What Types of Properties Qualify for a 721 Exchange?

Carl E. Sera, CMT

April 30, 2024

Real estate investments and tax planning aren’t easy to navigate. Mastering the nuances of tax-deferred exchanges, such as the Section 721 exchange, is essential for any savvy investor or business owner looking to optimize their financial strategy. Continue reading to explore what property types qualify for a 721 exchange and more about the exchange types.

Unveiling the 721 Exchange

A 721 exchange allows investors to convert an interest in a partnership, or a portion, into an interest in a real estate investment trust (REIT) without having to recognize capital gains. This transaction equips investors with a multilayered approach to portfolio diversification, tax efficiency, and passive income generation, making it an ideal counterpart to the orthodox 1031 exchange.

The 721 exchange offers distinctive advantages, enabling shareholders to trade properties across a wider scope, including tangible real estate and vast opportunities within real estate assets and infrastructure. For small business owners looking to enhance their bottom line or real estate investors capitalizing on market opportunities, the 721 exchange is a golden ticket to tax-deferred prosperity.

Qualifying Property Types

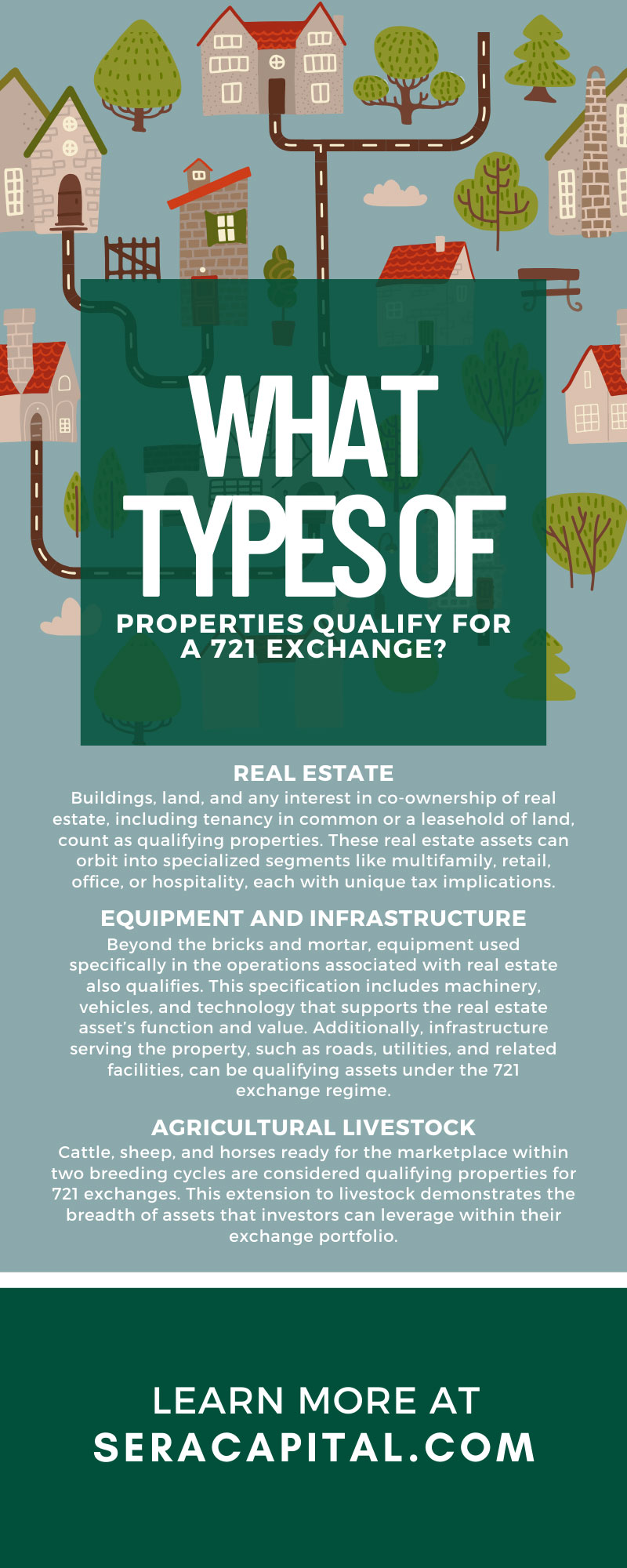

Understanding what properties qualify for a 721 exchange is crucial to the success of your investment strategy. Let’s explore the three primary categories:

1. Real Estate

Tangible property, such as commercial and residential real estate assets directly used in the business or property held for investment purposes, falls under this umbrella. Buildings, land, and any interest in co-ownership of real estate, including tenancy in common or a leasehold of land, count as qualifying properties. These real estate assets can orbit into specialized segments like multifamily, retail, office, or hospitality, each with unique tax implications.

2. Equipment and Infrastructure

Beyond the bricks and mortar, equipment used specifically in the operations associated with real estate also qualifies. This specification includes machinery, vehicles, and technology that supports the real estate asset’s function and value. Additionally, infrastructure serving the property, such as roads, utilities, and related facilities, can be qualifying assets under the 721 exchange regime.

3. Agricultural Livestock

Cattle, sheep, and horses ready for the marketplace within two breeding cycles are considered qualifying properties for 721 exchanges. This extension to livestock demonstrates the breadth of assets that investors can leverage within their exchange portfolio.

Understanding the Criteria for Eligibility

You can’t shuffle every potential property in and out of a 721 exchange at will. In order for an asset to be eligible, it must satisfy stringent criteria.

Investment vs. Personal Use

The foremost criterion is that the investor must hold the property for the investment or use it in a trade or business. Personal properties or those held for personal use are ineligible. It is crucial to differentiate between individual and investment assets to ensure compliance with the tax laws governing 721 exchanges.

Holding Periods

Investors must maintain the property for a minimum period pre and post-exchange to fulfill the holding period criteria. The exact duration is case-sensitive and contingent on many factors, including the nature of the asset and the strategic intent behind the exchange.

Like-Kind Requirements

Like the 1031 exchange framework, the 721 exchange mandates that the properties involved must be “like-kind”—defined with broad flexibility but accountability. Understanding what constitutes like-kind properties will help you structure a viable exchange.

A Strategic Perspective

Executing a successful 721 exchange demands precision and foresight. You must consider many things in order to achieve such an exchange. It intertwines with several other tax structures to deliver the most efficient outcome.

Establishing the Possibility of Exchange

Preparation is key. Before initiating an exchange, an investor must engage with a specialized financial advisor to review current portfolios and assess the feasibility and strategic potential of a 721 exchange. This initial step lays the groundwork for informed decision-making.

Transferring the Partnership Interest

The actual transfer of the partnership interest to the REIT is a pivotal step in the 721 exchange process. This exchange shields the investor from immediate tax liability, reinforcing the broader objective of asset preservation and growth.

Ensuring Direct Compliance

All parties must adhere to Internal Revenue Service (IRS) guidelines throughout the exchange process. Policies include documentation, disclosures, and timing requirements that are non-negotiable components of a compliant 721 exchange.

Differentiating 721 DSTs From Traditional 721 Exchanges

When investors explore the domain of 721 exchanges, they often encounter the concept of Delaware Statutory Trusts (DSTs). Understanding the distinctions between these two forms is critical for optimizing investment strategies. A DST is a legal entity created as a trust under Delaware state law, which permits a flexible approach to investment in real estate and other assets. While DSTs and 721 exchanges offer avenues for deferring capital gains tax, their structures and implications for investors diverge significantly.

Traditional 721 exchanges primarily facilitate the exchange of partnership interests for interests in a REIT, directly enabling investors to diversify their portfolios without immediate tax repercussions. The focus here is on the fluid transition from one investment vehicle to another within the real estate sphere. It maintains the deferment of capital gain taxes while potentially expanding the investor’s asset base.

In contrast, 721 DSTs present an alternative strategy wherein investors can pool resources within a trust to invest in real estate or other assets. The DST is an independent legal entity that directly owns the underlying real estate. For investors, this means an opportunity to partake in larger, potentially more lucrative real estate investments than might be feasible individually. When investors utilize a DST structure within a 721 exchange framework, they transition their real estate holdings into a DST without recognizing immediate capital gains. This is similar to traditional 721 exchanges but under the governance of the trust entity.

One key difference lies in the control and decision-making process. Traditional 721 exchanges give investors a direct stake in the REIT’s operations and decisions through their ownership interest. Conversely, DST investors relinquish active control and decision-making to the trust’s trustee(s) in exchange for a more passive investment stance.

Lastly, the regulatory environment for DSTs often involves rigid stipulations, limiting the number and type of investments a DST can engage in compared to the broader flexibility REITs enjoy. This limitation could impact the agility of investors’ portfolios. Understanding these mechanisms is essential for aligning with long-term investment objectives.

Pro Tips for Mastering the 721 Exchange

Engaging in a 721 exchange is a substantial endeavor, but it can elevate your investment strategy with the right measures.

Leverage Professional Expertise

The complexity of tax law and the intricacies of real estate investment underscore the necessity of professional guidance. Working with real estate attorneys, tax advisors, and 721 exchange advisors ensures that investors address all facets of the exchange and realize the most favorable terms.

The 721 exchange represents an opportunity for small business owners and real estate investors. By understanding the mechanics, benefits, and responsibilities of this tax strategy, investors can position themselves on the cusp of innovative approaches to wealth management.

Sera Capital is at the forefront of empowering investors with the knowledge and resources to make informed decisions about their financial futures. Our commitment to personalized service and comprehensive support highlights our dedication to helping you unlock the full potential of 721 exchanges and other tax-deferring vehicles. Contact us today to schedule your free 20-minute consultation.

Categories

Strategize Your Success