How To Construct a Diverse Real Estate Investment Portfolio

Carl E. Sera, CMT

July 25, 2023

A diversified portfolio can prevent investors from placing all their eggs into one basket. Consolidating investments puts a portfolio at more risk when the market changes. It’s crucial to learn how to construct a diverse real estate investment portfolio.

What Is Portfolio Diversification?

Portfolio diversification involves an investor spreading their investments across various assets, asset classes, or strategies to reduce risk. Diversification includes concentration on a singular asset, improving long-term value potential, and reducing short-term volatility risks. Other portfolio investments can help balance the difference with their existing gains if an investment doesn’t perform well. Proper portfolio diversification involves choosing investments that don’t correlate highly with one another, as similar investments will likely move in similar directions simultaneously.

Real estate investment portfolio diversification consists of structure, assets, and strategy. For instance, asset diversification could translate to different property type investments, including commercial, industrial, residential, and more. REITs, or real estate investment trusts, are non-traded, private funds, direct ownerships, or partnerships that consist of flipping family homes, commercial land leasing, bridge lending, and more.

Why Investment Portfolio Diversification Matters

Real estate investments can come with challenges and risks, such as being illiquid, meaning it takes time to sell properties to access cash. Each real estate investment should come with the assumption of having different, individual timelines. Because real estate consists of complex, tedious transactions, it can carry high costs due to ongoing maintenance, transaction costs, and management fees. Lastly, real estate depends highly on local marketing trends, interest rates, supply and demand, and economic wellness.

Portfolio diversification can help mitigate potential risks, such as investments in different property types or locations. This method can help reduce local market condition exposure. For instance, if one market area performs poorly, other market areas may do better, helping to balance out investors’ returns. Investing in differing vehicles can help spread risks across broader structures and assets, reducing investors’ reliance on a single investment or property. As such, diversification can benefit an investor’s portfolio in emergency situations where they can access their capital differently. Structuring a real estate investment portfolio can create peace of mind and significantly impact long-term investment.

Tips for Constructing a Diverse Portfolio

Investors can benefit significantly from real estate investment portfolio diversification. Use these tips on how to construct a diverse real estate investment portfolio concisely and straightforwardly.

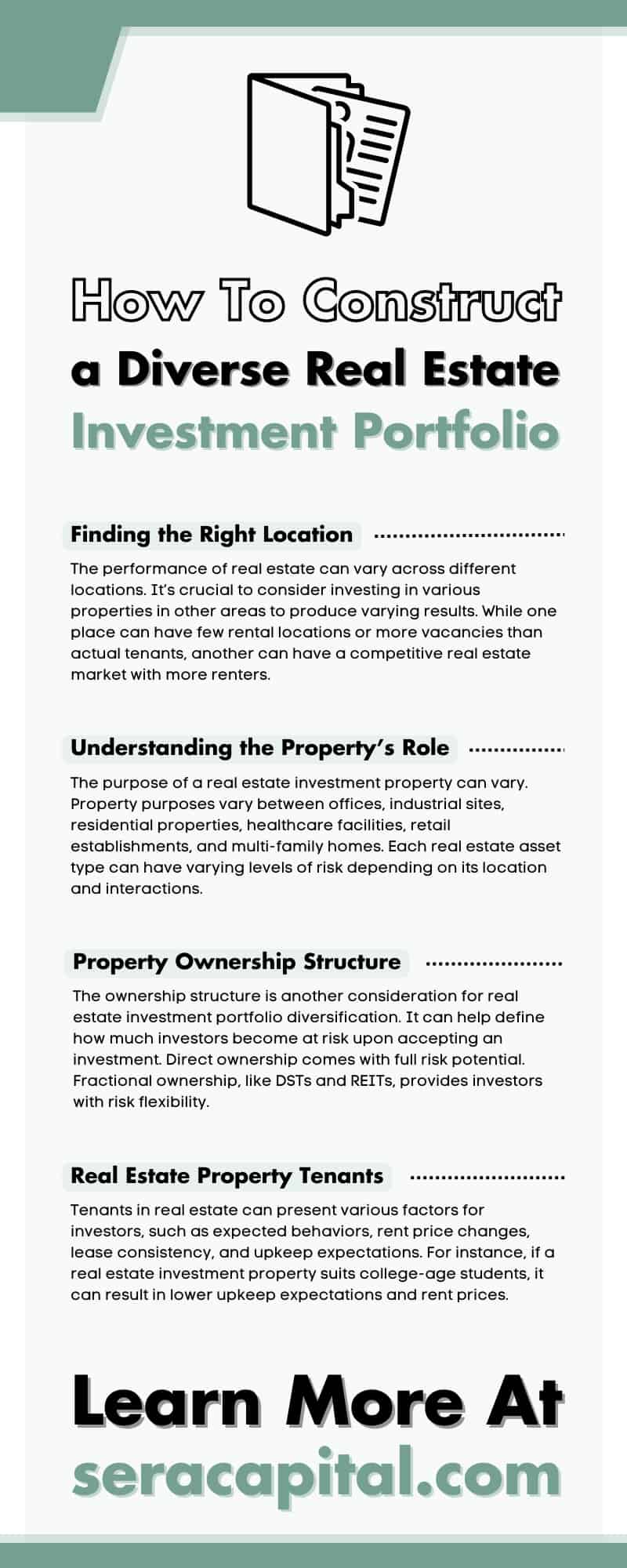

Finding the Right Location

The performance of real estate can vary across different locations. It’s crucial to consider investing in various properties in other areas to produce varying results. While one place can have few rental locations or more vacancies than actual tenants, another can have a competitive real estate market with more renters. Some location examples include urban, suburban, and rural areas, foreign or domestic locations, regions, and high- or low-income communities.

Unpredictable market behavior can impact your real estate investments. However, when searching for high-growth markets, keep in mind that population growth, job opportunities, and job diversity can correlate with property demand in return.

Understanding the Property’s Role

The purpose of a real estate investment property can vary. Property purposes vary between offices, industrial sites, residential properties, healthcare facilities, retail establishments, and multi-family homes.

Each real estate asset type can have varying levels of risk depending on its location and interactions. For instance, retail establishments in high-volume areas can thrive compared to remote town vendors. Factors such as tenants and location can impact the price of rent and tenant consistency.

Property Ownership Structure

The ownership structure is another consideration for real estate investment portfolio diversification. It can help define how much investors become at risk upon accepting an investment. Direct ownership comes with full risk potential. Fractional ownership, like DSTs and REITs, provides investors with risk flexibility.

A fractional ownership structure, such as a Delaware Statutory Trust, is an option for investors not wanting to qualify for beneficial interest gains for property debt. When investors get involved with debt, the trust then takes on the debt, assigning a portion to the investor based on a ratio of loan-to-debt.

Real Estate Property Tenants

Tenants in real estate can present various factors for investors, such as expected behaviors, rent price changes, lease consistency, and upkeep expectations. For instance, if a real estate investment property suits college-age students, it can result in lower upkeep expectations and rent prices. Properties further from campus may not permit high earnings on rent but can result in not needing as much property improvement.

Furthermore, the student turnover rate sits higher. There are other tenant types of real estate, such as individuals, small businesses, government agencies, families, healthcare workers, and more.

Property Investment Strategy

When investors want to diversify their real estate investment portfolio, they must consider their strategy. Investors that use multiple diverse strategies across differing properties can also influence potential gains and risks. For instance, a buy-and-hold approach is a long-term, passive investment technique that helps create a stable, consistent portfolio over a long period, generating increased returns. Investors will wait for a market upturn to gain and sell.

Other real estate investment properties can lend themselves to renting and rehabbing processes, which generate income in a timely manner. Combining various real estate investment portfolio diversification strategies can help investors prepare for potential market downturns and minimize risks. So, investors must consider their investment strategies for future obstacles.

Real Estate Management Structure

Real estate management structure is one of the most essential considerations in property diversification. An investor can manage properties themselves, but it can come with a significantly large time commitment, taking time away from focusing on other investments and monitoring local market trends. Investors can opt to work with fund sponsors or third-party management companies to decrease responsibilities throughout their portfolios.

Third-party management companies and fund sponsors do come with their expenses. Suppose an investor makes plans to work with third-party management companies. In that case, they must consider the costs as they can outweigh their property investment’s potential gains and the time commitment needed.

Portfolio diversification takes a considerable amount of understanding, time, and thought. We at Sera Capital help individuals who seek guidance on optimal investment portfolio diversification with fee-only consulting practices, including 1031 and 721 exchanges, Delaware Statutory Trusts, Opportunity Zones, and more. Our financial advisors in Annapolis, IN, help many clients with professional learning tools, tutorials, newsletters, and more to overcome investment obstacles and reach their financial goals. In stressful economic situations, we provide professional insight into individual investment behavior. If you have inquiries regarding our services and expertise, schedule a free 20-minute phone call today.

Categories

Strategize Your Success