How Do DSTs and REITs Differ From Each Other?

Carl E. Sera, CMT

January 25, 2024

The real estate industry offers many incredible investment opportunities. Delaware statutory trusts (DSTs) and real estate investment trusts (REITs) both offer the opportunity to invest in real estate without property management responsibilities, but they have significant differences that investors should be aware of. Understanding the key differences between DSTs and REITs will allow you to make informed investment decisions. If you have a rental property and want a 1031 exchange into an investment product, continue reading to explore the way these trusts differ from one another.

What Are DSTs?

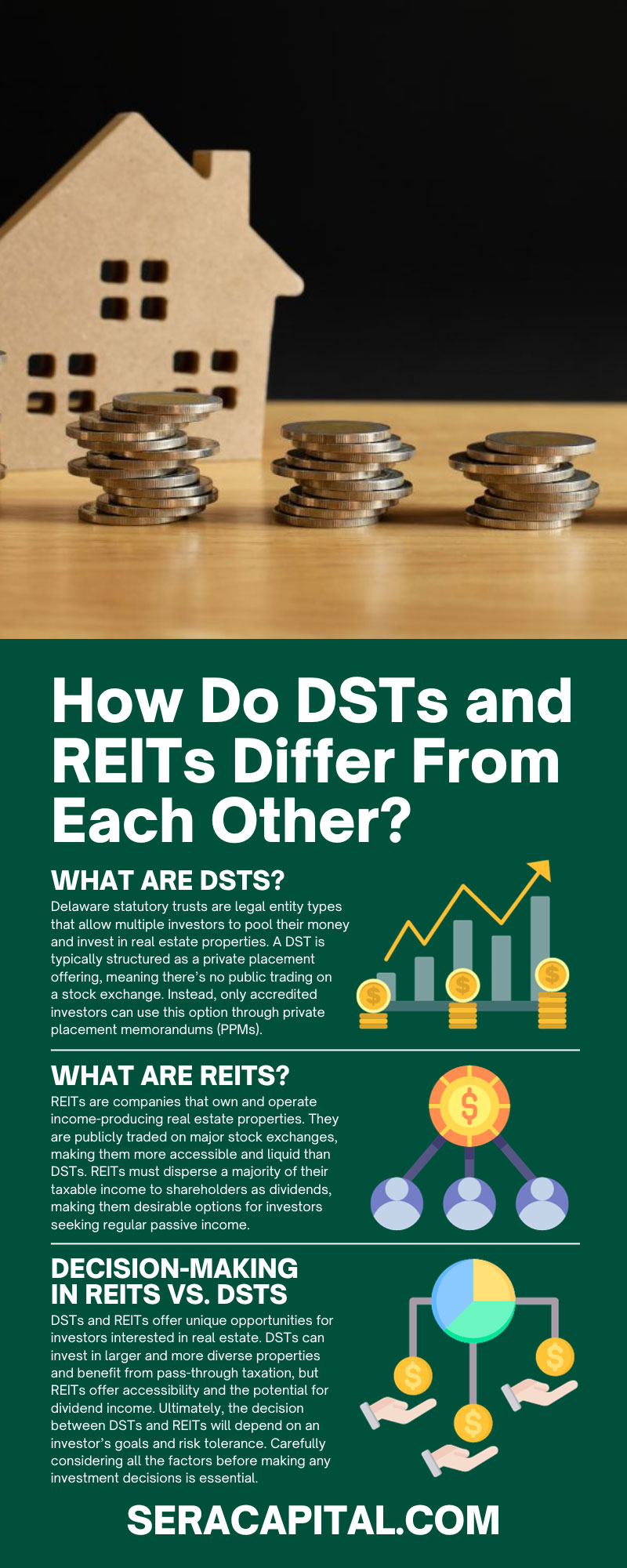

Delaware statutory trusts are legal entity types that allow multiple investors to pool their money and invest in real estate properties. A DST is typically structured as a private placement offering, meaning there’s no public trading on a stock exchange. Instead, only accredited investors can use this option through private placement memorandums (PPMs).

Benefits of DSTs

One of the main benefits of DSTs is the ability to invest in larger and more diverse real estate properties. With DSTs, multiple investors can come together to invest in institutional-grade properties such as apartment buildings, office buildings, and shopping centers. This collaboration allows investors to diversify their portfolios and potentially earn higher returns on their investments.

Another advantage of DSTs is the pass-through taxation structure. As pass-through entities, DSTs do not pay corporate taxes. Instead, the property’s income and losses pass through to the individual investors, who then report them on their personal tax returns. This advantage can benefit investors, as it may result in a lower overall tax liability.

Potential Risks of DSTs

As with any investment, there are also potential risks associated with DSTs. One risk to consider is the illiquid nature of these investments. Unlike publicly traded REITs, DST interests are not easily sold or transferred. Investors may also face limited control over the management of the properties, as the DST sponsor or manager typically makes decisions. Additionally, DSTs are subject to high fees and expenses, which can eat into potential returns. These fees often include acquisition, asset management, and disposition fees.

What Are REITs?

REITs are companies that own and operate income-producing real estate properties. They are publicly traded on major stock exchanges, making them more accessible and liquid than DSTs. REITs must disperse a majority of their taxable income to shareholders as dividends, making them desirable options for investors seeking regular passive income.

Benefits of REITs

One of the main benefits of REITs is their accessibility. Since you can publicly trade REITs, investors can easily buy and sell shares on a stock exchange, providing liquidity for their investment. Additionally, REITs offer the opportunity to invest in various real estate property types, including residential, commercial, and industrial.

Another advantage of REITs is that they tend to have lower fees than DSTs, since they do not require private placement offerings. REITs also offer the potential for dividend income, making them popular among investors seeking regular cash flow.

Potential Risks of REITs

REITs are not without their risks as well. Due to their publicly traded nature, they can be susceptible to market fluctuations, and they may experience high volatility. This risk could potentially result in significant losses for investors.

Additionally, REITs are subject to corporate taxes, meaning the dividends shareholders receive may have a higher tax rate than those from DSTs. This higher rate could potentially affect an investor’s overall return on investment.

Key Differences Between DSTs and REITs

Now that we have explored the respective benefits and potential risks of DSTs and REITs, let’s take a closer look at the key differences between these two investment options.

Ownership Structure

DSTs are structured as private placements, meaning investors own the underlying properties directly. On the other hand, REITs are publicly traded companies, and investors own shares in the company rather than individual properties.

Access to Properties

As we mentioned earlier, DSTs allow investing in larger and more diverse properties, whereas REITs may have more limited portfolios.

Taxation

DSTs are pass-through entities, while REITs are subject to corporate taxes. This variety can result in different tax implications for investors.

Liquidity

REITs are publicly traded and therefore offer more liquidity than DSTs, which are not easily sold or transferred.

Control

Investors in DSTs have limited control over property management decisions, while REIT shareholders have the opportunity to vote on major company decisions.

Decision-Making in REITs vs. DSTs

Regarding decision-making, there’s a stark difference between REITs and DSTs. As REIT shareholders, investors have a certain degree of control over major company decisions. They have voting rights proportional to their shareholdings, allowing them to influence the company’s strategic direction. These decisions may include electing board members, approving significant asset sales, or merger and acquisition activities.

In contrast, DST investors typically have minimal control over the day-to-day operations or bigger strategic decisions related to the property. These decisions, which may include leasing, property improvements, or eventual property sale, are primarily made by the trustee or the designated sponsor company. Some investors may view this as a disadvantage, but others find it appealing because it allows them to enjoy the benefits of real estate ownership without the burdens of direct management. Therefore, the choice between a DST and a REIT may ultimately come down to the individual investor’s preference for the level of control and the involvement they desire in their real estate investments.

DSTs and REITs offer unique opportunities for investors interested in real estate. DSTs can invest in larger and more diverse properties and benefit from pass-through taxation, but REITs offer accessibility and the potential for dividend income. Ultimately, the decision between DSTs and REITs will depend on an investor’s goals and risk tolerance. Carefully considering all the factors before making any investment decisions is essential.

We recommend consulting with a financial advisor who can provide personalized guidance based on your financial situation. Get a financial service consultation with Sera Capital to ensure we’re the right advisor for you. With the right knowledge and careful consideration, you can make informed investment decisions that align with your goals and objectives. So choose wisely, and happy investing!

Categories

Strategize Your Success