worth $300,000. In fact, if they are smart and understand the difference between listed and non-listed real estate, they borrow $300,000 and buy the publicly traded Amazon warehouse from the REIT. We can explore this arbitrage opportunity later but, at Sera Capital, we watch these relationships closely. In fact, as part of our wealth management practice, we would look to take advantage of this discrepancy.

The essential question is obvious. How can two identical properties be worth different amounts based on how they are held? When the stock market drops are they still worth $1,000,000, or are they worth $300,000? We can clearly see that the stock market is saying they are worth $300,000. But what about the individual investor? Ask yourself the question, would you sell your $50,000 per year cash-flowing warehouse that is backed by Amazon or any other AAA tenant for $300,000? The answer is no. In fact, it is a resounding no. Yet there are those that don’t understand real estate that would have you believe publicly listed REITs are a true reflection of the value of the real estate and publish academic studies to “prove” their perspective is correct. In our opinion, they could not be more wrong, and we would be buying their real estate at bargain-level prices when real estate is trading like the stock market. BTW, the opposite happens as well when the stock market is trading euphorically and real estate that is held in listed REITs trades euphorically. When this happens, the opportunity to sell at inflated prices is also a logical trade to make.

To the real estate investor, the concept of the stock market dropping and significantly changing the value of their property is foreign. So how much is the property worth to the individual investors? We suggest and believe that it is worth somewhere closer to $1,000,000 than the arbitrary $300,000 that the stock market says it is worth. How much closer is anyone’s guess but we think $300,000 is an extreme overreaction that results from the real estate being held in stock ownership. Please note once again, there are those that disagree with us and think it is worth $300,000 but in our opinion, those people have no understanding of how real estate is valued.

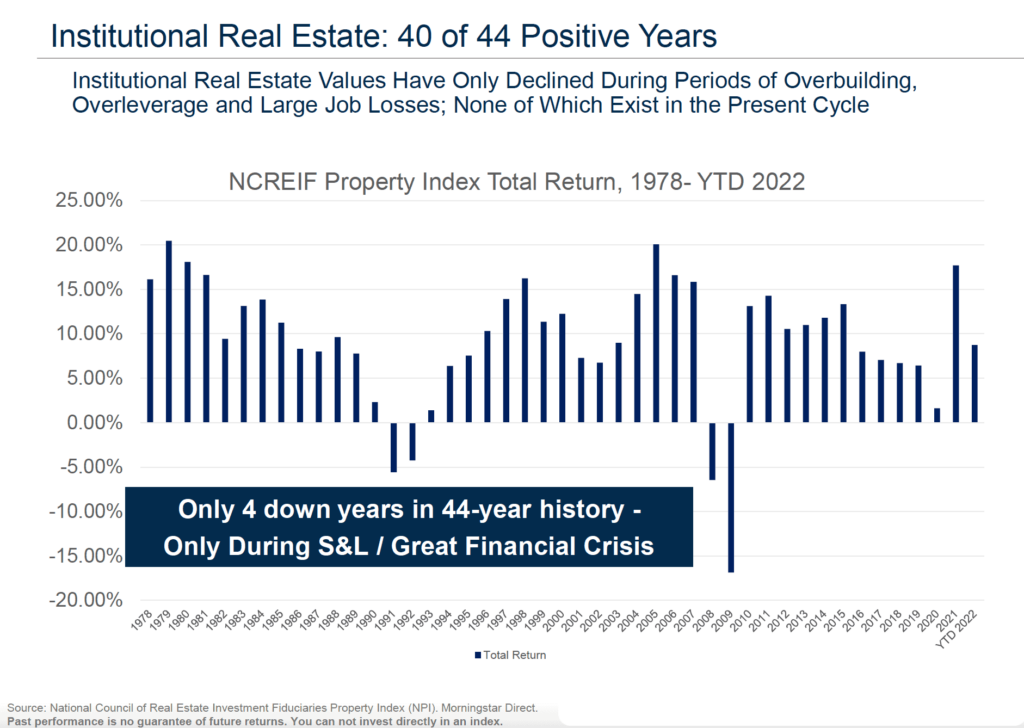

Can we test this with facts? The answer is yes. We can look at a real estate equivalent index that goes back 44 years and is more aligned with how individual investors and non-traded REITs value real estate. It is called the National Council of Real Estate Investment Fiduciaries Property Index or NCREIF and we can own the types of properties that track this index. We, individual investors, can approximately participate in this stream of returns by owning the same type of real estate in the same type of ownership structure that the smartest investors do, and this includes endowments, pension plans, sovereign wealth funds, and family offices. We can do this through the ownership of publicly traded non-listed REITs as well as real estate-focused interval funds. At Sera Capital, we have identified several we find attractive.

Let’s see how the NCREIF index performed during the same periods that we witnessed publicly-traded REITs as well as real estate-focused mutual funds and ETFs get destroyed. How did the NCREIF index perform during the same period we witnessed a 55% drop in the stock market and a 70+% drop in stocks that hold real estate during the 2008/2009 period? The index lost just over 5% in 2008 and just over 15% in 2009 and has had positive performance every year since. In fact, it has only had 4 losing years over the last 44 years, which can’t be said for stocks that own real estate. We saw a similar event in 2020 during the pandemic crash when REITs dropped over 40% in a 5-week period while the publicly listed non-traded REITs we like were down 0-5%. Lastly, we saw the stock market drop in 2022 while the publicly listed non-traded REITs had positive returns. The evidence is overwhelming and compelling.

To be fair, several academicians and theorists will contest the validity of the NCREIF index for a variety of reasons. They make the case that the $300,000 value on the Amazon warehouse is the correct value and furthermore, they make the case that since the NCREIF index is based on the appraised value that it does not reflect what is transpiring in the normal price discovery of markets. Our job is not to argue with them. Our job is to provide common sense and reflect what we know is the way real estate investors think compared to the way academicians think.

To prove our perspective, we like to start with a hypothesis. If the warehouse is in fact worth $300,000 then the yield from a triple AAA credit tenant with a long-term lease is yielding 16.66% while the bonds on this same AAA credit tenant are yielding 3-4%. Furthermore, the bonds have limited upside potential while the real estate could explode in value if purchased at $300,000. So, what would happen in this hypothetical case? Amazon would borrow $300,000 at 3%-4% and buy the warehouse and avoid the $50,000 per year payment and instead pay $9,000-$12,000 in interest with capital appreciation potential. Any Chief Financial Officer worth their salt would make this transaction without blinking an eye. Said differently, we don’t agree at all with the valuations of real estate when held in stock format. If this type of situation presents itself and an opportunistic investor isn’t buying the warehouse for $300,000 then they are not opportunistic, they are academics.

To learn more about Publicly Listed Non-Traded REITs and how you can incorporate them into your 1031 Exchange,

Schedule Your Free 20-minute Call Today

The following chart shows NCREIF returns since 1978.

Categories

Strategize Your Success