What Are the Potential Benefits of DST Investments?

Carl E. Sera, CMT

November 27, 2023

As a leading provider of financial services, Sera Capital understands the importance of exploring all options when maximizing your investments. The Delaware Statutory Trust (DST) is one such option that has gained popularity in recent years.

What makes them popular? DSTs combine increasing real estate values, low investment returns from traditional banking investments, and aging demographics. They deserve the growth because they offer incredible benefits for real estate investors. What are the potential benefits of DST investments? Continue reading to find out.

What Is a DST?

A Delaware Statutory Trust (DST) is a legal entity that allows multiple investors to pool their money when investing in real estate properties. These properties range from apartment complexes and office buildings to shopping centers and storage facilities. The DST structure is similar to a Real Estate Investment Trust (REIT) but has some key differences.

Allowing investors to own fractional interests in larger, higher-quality properties that they may not be able to afford alone is one of the main benefits of a DST. This freedom allows for diversification within the real estate market without the burden of managing individual properties.

Who Can Invest?

Only accredited investors can invest in DSTs. The Security and Exchange Commission defines an accredited investor as a person who has a net worth of one million dollars or has had a yearly annual income of over $200,000 in the past two years. The average income has to be at or above $300,000 if a couple is filing jointly. It’s important to note that the net worth can’t include the individual’s main residence.

Minimum Investment

DSTs usually require a minimum $100,000 investment. An investor can exchange or acquire ownership of one or more Delaware Statutory Trusts.

Investors receive the entire profit, including potential appreciation gains, when they sell the investment property. You can exchange these investments again to continue deferring tax. Investors typically hold DST real estate investments for three to ten years.

Benefits DSTs Provide

Knowing the potential benefits is important if you’re considering a DST. It will make the decision process easier and ensure you make the right investment. Continue reading to check out the advantages.

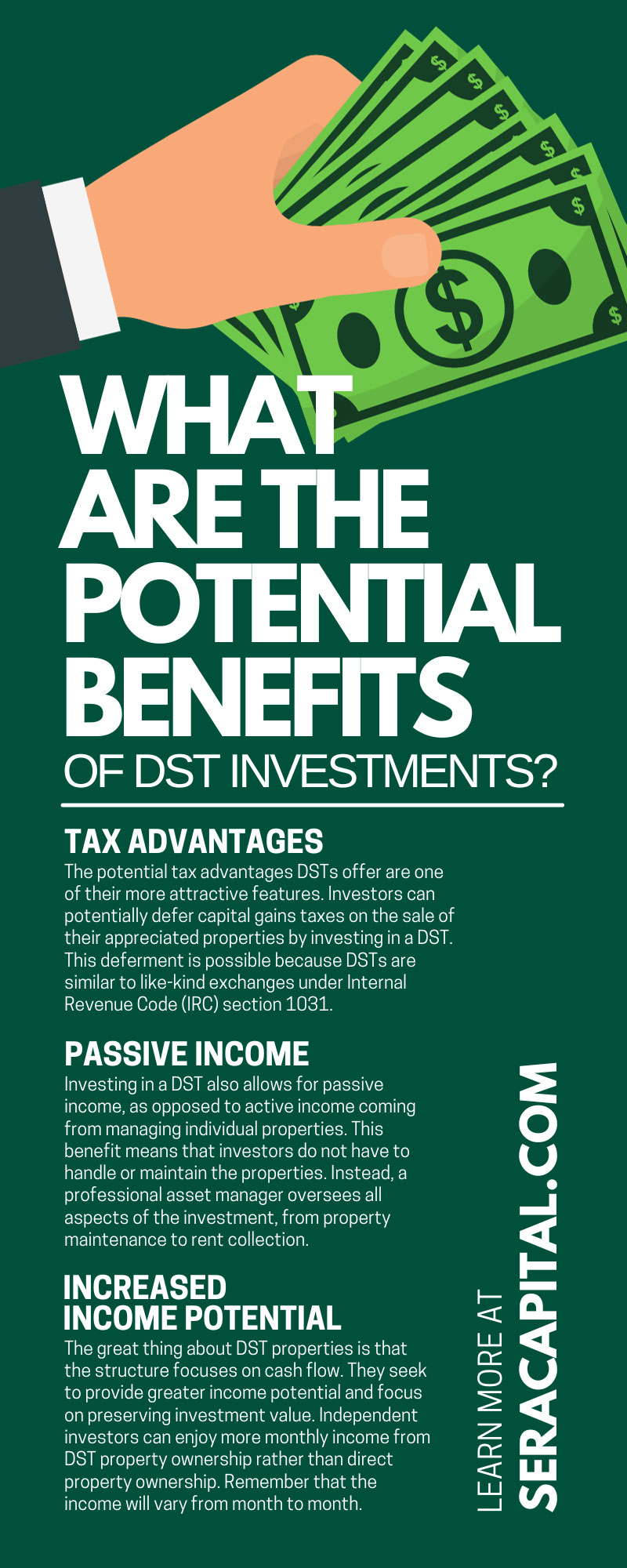

Tax Advantages

The potential tax advantages DSTs offer are one of their more attractive features. Investors can potentially defer capital gains taxes on the sale of their appreciated properties by investing in a DST. This deferment is possible because DSTs are similar to like-kind exchanges under Internal Revenue Code (IRC) section 1031.

In addition, DSTs also offer potential tax deductions through depreciation. As property values typically appreciate over time, the depreciation deductions can help offset any taxable income from the property. This offset can be especially beneficial for high-income investors.

Passive Income

Investing in a DST also allows for passive income, as opposed to active income coming from managing individual properties. This benefit means that investors do not have to handle or maintain the properties. Instead, a professional asset manager oversees all aspects of the investment, from property maintenance to rent collection.

This advantage is huge for busy investors who do not have the time or resources to manage properties themselves. It also allows for more passive investing and diversification within the real estate market.

Increased Income Potential

The great thing about DST properties is that the structure focuses on cash flow. They seek to provide greater income potential and focus on preserving investment value. Independent investors can enjoy more monthly income from DST property ownership rather than direct property ownership. Remember that the income will vary from month to month.

Lower Risk

DSTs can potentially offer lower risk compared to other types of real estate investments. Investors can spread their money across multiple properties, minimizing the impact of any individual property’s performance, by pooling their funds. This minimization can help mitigate overall risk and potentially provide more stable returns.

Additionally, experienced asset managers with a vested interest in the success of the investment professionally manage these DSTs. They conduct thorough due diligence on properties before investing and continue to monitor and manage them throughout the life of the DST.

Flexibility and Liquidity

Another potential benefit of DSTs is their flexibility and liquidity. Unlike traditional real estate investments, tying a specific property to an investor for a set period, DSTs have more flexible investment periods. This flexibility means that investors can choose how long they want to stay invested in the trust and potentially exit at any time.

In addition, DSTs offer liquidity options through the secondary market. This option allows investors to sell their interests in the trust to other interested buyers if they need access to their funds before the investment period is over.

Non-Recourse Debt

Most DST-related debt is non-recourse. Non-recourse debts limit an investor’s liability to the lender and protect an investor’s other assets and properties in case an investment fails. What is non-recourse debt? It’s a loan investors can secure with collateral, typically property. It saves the borrower because if they happen to default, the lender can’t seize anything besides the listed collateral, even if it doesn’t fully cover the loan. Non-recourse debts add a layer of protection.

In conclusion, the potential benefits of DST investments are numerous, from tax advantages and passive income to lower risk and flexibility. DSTs provide an alternative option for those looking to diversify their investment portfolio. As with any investment, it is important to thoroughly research and understand the potential risks and benefits before deciding. Consult a trusted, fiduciary financial advisor for guidance if you want to explore DSTs as an investment option. They will help you tailor your specific financial goals and needs. Turn to the most trusted advisors out there, Sera Capital. We are fee-only fiduciary financial advisors who will ensure you’re taken care of and understand what’s happening when it’s happening. We’re not afraid of a challenge and will always put transparency first. Contact our offices today to find out more information if this sounds like what you’re looking for.

So, why not consider adding a DST to your investment strategy today? Your future self may thank you for it. Take the next step towards maximizing your investments with a Delaware Statutory Trust.

Categories

Strategize Your Success