The Differences Between 721 and 1031 Exchanges

Carl E. Sera, CMT

April 19, 2023

Investing in real estate comes with its pros and cons, and knowing how to pursue property investment successfully takes time and knowledge. So, here are the differences between the 1031 and 721 exchanges that investors should know.

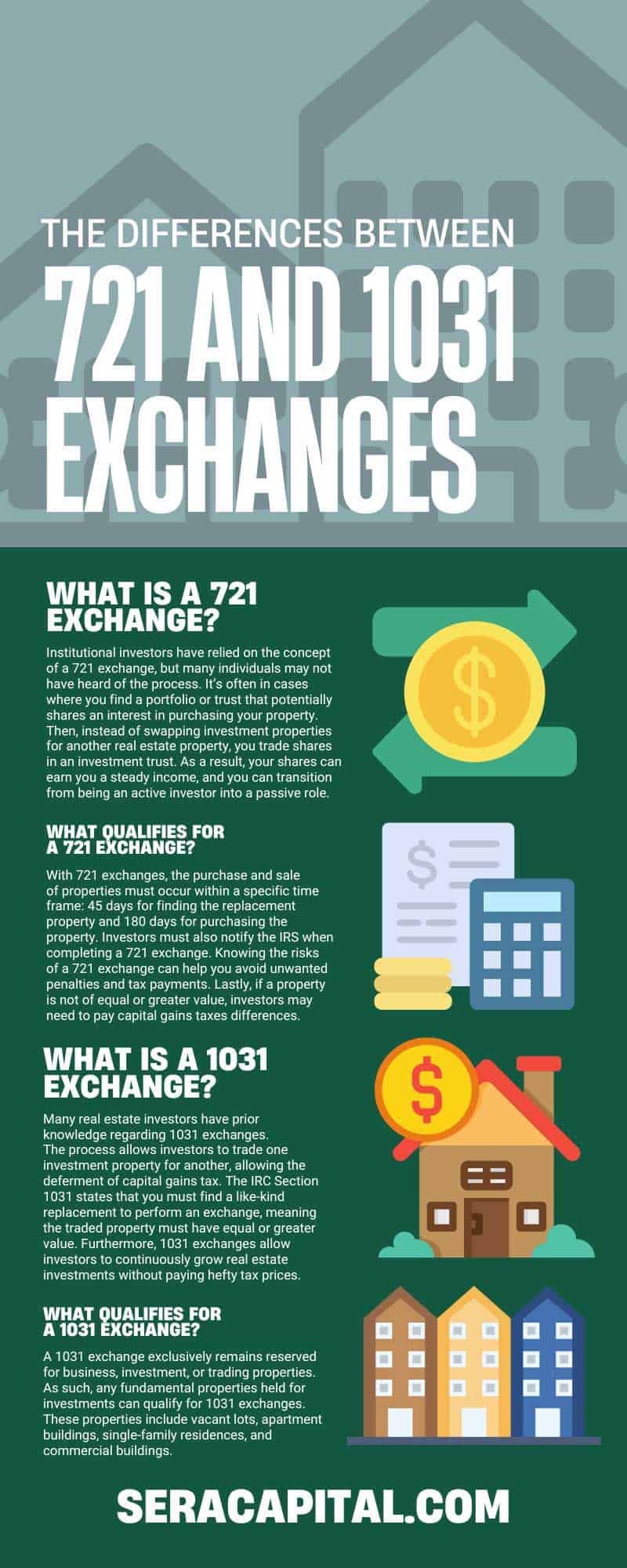

What Is a 721 Exchange?

Institutional investors have relied on the concept of a 721 exchange, but many individuals may not have heard of the process. It’s often in cases where you find a portfolio or trust that potentially shares an interest in purchasing your property. Then, instead of swapping investment properties for another real estate property, you trade shares in an investment trust. As a result, your shares can earn you a steady income, and you can transition from being an active investor into a passive role.

One significant difference between a 1031 and 721 exchange is that you won’t have to worry about the day-to-day management and ownership responsibilities, such as rent collection, maintenance, and tenants. Furthermore, 721 exchanges don’t trigger taxable events; you won’t need to pay taxes until you redeem shares. You can do it all at once or spread it out over time.

What Qualifies for a 721 Exchange?

You must meet a few qualifications to pursue a 721 exchange. Firstly, the sold property must exchange for another property of equal or greater value. Furthermore, the exchange must go through a qualified intermediary.

With 721 exchanges, the purchase and sale of properties must occur within a specific time frame: 45 days for finding the replacement property and 180 days for purchasing the property. Investors must also notify the IRS when completing a 721 exchange. Knowing the risks of a 721 exchange can help you avoid unwanted penalties and tax payments. Lastly, if a property is not of equal or greater value, investors may need to pay capital gains taxes differences.

Advantages of 721 Exchanges

Luckily, 721 exchanges come with many benefits. Real estate investment trust (REIT) shareholders won’t have interests attached to a singular asset. A 721 umbrella partnership real estate investment trust (UPREIT) exchange allows investors to purchase REIT shares. Investors can manage risks through diversification, mainly if a REIT contains properties in different locations, such as tenant classes, industry, and asset diversification.

Furthermore, 721 exchanges allow for passive income opportunities. Because the economy can impact property investments, it can result in cash flow changes. Instead, 721 exchanges pay dividends to the shareholders, which results in a passive income. While investors have a minor role in managing day-to-day decisions, managers have control over management and REIT operations.

Disadvantages of 721 Exchanges

Unfortunately, 721 exchanges aren’t without downsides. With a 721 exchange, investors can’t perform another deferred tax exchange after receiving REIT shares. REIT shares themselves don’t allow for other tax-deferred exchanges compared to 1031 exchanges. You remain permanently attached to the chosen REIT you invested in, as ditching shares can involve paying capital gains taxes.

Another downside is that if the REIT decides to sell parts of the investor’s portfolio, this could impact the investor. REITs can return capital to the investor, which forces admission of a capital gain or loss on tax filings.

What Is a 1031 Exchange?

Many real estate investors have prior knowledge regarding 1031 exchanges. The process allows investors to trade one investment property for another, allowing the deferment of capital gains tax. The IRC Section 1031 states that you must find a like-kind replacement to perform an exchange, meaning the traded property must have equal or greater value. Furthermore, 1031 exchanges allow investors to continuously grow real estate investments without paying hefty tax prices.

However, it’s crucial to remember that the exchange itself doesn’t mean tax-free; instead, it’s a tax deferment. Eventually, investors must pay taxes after selling their replacement property unless they pass away. In cases of passing, heirs of the investment will not have to pay capital gains taxes.

What Qualifies for a 1031 Exchange?

A 1031 exchange exclusively remains reserved for business, investment, or trading properties. As such, any fundamental properties held for investments can qualify for 1031 exchanges. These properties include vacant lots, apartment buildings, single-family residences, and commercial buildings.

More importantly, properties held for personal use do not qualify for 1031 exchanges, including primary or secondary homes. However, 1031 exchanges aren’t restricted to real estate, and some personal properties, such as C-corporations, S-corporations, trusts, partnerships, and limited liability companies, can potentially qualify.

Advantages of 1031 Exchanges

A 1031 exchange has numerous benefits for investors. As previously mentioned, 1031 exchanges allow for capital gains tax deferment, which helps accumulate wealth faster. It will enable investors to defer tax, taking the full return on their investment into another deal. Investors can repeatedly invest in various investments as wealth increases. However, investors must pay taxes if they plan on investing in a property that doesn’t qualify under Section 1031.

Furthermore, you can continue to invest until your passing and leave your properties to your heirs. As a result, they won’t have to pay accumulated capital gains taxes on 1031 exchange properties. Adversely, heirs inherit properties at current fair-market prices, and all accumulated gains will vanish. It’s an effective tool to help build generational wealth.

Disadvantages of 1031 Exchanges

A significant downside to 1031 exchanges is their complexity. Finding the right like-kind property can become time-consuming, especially since investors are on a specific time limit. If tax deferment is a goal, you have to have 45 days from the initial sale of your property to find a replacement property by describing the specific property in extensive detail, along with a written signature. Furthermore, you have 180 days from the sale date to relinquish your property to close for the purchase of the replacement property. So, it’s crucial that you move quickly when pursuing a 1031 exchange.

Finding a like-kind property with a specific time window looming over your head can become stressful. The last thing you want is to scramble to find a like-kind property that doesn’t meet all your goals, especially for tax deferment. Even more so, not being able to find a replacement property at all results in your paying the total gains tax from selling your initial property.

Pursuing a 721 or a 1031 exchange should be in the hands of a professional who cares about your finances. At Sera Capital, we are a fee-only fiduciary focusing on tax-efficient exit planning for individuals who want help managing their money. We also provide investment management, advice, and education, along with couples and industry professionals who want to learn more about investments. Our 721 UPREIT exchange services can help investors better their portfolio diversification and increase their investment liquidity. If you want to know more about our financial services, schedule a free 20-minute phone call with us today.

Sera Capital is a wealth management consulting firm specializing in all aspects and all available tax-efficient exit options for business owners, real estate investors, and developers. Our team works with you and your advisors to examine all available solutions, including 1031 Exchanges, Delaware Statutory Trusts, 721 UPREITS, Opportunity Zone Funds, and Section 453 Installment Sales, including Deferred Sales Trusts and Structured Installment Sales. We have two mottos. The first is “We help landlords and business owners exit tax efficiently,” and our second is “When you want out, call us in.”

If you want to explore your options, make a no-obligation appointment with us today. Discover the possibilities.

Categories

Strategize Your Success