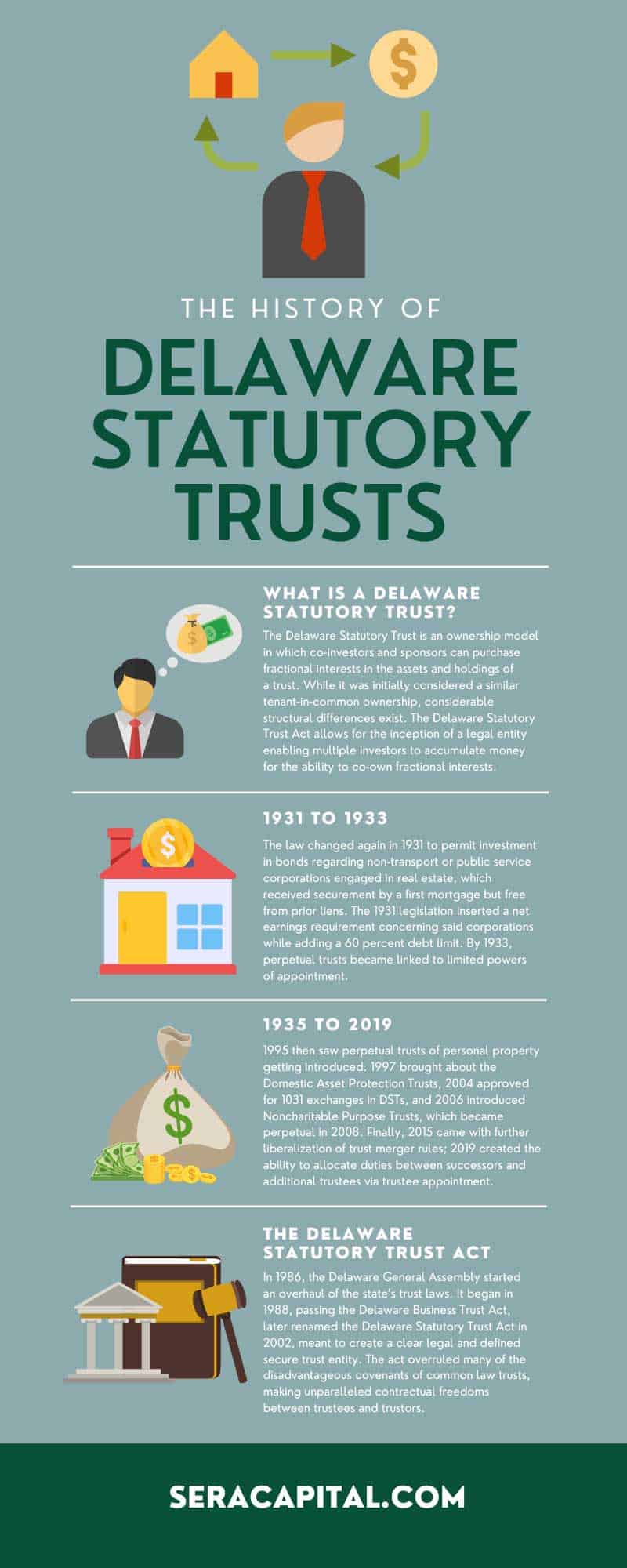

The History of Delaware Statutory Trusts

Carl E. Sera, CMT

March 23, 2023

Trusts acted as a primary method for wealthy Americans for many years to transfer properties from one generation to the next with minimal taxes and maximum security and protection. As such, Delaware modernized common law, becoming the first state to create an effective, judicial secure entity known as the Delaware Statutory Trust (DST). So, here’s what to know about the Delaware Statutory Trust and a brief history of its many changes.

What is a Delaware Statutory Trust?

The Delaware Statutory Trust is an ownership model in which co-investors and sponsors can purchase fractional interests in the assets and holdings of a trust. While it was initially considered a similar tenant-in-common ownership, considerable structural differences exist. The Delaware Statutory Trust Act allows for the inception of a legal entity enabling multiple investors to accumulate money for the ability to co-own fractional interests.

Trustees, also known as beneficiaries, hold onto individual beneficial interests in the trust, thus receiving distributions, when applicable, according to their pro-rata shares in the Delaware Statutory Trust. These trusts have title to singular or multiple income-producing properties, including rental, office, multi-family, similar commercial, or industrial real estate assets.

How a Delaware Statutory Trust Operates

To form a Delaware Statutory Trust, a certificate of trust should include the name of the trust, along with the name and address of the Delaware trustee for official filing with the Office of the Secretary of State of the State of Delaware. The trust formation includes a one-time, low filing fee without the need to disclose the owner’s identity or agreement conditions.

A Delaware Statutory Trust can become structured differently or qualify as different investment trusts or conduits. A DST may include the name of several people or legal entities, delivering more security than a typical trust.

History of Delaware Statutory Trusts

The history of Delaware Statutory Trusts starts with events that tie back to Delaware history laws. In 1929, Delaware took a step forward in changing its laws concerning corporate investments, which weren’t previously included.

1931 to 1933

The law changed again in 1931 to permit investment in bonds regarding non-transport or public service corporations engaged in real estate, which received securement by a first mortgage but free from prior liens. The 1931 legislation inserted a net earnings requirement concerning said corporations while adding a 60 percent debt limit. By 1933, perpetual trusts became linked to limited powers of appointment.

1935 to 2019

The 1935 amendment added the ability of trusts to invest in mortgage bonds that weren’t included in loan default in the previous five years and land only within Delaware estate. Furthermore, the amendment removed the “free from prior liens” stipulation. As of 1986, 110-year trusts became introduced as a “prudent investor” rule.

1995 then saw perpetual trusts of personal property getting introduced. 1997 brought about the Domestic Asset Protection Trusts, 2004 approved for 1031 exchanges in DSTs, and 2006 introduced Noncharitable Purpose Trusts, which became perpetual in 2008. Finally, 2015 came with further liberalization of trust merger rules; 2019 created the ability to allocate duties between successors and additional trustees via trustee appointment.

The Delaware Statutory Trust Act

In 1986, the Delaware General Assembly started an overhaul of the state’s trust laws. It began in 1988, passing the Delaware Business Trust Act, later renamed the Delaware Statutory Trust Act in 2002, meant to create a clear legal and defined secure trust entity. The act overruled many of the disadvantageous covenants of common law trusts, making unparalleled contractual freedoms between trustees and trustors.

The Delaware Statutory Trust Act continues to refine and advance to reflect current practices better. Most notably, the Delaware Trust Act 2020, signed by Delaware Governor John Carney, modified certain statutes and provisions, including the authority to trust duties to numerous trustees.

Common Uses of DSTs

Now that you know more about how Delaware Statutory Trusts work and their history, let’s review their common uses. They can apply towards leveraged leasing and equipment or collateral trusts and asset securitizations that allow flexibility. Moreover, they include tax benefits, income potential, and eligibility for 1031 exchanges.

Leveraged Leasing and Equipment/Collateral Trusts

Regarding leverage leasing, the DST provides limited liability for equity protectors while protecting lessees and debt investors against the risk of bankruptcy toward equity investors. As such, there is a significant reduction in the risk that the DST will cause debtor bankruptcy. Moreover, Delaware Statutory Trusts frequently get used to hold “replacement properties” in a scenario of a like-kind exchange transaction that’s structured to comply with Revenue Ruling 2004-86.

Structured/Synthetic Securities and Leases

As for structured or synthetic securities and leases, a DST acquires and holds the security or asset for repackaging purposes. It then enters a swap transaction for the exchange of cash flows with a swap counterparty. As such, it issues new debt and equity securities to investors, carrying the desired investment characteristic based on the cash flow received from the swap counterparty.

Regarding synthetic leases, the DSTs flexibility, bankruptcy-remote features, and the limited liability of DST beneficial owners make the DST a good choice. It serves as borrower, owner, or lessor in tax retention operating lease transactions, known as TROL.

Registered Investment Companies

Another everyday use for Delaware Statutory Trusts is towards registered investment companies. They offer flexibility as an advantage, mainly because no limit exists on the number of beneficial owners or interests. Furthermore, inter-series liabilities can have limitations to the property of a series, along with no annual meetings required.

Delaware Statutory trusts can also have the authorization to redeem or issue additional beneficial interest without the consent of beneficial owners. They also do not need to amend a public filing or documentation. Flexibility is a crucial asset to DSTs, making it a straightforward process.

Asset Securitizations

The Delaware Statutory Trusts issue debt or equity securities backed by trust assets. It is a primary advantage that can receive protection towards DST assets from creditors of the originator. Such assets and creditors of the beneficial owners of the DST.

Some common uses include municipal tax liens, residential mortgages, collateralized bond obligations, commercial mortgage loans, real estate investment trusts, automobile leases and loans, and more. Furthermore, receivables such as credit cards, trade, installment sales, healthcare, and more remain applicable for Delaware Statutory Trusts.

When you need proper education on 1031 exchanges and the prospect of Delaware Statutory Trusts, we at Sera Capital have you covered. We believe in providing extensive education regarding selling highly appreciated real estate, businesses, and concentrated stock positions, helping you embrace a high rate of return per unit of risk investing. Our 1031 exchange advisors will help waive 100 percent of all commissions and never direct clients toward investments that can compromise retirement plans. If you want to know more, schedule a free 30-minute call with us today.

Categories

Strategize Your Success