Essential Investment Terms You Should Know

Carl E. Sera, CMT

August 15, 2024

Investing requires more than just capital; it demands knowledge and a keen understanding of the market's intricacies. For those interested in DSTs or 721 exchanges, mastering certain investment terms is not just beneficial—it's essential.

Today, we will introduce you to essential investment terms you should know and explain their relevance to an investment strategy. From the foundations of a DST to the importance of fiduciary consultants, this blog will explore various topics to help you gain insight into the essential components that drive successful investments.

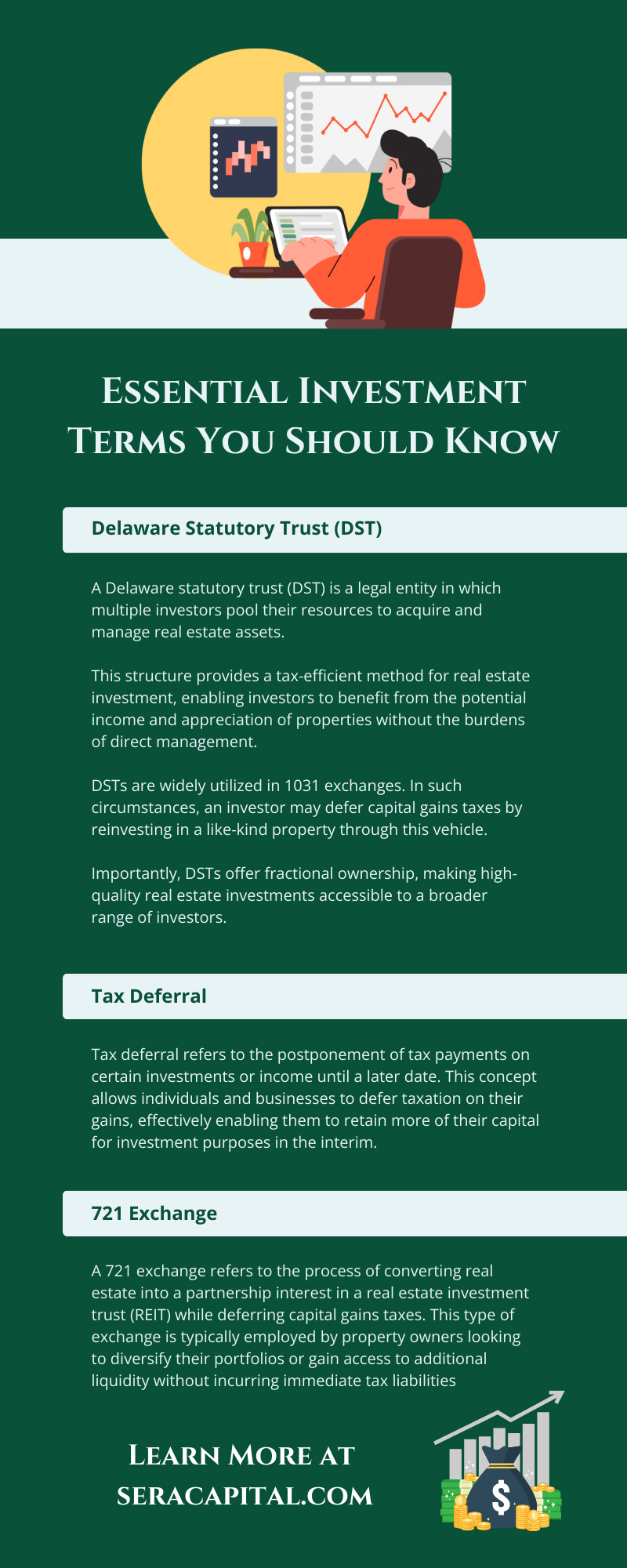

Delaware Statutory Trust (DST)

A Delaware statutory trust (DST) is a legal entity in which multiple investors pool their resources to acquire and manage real estate assets.

This structure provides a tax-efficient method for real estate investment, enabling investors to benefit from the potential income and appreciation of properties without the burdens of direct management.

DSTs are widely utilized in 1031 exchanges. In such circumstances, an investor may defer capital gains taxes by reinvesting in a like-kind property through this vehicle.

Importantly, DSTs offer fractional ownership, making high-quality real estate investments accessible to a broader range of investors.

Tax Deferral

As mentioned above, DSTs can help with deferring capital gains taxes, but it’s crucial to understand what a tax deferral really means.

Tax deferral refers to the postponement of tax payments on certain investments or income until a later date. This concept allows individuals and businesses to defer taxation on their gains, effectively enabling them to retain more of their capital for investment purposes in the interim.

Tax deferral is achievable through various financial structures, such as 1031 exchanges and Delaware statutory trusts (DSTs).

However, it is important to understand that tax deferral does not eliminate tax liability; it merely delays the payment, which will be due at a future date when funds are withdrawn or gains are realized.

721 Exchange

This term stems from Section 721 of the Internal Revenue Code (IRC).

A 721 exchange refers to the process of converting real estate into a partnership interest in a real estate investment trust (REIT) while deferring capital gains taxes. This type of exchange is typically employed by property owners looking to diversify their portfolios or gain access to additional liquidity without incurring immediate tax liabilities

The 721 exchange allows investors to exchange appreciated properties for operating partnership units in a REIT, thus providing an opportunity to participate in a professionally managed real estate portfolio. By utilizing this exchange, investors can maintain their investment goals while benefiting from the inherent advantages of the REIT structure, such as diversification and passive income.

Fiduciary Consultants

Fiduciary consultants are professionals who provide expert guidance and advice to clients on investment management and financial planning, ensuring decisions are made in the best interest of the client.

That last part is critical to understanding what these experts do. These consultants adhere to a fiduciary standard, meaning they are legally and ethically obligated to act in the best interest of their clients. A fiduciary advisor does not put their business or personal interests above the clients.

Instead, they give the client the guidance they need to achieve the desired end result, whatever that may be for the specific individual.

They typically work with a diverse range of clients, including individual investors, institutions, and organizations, helping them navigate complex financial landscapes. Fiduciary consultants evaluate investment strategies, assess risk tolerance, and develop personalized plans to meet specific financial goals.

These experts cover a wide range of services. For example, at Sera Capital, our team includes various financial advisors in Annapolis, MD. Our financial advisors and fiduciary consultants can provide services that include money management, investment education, portfolio reviews, and more.

Their role is particularly valuable in environments where investment decisions can significantly impact long-term financial health. As such, they are essential allies for investors involved in intricate strategies such as DSTs and 721 exchanges.

Capital Gains Taxes

Capital gains tax is one of the most important investment terms you should know. This term refers to taxes imposed on the profit earned from the sale of assets or investments, such as real estate, stocks, or bonds.

There are two primary categories of capital gains: long-term and short-term.

Short-term capital gains from the sale of assets held for one year or less typically incur higher ordinary income tax rates. In contrast, long-term capital gains—gains from assets held for more than one year—typically have lower tax rates, encouraging longer-term investment.

Understanding capital gains taxes is crucial for investors, particularly when utilizing strategies such as Delaware statutory trusts (DSTs) or 721 exchanges, as these structures can provide opportunities for deferral or mitigation of these tax liabilities.

1031 Exchange/Like-Kind Exchange

A 1031 exchange is a common tax-deferral strategy. In this strategy, investors sell one investment property and reinvest the proceeds they earn into another similar property without facing immediate capital gains taxes. You will also find this type of exchange frequently referred to as a Like-Kind exchange. Whichever moniker you use, the function is the same.

Similar to the origins of the 721 exchange, the 1031 exchange refers to Section 1031 of the IRC. By following specific guidelines, such as identifying a replacement property within 45 days and closing on it within 180 days of the sale, investors can defer paying taxes on the gains from the original property.

This mechanism is particularly beneficial for real estate investors seeking to upgrade or diversify their portfolios while preserving their investment capital. Understanding the intricacies of 1031 exchanges can enhance an investor's strategic approach to property transactions and overall portfolio management.

Reflecting on Essential Terms

Before talking to a financial advisor, it’s important to expand your knowledge of investments. Once you have a strong grasp on the type of investment you’re looking at, communication between you and the advisor will become much clearer.

Understanding essential investment terms such as Delaware statutory trust (DST), 721 exchange, 1031 exchange, fiduciary consultants, tax deferral, and capital gains tax can significantly enhance your ability to make informed decisions. Each of these concepts offers unique opportunities and benefits to investors.

By mastering these terms and their applications, you can unlock new avenues for growth, diversification, and tax efficiency. Whether you're a seasoned investor or just starting, staying informed is the key to success in the ever-evolving investment landscape.

Take the next step in your investment journey by exploring these concepts further and considering how you can successfully integrate them into your overall strategy.

Take the next step now—reach out to Sera Capital for your free consultation today.

Categories

Strategize Your Success