AN ASSET ALLOCATION TALE: WHAT ARE THE CORE ASSET CLASSES?

Carlos M. Sera, MBA

August 10, 2015

If you have $1 what do you do with it? How about $1000 or $10,000 or more? You only have two choices; you can either spend it or save it. If you save it you can put it in your pocket, you can bury it in the back yard, put it under a mattress or you can invest it. So when choosing between whether to invest money vs save money, you need to be sure you do what's best for you: Because most people correctly recognize that anything other than investing it means they will lose the ability to preserve purchasing power due to inflation they choose to invest it.

If you have $1 what do you do with it? How about $1000 or $10,000 or more? You only have two choices; you can either spend it or save it. If you save it you can put it in your pocket, you can bury it in the back yard, put it under a mattress or you can invest it. So when choosing between whether to invest money vs save money, you need to be sure you do what's best for you: Because most people correctly recognize that anything other than investing it means they will lose the ability to preserve purchasing power due to inflation they choose to invest it.

HOW TO INVEST YOUR MONEY

If you invest it you must decide how to invest it. This means you will invest it in something. This something is called an asset and they come in many forms but in my opinion there are only three “Core Asset Classes.” So, what are the core asset classes? They are stocks, short-term investment grade bonds and longer-term investment grade bonds. We are familiar with stocks but maybe not so familiar with bonds. Short-term investment grade bonds are commonly referred to as cash and have maturities of 1 year or less. Most people recognize them as money market funds. Longer-term investment grade bonds are commonly referred to as bonds and mature in more than 1 year. With these three building blocks of stocks, cash and bonds an investor can work wonders.

Asset classes that do not fall into one of these two categories I consider non-core. In the hands of the most sophisticated of investors these non-core asset classes can add value to a portfolio. However, seeing these types of non-core assets in real portfolios over the last 30 years tells me that for the vast majority of investors they are counterproductive. The reason of course is that people don’t know how to use them correctly. In the wrong hands, these non-core assets do more harm than good. Some examples of non-core asset classes include real estate, commodities, natural resources, currencies, high yield bonds and options. This tale focuses on the big three core classes. I think investors have their hands plenty full just dealing with these three.

THE ASSET ALLOCATION DECISION

In A Tale of Diversification we learned that the most crucial decision an investor must make is determining if they want to even have a diversified portfolio of stocks as well as a diversified portfolio of bonds or some combination of the two. If the decision, which I highly encourage, is to diversify using stocks and bonds then the next critical question is how much should I have in a diversified portfolio of stocks and how much in a diversified portfolio of bonds. This is the asset allocation decision. Investing is just another term for allocating your capital. It is the second most important decision about investing after the will I or will I not choose to diversify.

Let’s look at some examples. If Investor A chooses to put all their money in a single stock such as General Electric, he has made two decisions. He has chosen to not diversify and he has chosen to allocate 100% of his money to stocks since General Electric is a stock. If Investor B chooses to put all their money in an exchange-traded fund such as SPY, he has also made two decisions. He has chosen to diversify and he has chosen to allocate 100% of his money to stocks. The reason Investor B is diversified and Investor A is not is because by investing in SPY, Investor B has chosen to invest in a diversified portfolio of stocks while Investor A has invested in only one stock. Nevertheless they are both 100% allocated to the stock market. The same reasoning we used for stocks can be used for bond investing. This leads to the logical conclusion that “You can’t make an investment decision without making an asset allocation decision.” Investing and asset allocation are one and the same. Asset allocation is nothing more than the slicing and the dicing of your money. Asset allocation is the percentage of your money that is allocated to different asset classes so that it adds up to 100%..

CONSTRUCTING A PORTFOLIO

Let’s construct a simple portfolio with our three core asset classes. If you allocate 60% of your money to stock investments, 30% to bond investments and 10% to cash investments you have created an asset allocation that includes all three. A portfolio like this might be called a 60/30/10 portfolio to reflect the individual pieces. This is a good way to look at any portfolio. If the 60% stock piece is invested in a diversified portfolio of stocks and the 30 piece is invested in a diversified portfolio of bonds and the cash piece is safe and plays the role that cash is designed to play in a portfolio then the investor with a 60/30/10 can expect to make rates of return that are within historical parameters while taking risks that are also within historical parameters. But what if the investor chooses not to diversify?

Lets look at an example of an asset allocation where the investor has a 60/40/0 portfolio that is dangerous and misses the objective of asset allocation. I stumbled upon an investor in my travels that said he had a 60/40 portfolio. I was impressed with his ability to recognize and quantify his holdings. Most people can’t or don’t know the importance of asset allocation. This guy knew however somewhere along the way he missed the point about diversification. I asked him to explain and he said that he had 60% of his money in a small stock I had never heard of and the other 40% in a bond I had never heard of either. This guy knew the lingo, did in fact have a 60/40/0 asset allocation, but he didn’t have a firm grasp of the implications behind the term asset allocation. Implicit in the term asset allocation amongst academicians and professional investors is the notion that a portfolio is diversified. Since this fellow lacked diversification because he only owned one stock and one bond, he was missing the benefit of diversification. He was right but he was wrong. Most importantly, his expected returns and potential losses were not the same as the investor that chose to asset allocate while employing diversification as well.

Now that we know the 3 “Core Asset Classes” we can learn a bit more. When people speak of asset allocation they might say they have a 40/60 or 50/50 or 60/40 or 75/25 or 90/10 portfolio. In every case the first part is the portfolio allocation to stocks and the second part is the allocation to bonds and cash. Bonds and cash are typically lumped together and is something you should be aware of but not how you should look at your portfolio since cash and bonds have different return and risk characteristics. Nevertheless this is the way asset allocation has evolved when people talk about portfolios. This lumping together effectively leaves us with just 2 “Core Asset Classes” which are commonly referred to as simply stocks and bonds. So when I met the investor that said he had a 60/40 portfolio I immediately assumed he had a diversified portfolio that had 60% allocated or invested in stocks and 40% allocated or invested in bonds. Had he told me he had a 75/25 portfolio I would have assumed he had 75% invested in stocks and 25% invested in bonds. Learn this lingo because it’s universal.

Pay attention to the rest of this tale because if the only thing you learn from this tale is what follows, you will know more than most everyone you meet.

BUILDING A DIVERSIFIED PORTFOLIO

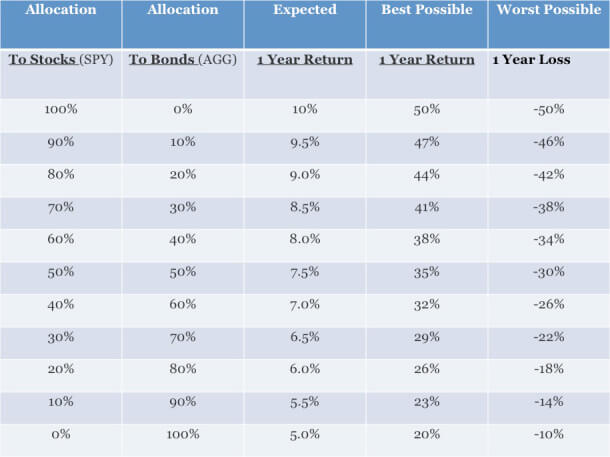

Let’s build a diversified portfolio with just the stock and bond “Core Asset Classes.” We need to give them some characteristics. In the stock class we will use the S&P 500 as a representation of the stock market and in the bond class we will use the Barclay’s Aggregate as a representation of the bond market. With just these two you can build a diversified portfolio because with these two investments you are effectively investing in hundreds of stocks and bonds. Let’s pick an actual investment that we can utilize. Let’s pick the exchange traded fund SPY for the stock market and AGG for the bond market. Let’s examine some characteristics of each of these. For this example, SPY should make the investor about 10% annually and AGG should make about 5% over the long run based on historical returns. In addition at times SPY might make as much as 50% or lose as much as 50% in a year. AGG is much tamer and might make as much as 20% or lose as much as 10% in a year. Let’s look at the table below and see what this means to an investor.

This table is what I consider a highly realistic portrayal of what a person can expect to make in any 1 year because the assumptions I made for the characteristics of SPY and AGG reflect their approximate historical nature. We can see that when the investor told me he had a 60/40 portfolio I immediately was able to characterize him as a person that would reasonably expect to make 8% over the long run, but that he would have at least 1 year where he made as much as 38% that year and others where he lose as much as 34%. Thus asset allocation, though it doesn’t say it in its’ name, means that once you choose an asset allocation you are targeting a return as well as a risk level for your portfolio. Stocks provide a higher long-term return but with more risk than bonds. Conversely, bonds will give you a lower long-term return but with less risk than stocks.

Here comes the part that will put money in your pocket if you can execute it properly. Rest assured it is not psychologically easy to do but if you do it you will make approximately an additional 1% per year compared to what the table above suggests. What is it? It’s called rebalancing between stocks and bonds. If you don’t know what rebalancing is I suggest you read A Rebalancing Tale. Let me say one last time that if the only two investments you ever made were in SPY and AGG and if your asset allocation is not skewed to overly aggressive or conservative, then the proper rebalancing formula or algorithm will put about an extra 1% per year in your pocket. For example, pick an asset allocation that’s not overly aggressive or conservative such as a 60/40 allocation and every time that the stock allocation reaches either 10% higher or lower you rebalance back to 60/40. My research as well as that of many others shows that this adds almost 1% rate of return to your portfolio. In practice this means that if the portfolio composition reaches 66% stocks, 10% higher than the initial 60%, at any time from the last rebalancing you would sell 6% of SPY and buy AGG to get back to 60/40. Conversely, if the portfolio composition reaches 54% stocks at any time from the last rebalancing you would sell 6% of AGG and buy SPY to get back to 60/40.

WHY DOESN'T EVERYONE DO THIS?

What makes this difficult? Why doesn’t everyone do this? The answer is human behavior and why I consider the reconditioning or reprogramming of our evolutionary tendency to make poor investment decisions one if not the most important aspect of successful investing. Let me give you an example to help you understand. The subtitle of this tale is “Everyone’s Got A Plan.” I often use subtitles to help you remember the moral of a tale. In this case I use it to help you understand the psychological difficulty of rebalancing. It is not easy to do because while it may seem simple to think that you will act in a rational manner when the time comes to rebalance, rest assured, most people are ill equipped because they’ve been taken out of their game plan. Let me draw a similarity between boxing and rebalancing. There was a time when Mike Tyson was the greatest heavyweight boxer on the planet. In a post fight interview after a decisive win by knockout the still undefeated champ is told by the announcer that his next opponent has a plan to defeat Mike in their upcoming bout. Mike looks him right in the eye and says “Everyone’s got a plan, till I hit them.” It’s the same with rebalancing. Everyone’s got a plan until the market hits them. It’s easy in theory to project how you will behave, but when you get hit by losses and fear grips your psyche it is hard to execute. You’ve been hit and your plan goes out the window.

As of this writing, February of 2009, most investors are in a state of fear. They are unwilling to buy stocks or take risk. They have lost money and all they see or experience is the recent past. They are seeking safety. They are avoiding pain and in portfolios, pain means stocks. Yet, many of the 60/40 models I look at have signaled the purchase of stocks from the sale of bonds multiple times from the market high of October 2007. If and only if an investor can overcome this fear can they take advantage of rebalancing between stocks and bonds. It is easier said than done. One last note on rebalancing. Psychologically rebalancing is asymmetrical. What I mean by this is that it is much easier to sell stocks when they reach 66% of your portfolio than to buy them when they reach 54% of your portfolio. Fear is a much harder emotion to overcome than greed.

THE REAL BENEFITS OF ASSET ALLOCATION

You may have read studies that discuss the benefits of asset allocation. They are very confusing to most because they make conclusions that very few people understand. They say things like “90% or 93% of the return that a portfolio generates is based on asset allocation.” It’s silly. We know that 100% of the return that a portfolio generates is based on asset allocation. What these experts are trying to say is something else. They are trying to say that the most important decision that a person makes is the amount they allocate to stocks vs. bonds. I agree. There is a world of difference between allocating 100% to stocks vs. 100% to bonds. Just look at the table for proof.

We learned that by choosing a 60/40 portfolio of SPY and AGG you will make about 8% per year. We also learned that rebalancing between the two when they get too far away from their original allocation increases that return by 1% so that you can now make 9% per year. Rebalancing effectively converts a 60/40 portfolio to an 80/20 portfolio while maintaining the risk of a 60/40 portfolio. Rebalancing is a tool you should use. Finally, examine the all-stock allocation. It can’t rebalance because it is always fully invested in stocks so it can’t get the 1% boost from rebalancing. Rebalancing between stocks and bonds is after diversification the single most important thing that the average investor can do to make money. Do it if you can. If you can’t, hire someone that will do it for you.

If diversification is the Wall Street version of a free lunch, then rebalancing must surely be the equivalent of a free breakfast. I highly encourage people to fully participate in both breakfast and lunch. Unfortunately, there are no free dinners on Wall Street.

Categories

Strategize Your Success