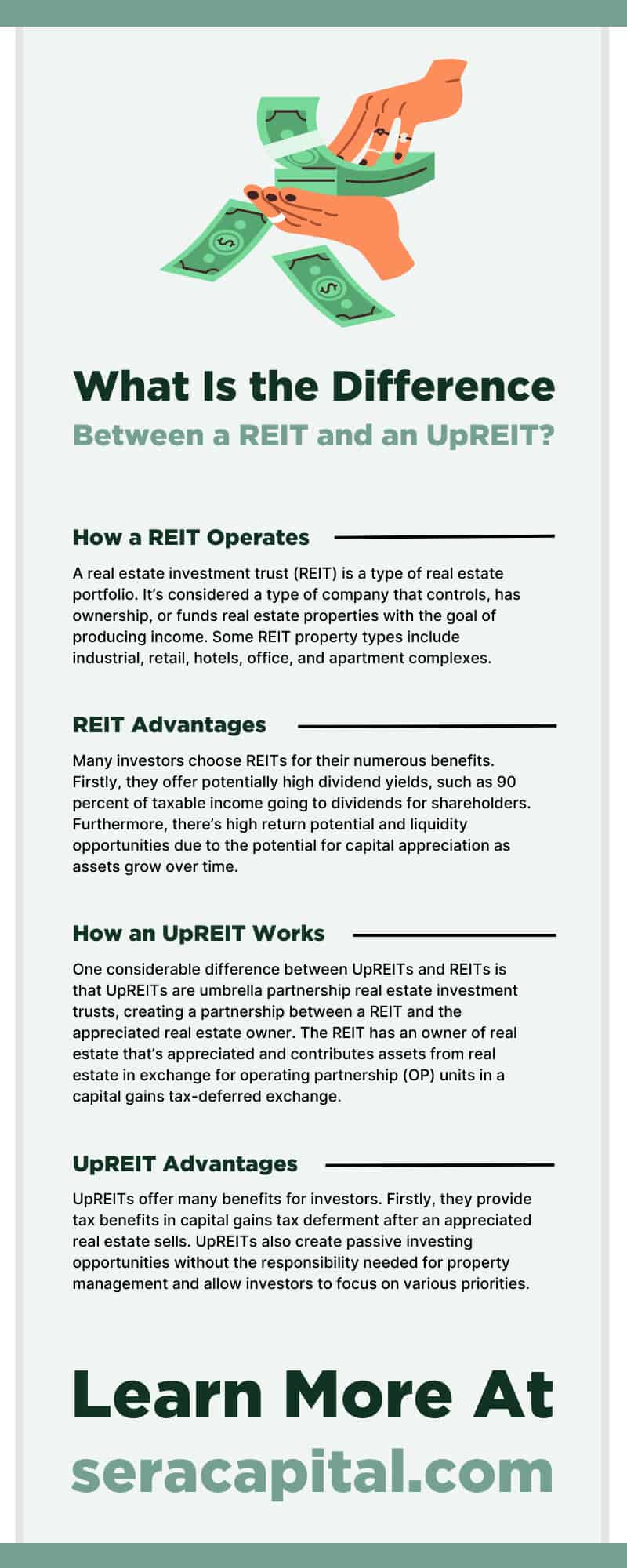

What Is the Difference Between a REIT and an UpREIT?

Carl E. Sera, CMT

June 22, 2023

What are the differences between an UpREIT and a REIT? Which one is right for you? Let’s find out.

How a REIT Operates

A real estate investment trust (REIT) is a type of real estate portfolio. It’s considered a type of company that controls, has ownership, or funds real estate properties with the goal of producing income. Some REIT property types include industrial, retail, hotels, office, and apartment complexes. REITs allow investors to earn dividends on real estate without having the responsibility of buying, financing, and managing the properties themselves.

REITs allow investors to purchase shares in commercial real estate portfolios, only previously available to large financial intermediaries and wealthy individuals. REITs operate in specialized real estate sectors. Specialty and diversified REITS may possess different property types in their portfolio, including REITs consisting of both retail and office properties. To qualify, a company must comply with certain IRC provisions, including direct long-term ownership of income-generating real estate and distributing income to shareholders.

REIT Advantages

Many investors choose REITs for their numerous benefits. Firstly, they offer potentially high dividend yields, such as 90 percent of taxable income going to dividends for shareholders. Furthermore, there’s high return potential and liquidity opportunities due to the potential for capital appreciation as assets grow over time. This results in investors benefiting from potentially high return amounts. As for liquidity, REITs make for easier selling and purchasing compared to traditional commercial real estate ownership due to getting traded in major stock exchanges.

Additionally, REITs allow portfolio diversification and commercial real estate access to investors. REITs came to fruition as the result of smaller investors wanting to have opportunities to invest in real estate. REITs also offer an alternative means for diversifying investors’ portfolios, treated as stocks representing real estate assets.

REIT Disadvantages

While REITs have many benefits to offer, investors need to remain aware of potential downsides. Firstly, REITs can come with tax burdens due to having complex tax structures. Dividends don’t meet qualified dividends defined by the IRS, which, unless they become collected in tax-advantaged accounts, become taxed as traditional income. Furthermore, REITs act as a leverage to fund growth, leading to lower earnings and higher interest, resulting in bad REIT stock prices.

REITs can also have lower growth. Due to 90 percent of taxable income getting put into dividends, REITs must bring in more cash by issuing new shares and bonds. However, it doesn’t translate into being quickly bought up by investors. Lastly, REITs have potential property-specific risks due to varying sensitivities of the economy compared to others. Investors can risk exposure by investing in one type of REIT.

REITs vs. Direct Real Estate Investment

So, what are the differences between REITs and direct real estate investments? First, it’s essential to know their similarities, including both allowing diversified real estate access to investors. Investor portfolios don’t have to have a complicated portfolio limited to struggling commercial spaces and multi-family units. Furthermore, choosing either investment option can reduce risk factors, as real estate investors provide investors access to stable, consistent income.

Direct real estate allows investors more control over their investments and provides tax breaks to offset the income. As for REITs, investors have a more hands-off approach by putting real estate management and operation into someone else’s hands. Furthermore, REITs work for investors who don’t have the necessary funds or proper financing to purchase real estate. It’s the perfect beginner tool for real estate investment to help gain experience.

How an UpREIT Works

One considerable difference between UpREITs and REITs is that UpREITs are umbrella partnership real estate investment trusts, creating a partnership between a REIT and the appreciated real estate owner. The REIT has an owner of real estate that’s appreciated and contributes assets from real estate in exchange for operating partnership (OP) units in a capital gains tax-deferred exchange. Also known as a 721 exchange, UpREITs share similar benefits with 1031 exchanges, as capital gains become realized when exchange sellers sell OP units that convert into REIT shares or if an acquiring operating partnership sells contributing properties.

UPREITs are also a helpful wealth management tool for private real estate owners who have no desire to manage their taxes, as REITs allow commercial real estate access to individual investors. As such, UpREITs award investors with put options, which can convert to cash or REIT shares after a future agreement period. Lastly, UpREITs allow investors to transfer their estates to heirs without taxes. Heirs can postpone exercising put options until after the owner’s passing.

UpREIT Advantages

UpREITs offer many benefits for investors. Firstly, they provide tax benefits in capital gains tax deferment after an appreciated real estate sells. UpREITs also create passive investing opportunities without the responsibility needed for property management and allow investors to focus on various priorities. Furthermore, UpREITs create passive income as dividends become paid to the investors via income rather than fluctuating cash flow through standard real estate property investments.

Additionally, UpREITs can help with estate planning as OP units become transferred to beneficiaries or heirs upon the investor’s death on a stepped-up basis. As such, heirs can continuously benefit from dividends and allow for complete capital gains tax elimination unless units become converted into REIT shares. Lastly, UpREITs can create portfolio diversification and aid in investment portfolio balance.

UpREIT Disadvantages

UpREITs may have numerous positives, but knowing the potential negatives is crucial. Firstly, UpREITs don’t allow for flexible control, which can disadvantage those who like a more hands-on approach to their investments. Furthermore, UpREITs have limited voting rights but apply to situations that may affect the holder’s rights, such as redemptions, distributions, and tax allocations.

Additionally, UpREITs don’t have a predictable stock market. Shares become subject to stock market fluctuations, but no investments remain impervious to volatility. Lastly, specific state and federal tax filing requirements can become a big obstacle. OP unitholders must file taxes with an operating partnership in each state that transacts business.

UpREITs vs. DownREITs

So, what are the differences between UpREITs and DownREITs for investors? Firstly, UpREITs act as an estate planning tool. Upon the investment owner’s passing, heirs can obtain estate assets and eliminate capital gains tax. Furthermore, UpREITs act as a put option without paying capital gains taxes on appreciated underlying real estate asset values. Exercising put options after the property owner’s passing creates greater liquidity preventing income tax and paying estate taxes.

DownREITs is a newer investment structure consisting of a joint partnership between the REIT and a property owner. It’s meant for property owners who don’t plan on operating under umbrella partnerships but adversely become partners in a limited REIT partnership. Investors who prefer deferring capital gains tax on appreciated real estate property sales choose DownREITs, especially if they believe their properties can exceed REIT-owned property values.

Sera Capital offers 721 exchange, 1031 exchange, DST, and other investment services and advice to individuals with highly-appreciated assets. Our 721 exchange advisors help guide eager investors in the right direction, offering advice and guidance on achieving their financial goals. Schedule a free 20-minute phone call with us today if you have any questions.

Categories

Strategize Your Success