Advantages of Choosing a 1031 Tax-Deferred Exchange Offer

Carl E. Sera, CMT

August 4, 2023

Investing in a singular or multiple properties doesn’t have to be complicated. Investors involve themselves in 1031 exchanges because of their many advantages, including tax benefits, passive income opportunities, estate planning, and more. Here are some of the advantages of choosing a 1031 tax-deferred exchange offer and why investors should consider it in their investment portfolio.

What Is a 1031 Exchange?

A 1031 exchange originates from Section 1031 of the US Internal Revenue Code. It allows investors to defer paying capital gains taxes when selling properties and reinvest proceeds from property sales within a specific time frame. It applies to singular or multiple like-kind properties, allowing investors to defer capital gains tax from property sales.

A 1031 exchange then puts the proceeds from the sale toward another property, often referred to as trading up. There are many reasons to invest in 1031 exchanges, such as investors seeking properties with better return prospects or those seeking to diversify assets. Furthermore, utilizing 1031 exchanges allows real estate investors to look for an already-managed property instead of managing one themselves.

1031 Exchanges Qualifications

Investors must meet several qualifications to perform a 1031 exchange. Such exchanges are a common tax strategy to help grow investment portfolios and efficiently increase net worth.

Identifying Eligible Properties

The Internal Revenue Service requires like-kind properties to have the same character or nature as the replacement property, even if the quality is different. According to the IRS, real estate properties must remain like-kind, regardless of how real estate improves. The Tax Cuts and Jobs Act eliminates intangible, personal properties from being involved in tax-deferment exchanges.

Active real estate investors perform 1031 exchanges on properties being sold and bought, allowing for capital gains, tax deferment, or complete elimination via estate planning. As such, it helps investors become more liquid, using capital gains to scale their estate portfolios at a better pace.

Follow the Three Main Rules

The three major rules of 1031 exchanges start with ensuring that an investor’s replacement property should have a similar or greater value than the selling property. To get the most out of an exchange, investors should identify the three potential replacement properties to purchase regardless of market value. Alternatively, investors must identify unlimited properties if the combined real estate values don’t exceed over 200 percent of the replacement property. Lastly, investors can identify unlimited properties if the acquired properties value 95 percent or more of the replacement property.

Secondly, the IRS requires that replacement properties must be identified within 45 days. Experienced real estate investors don’t wait for their property to sell before seeking out a replacement, thus ensuring they receive the best price on the replacement property. Finally, replacement properties must be purchased within 180 days; the IRS counts each individual day, including holidays and weekends.

Benefits of 1031 Tax-Deferred Exchanges

The advantages of 1031 tax-deferred exchange offers are plentiful, from portfolio diversification to a reduction in management responsibilities. Below are the various benefits that can come out of 1031 exchanges.

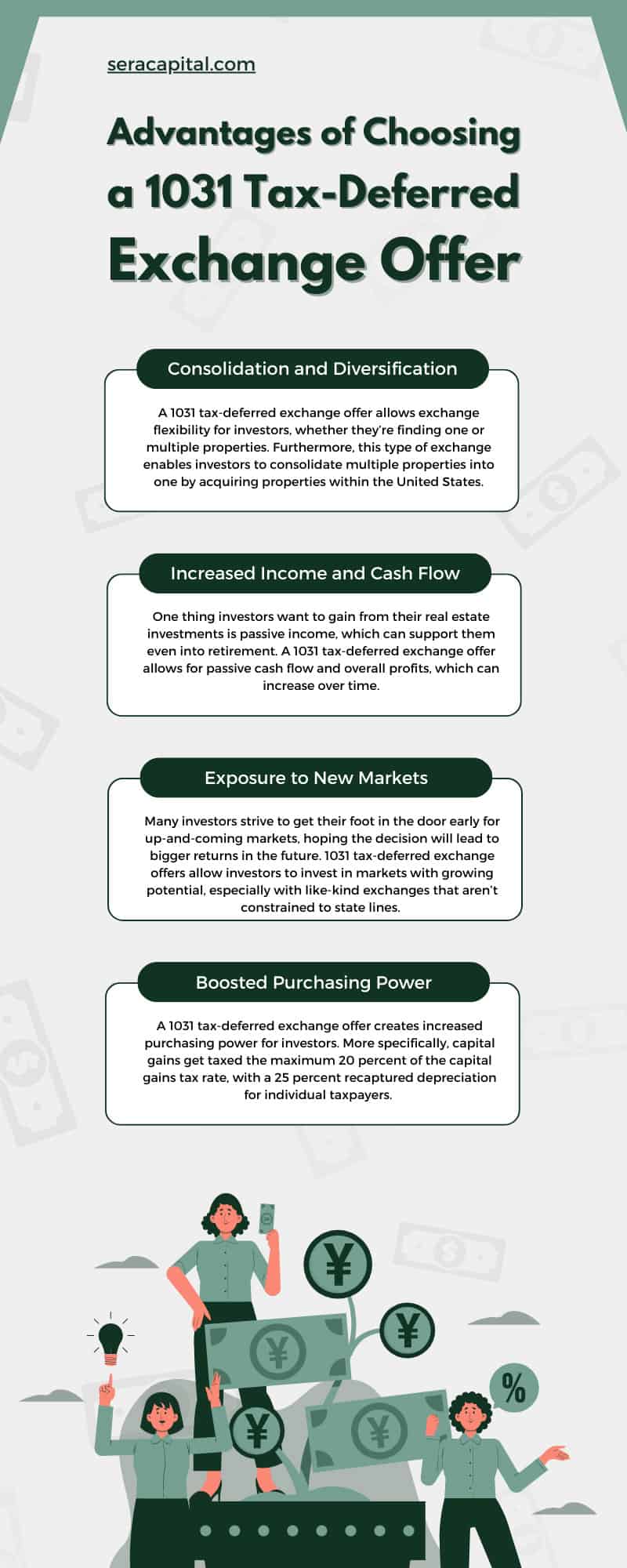

Consolidation and Diversification

A 1031 tax-deferred exchange offer allows exchange flexibility for investors, whether they’re finding one or multiple properties. Furthermore, this type of exchange enables investors to consolidate multiple properties into one by acquiring properties within the United States.

For instance, investors can acquire a retail strip mall in exchange for two duplex properties in their possession. They can also take advantage of newly growing areas by exchanging properties in one state for properties in another. The options are incredibly versatile as long as the investor focuses their exchanges within the United States and other US-owned areas.

Increased Income and Cash Flow

One thing investors want to gain from their real estate investments is passive income, which can support them even into retirement. A 1031 tax-deferred exchange offer allows for passive cash flow and overall profits, which can increase over time.

For instance, vacant land that doesn’t generate cash flow can be exchanged for a property that does. This can allow investors to create passive income, invest in retirement, and create generational wealth.

Exposure to New Markets

Many investors strive to get their foot in the door early for up-and-coming markets, hoping the decision will lead to bigger returns in the future. 1031 tax-deferred exchange offers allow investors to invest in markets with growing potential, especially with like-kind exchanges that aren’t constrained to state lines. Investors can capitalize on a real estate property’s advantage, which results in diversified risk.

1031 exchange offers allow passive investors to leave a single-managed property and explore different passive investments, thus spreading risk across other markets and reclaiming time spent managing and maintaining properties.

Reduced Managerial Responsibilities

If there’s one thing that holds investors back from taking on properties, it’s the managerial responsibilities they have to shoulder. Luckily, a 1031 tax-deferred exchange allows investors to own one or several rental properties without managing costly maintenance and intensive management tasks.

1031 exchanges can reduce the stress and headaches associated with property management. Investors can increase their profits and decrease the effort and time spent focusing on rental property maintenance. The exchange puts the responsibility in an impartial third party’s hands, leaving the investor to focus on increasing profits and investing in other properties.

Boosted Purchasing Power

A 1031 tax-deferred exchange offer creates increased purchasing power for investors. More specifically, capital gains get taxed the maximum 20 percent of the capital gains tax rate, with a 25 percent recaptured depreciation for individual taxpayers. Furthermore, most states within the US have a predetermined state capital gains tax that defers through 1031 tax-deferred exchanges, resulting in increased purchasing power.

Investment Leverage

One significant benefit of 1031 exchanges is their leveraging capabilities. Investors can benefit significantly from 1031 tax-deferred exchanges by acquiring more valuable investment properties.

They can increase down payments and improve their buying power by acquiring expensive replacement properties and utilizing money paid to the IRS via taxes. Therefore, they can leverage their money and continuously build wealth via real estate investments.

Investors who wish to diversify their investment portfolios and spread risk across various real estate investments can benefit from 1031 exchanges. At Sera Capital, we believe in supporting and educating individuals with highly appreciated assets who want to go in the right direction. Our 1031 exchange advisors help provide tools and guidance on investing in real estate properties for long-term financial planning. If you have questions regarding our 1031 exchange service, contact us through a free 20-minute phone call today.

Categories

Strategize Your Success