A VOLATILE TALE: "DOES VOLATILITY AFFECT MY INVESTMENTS?"

Carlos M. Sera, MBA

August 11, 2015

Most people are psyched out by the word volatility. They shouldn’t be. A practical synonym for volatility is predictability. The less volatile something is when it comes to investing the more predictable it is. The more volatile it is the less predictable. We know that a safe investment such as a 1 year US government bond is less volatile or more predictable than a mutual fund that invests in stocks over the next year. We learned in A Tale of Anarchy about the mathematics of recovery and how it can bring ruin to those that lose too much of their initial investment especially if they have finite capital. This tale teaches us about a second potential danger to the retiree. It’s called volatility or predictability.

Most people are psyched out by the word volatility. They shouldn’t be. A practical synonym for volatility is predictability. The less volatile something is when it comes to investing the more predictable it is. The more volatile it is the less predictable. We know that a safe investment such as a 1 year US government bond is less volatile or more predictable than a mutual fund that invests in stocks over the next year. We learned in A Tale of Anarchy about the mathematics of recovery and how it can bring ruin to those that lose too much of their initial investment especially if they have finite capital. This tale teaches us about a second potential danger to the retiree. It’s called volatility or predictability.

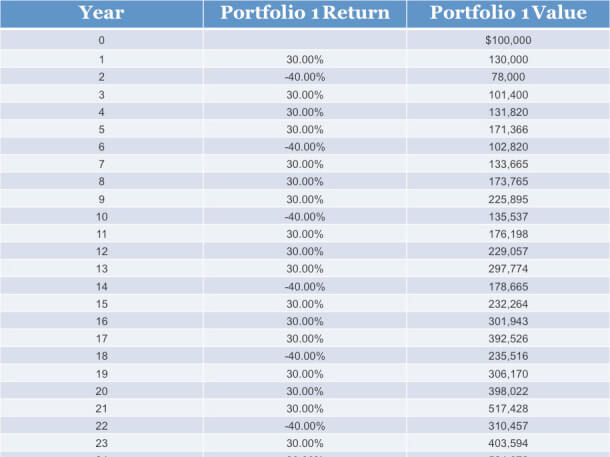

PORTFOLIO ONE

Let’s look at an example. Please pardon the math but it’s important in this case and I’ve kept it as simple as possible. We can conclude that two investments, or two portfolios or two mutual funds can have identical rates of return but how they achieve these returns or how volatile or predictable these returns are make a significant difference as to which one you should choose. This is especially true if you want your money to last a lifetime. Let’s look at an example to illustrate from the following table:

We can see that both portfolios end up with about the same amount of capital at the end of 25 years. They roughly make about 8% per year and in fact portfolio 2 makes exactly 8% per year. We can see that portfolio 1 is the most volatile since we see rates of return that fluctuate from positive 30% to negative 40%. We can see that portfolio 2 is the least volatile since the return is a steady 8% every year. We can also see that all returns are reinvested over the 25 years and if you were looking to accumulate wealth either would suit your purposes. However, which one of these portfolios is the best one for a person when they need to live off of the returns that their portfolio can provide? If you guessed portfolio 2 you are correct. But do you know why? The answer is that the mathematics of recovery work against the retiree when they are taking money out for living expenses on a consistent basis. Let’s see it in action.

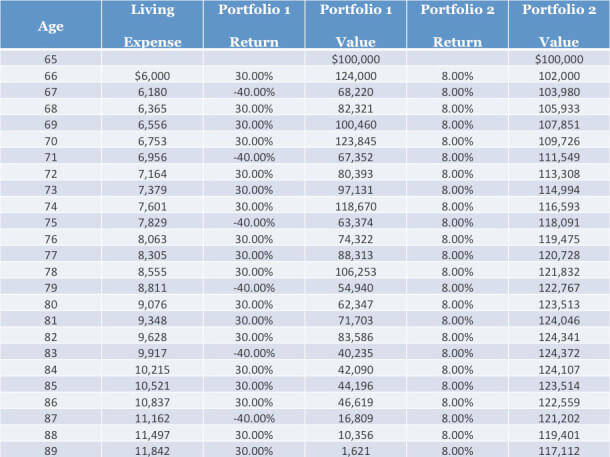

PORTFOLIO TWO

The following table depicts what happens under the two portfolios when a person retires at age 65 and lives another 25 years until age 90. During this time the retiree withdraws 6% of his starting capital at the end of every year in order to pay his living expenses and since inflation is a fact of life that we must all incorporate into our financial plans, every year he withdraws an additional 3% to keep up with the increased cost of living. We can see from the table that he withdraws $6,000 in year 1 at age 66 and every year thereafter he withdraws an additional 3%.

What can we learn from this table? We can learn that by age 90 you are broke if you chose to make your 8% per year by investing in portfolio 1 because it is such a volatile portfolio. The mathematics of recovery worked against you.

If we compare portfolio 1 to portfolio 2 we see that it has more money, $114,282, than when we started and clearly see that making 8% in a non-volatile fashion is the way to go.

MORAL OF THE STORY

The moral of this tale is volatility matters and that though you can’t predict short term rates of return, you can predict the way that the investment, portfolio or mutual fund intends to make its rate of return. This is why for retired clients that must live off the returns that their portfolio generates I don’t weigh past performance as much as consistency of past performance when making investment decisions for their portfolio. I suggest you do the same.

Categories

Strategize Your Success